US States Push Pro-Crypto Legislation in March 2025

March 2025 witnesses a significant wave of changes in the way the American states approach cryptocurrency. Several states actively introduce and adopt legislative initiatives to promote the adoption of cryptography.

Recent developments in last week indicate a clear change. American legislators no longer consider cryptocurrency only as a speculative asset but as a strategic part of the financial future.

Kentucky: protect the rights of bitcoin and the exploitation of cryptography

One of the most notable advances this month comes from Kentucky. On March 24, the Governor of the State signed the “Digital Blockchain Asset Act” (HB701) in law after the State Senate adopted it with an overwhelming vote of 37-0.

This law protects residents from Bitcoin self -sufficiency while legalizing and encouraging cryptographic exploitation. He points out that Kentucky aims to protect individual rights in cryptographic space and position itself as a potential hub of blockchain.

With abundant energy resources of coal and hydroelectricity, the state has a competitive advantage in the attraction of extro-exercise enterprises of cryptography. The data show that Kentucky represents 11% of the American Bitcoin hashrate.

North Carolina: Crypto in pension funds and strategic reserves

Northern Caroline legislators push things a little further by offering the integration of cryptocurrency into the public financial system.

According to the Bitcoin law, Bill H506, presented on March 24, allows 5% of the public funds of the State to invest in digital assets. Likewise, Bill S709, which also authorizes an allocation of public funds of 5%, was submitted Tuesday to the Senate.

In addition, Bill H92 offers an allowance up to 10% of public funds to buy digital assets as a strategic reserve.

If they have passed, these initiatives would mark a major turning point. North Carolina could become one of the pioneering states using cryptocurrency to protect public funds against inflation and economic volatility. Legislators accelerate discussions, with the expectations of a decision in the coming weeks.

Arizona: Advance towards digital asset reserves

Arizona also joins the race. The State Chamber Rules Committee recently approved two bills: the Digital Asset Strategic Reserve Bill (SB1373) and Arizona Bitcoin Strategic Reserve Act (SB1025).

SB1373 allows the creation of a reserve of digital assets funded by the assets seized in criminal cases managed by the state treasurer. The treasurer can invest up to 10% of the reserve per year and lend assets to generate additional income as long as financial risks remain controlled.

Meanwhile, SB1025 authorizes the Arizona Treasury and retirement system to invest up to 10% of their Bitcoin funds. If a federal Bitcoin reserve fund is created, Arizona Bitcoin reserves could be stored in complete safety in a separate account within this fund.

In addition, last week, Oklahoma House adopted the Bitcoin reserve strategic bill (HB1203).

This bill allows Oklahoma State Treasurer to invest in public funds from the General State Fund, the income stabilization fund and the Bitcoin Constitutional Reserve Fund and other large market digital assets (those with market capitalization exceeding $ 500 billion), as well as stablecoins.

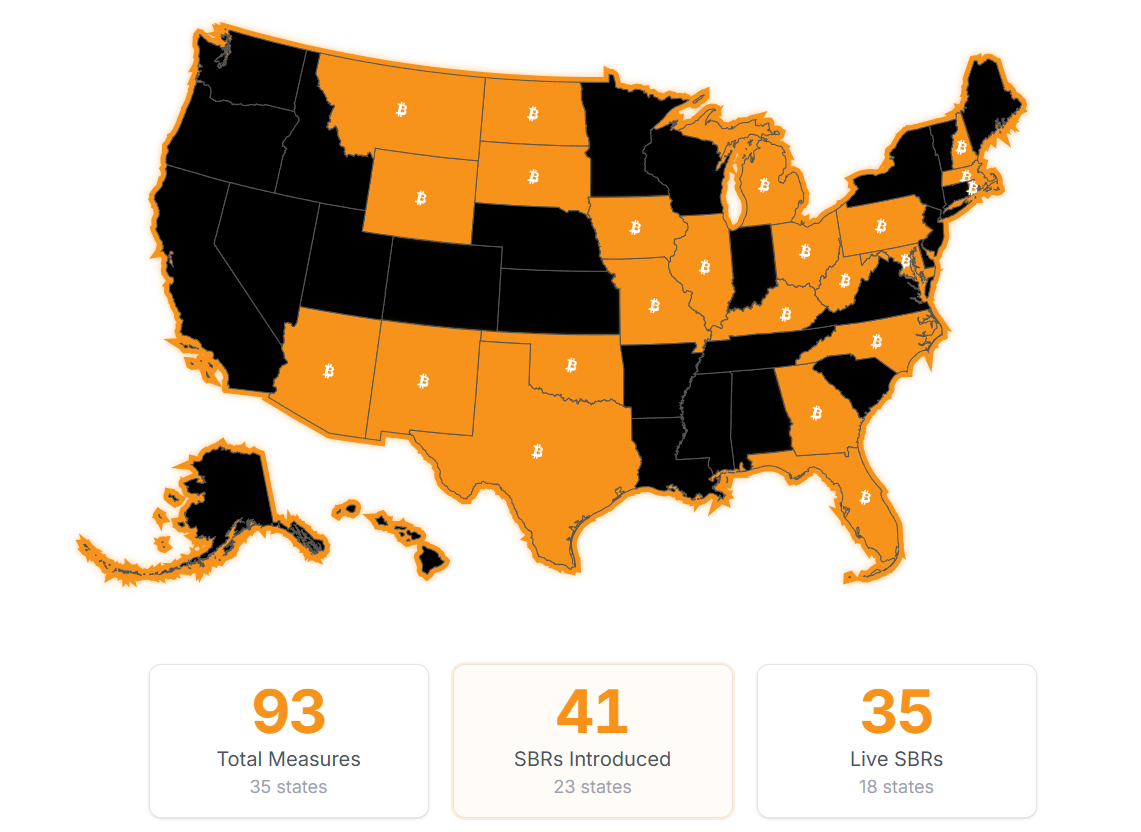

Half of the American states have introduced Bitcoin reserve invoices

According to Bitcoin law, 23 states in 50 United States have introduced Bitcoin reserve law. Matthew Sigel, manager of digital asset research at Vaneck, believes that if they were adopted, these invoices could generate significant Bitcoin purchases.

“We have analyzed 20 Bitcoin reserve invoices at the state level. If it is adopted, they could drive $ 23 billion in purchase, or 247,000 BTC. This sum is independent of any pension fund allowed, likely to increase if the legislators progress, ”predicted Sigel.

With the support of the Trump administration, in particular the creation of a Federal Bitcoin Strategic reserve on March 7, the States seized the opportunity to reshape their financial policies.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.