Vietnam Pilots Crypto Exchange and Bakkt Expands, and More

Welcome to the Asia -Pacific morning memory – your essential digestion of night cryptography developments shaping regional markets and global feeling. Take a green tea and look at this space.

Vietnam is launching an international financial center with an crypto exchange pilot program by the end of the year. Bakkt enters Japan with Bitcoin.jp Rebrand. ChainLink launches the data from American actions. License derived from Dubai de nomura guaranteed.

Vietnam to control crypto-actors exchanges at the International Financial Center

Vietnam advances cryptographic regulations while Prime Minister Pham Minh Chineh has announced that the international financial center will be operational by the end of 2025, with digital active trading platforms. Vice-Governor Pham Tien Dung revealed that Vietnam had established complete legal foundations for digital assets during the Vietnam 2025 GM conference.

The law of the digital technology industry, adopted in June 2025, officially recognizes cryptographic assets as distinct from virtual assets, taking effect in January 2026. The Ministry of Finance submitted a pilot resolution for trading soils of cryptographic assets using blockchain technology as a main infrastructure.

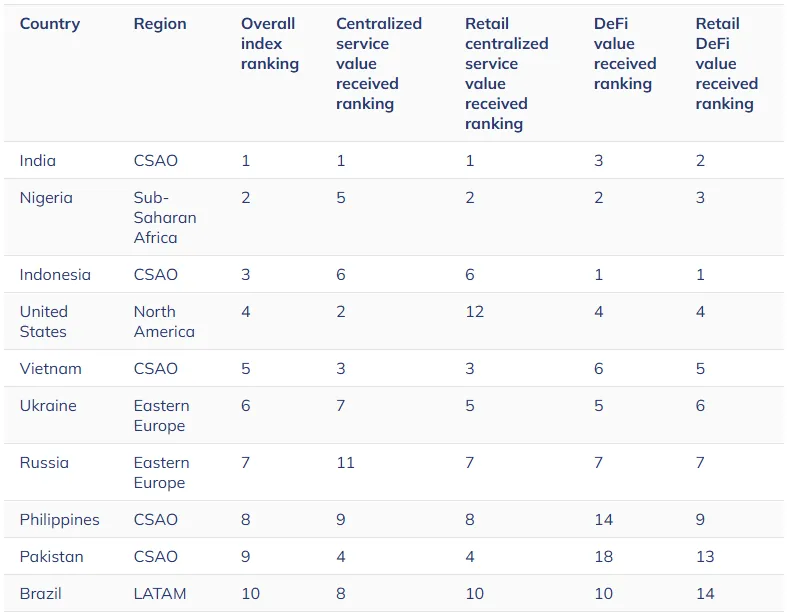

Vietnam has an cryptography property rate of 21.2% worldwide, with more than 21 million citizens with digital assets worth more than $ 100 billion per year. The regulatory sandbox will operate in Ho Chi Minh Ville and Da Nang, potentially attracting major exchanges. Upbit to South Korea already explores the entry of the Vietnamese market, signaling international trust in the emerging regulatory framework.

Bakkt launches Bitcoin Treasury Strategy in Japan via the brand change “bitcoin.jp”

Bakkt Holdings acquired a 30% stake in Marusho Hotta, listed in Tokyo, becoming its largest shareholder in an agreement of $ 235 million. The Japanese company will be renamed as the approval of shareholders awaiting “Bitcoin.jp”, Bakkt securing the corresponding web field. Phillip Lord, president of Bakkt International, will assume the functions of CEO and integrate Bitcoin into the company’s treasure strategy.

The Bakkt CO-PDG, Akshay Naheta, cited the regulatory environment of Japan as creating “an ideal platform for a growth company focused on Bitcoin”. This decision follows a recent increase in Bakkt equity of $ 75 million and $ 1 billion shelf to finance Bitcoin purchases, marking its pivot from cryptographic infrastructure for directly Bitcoin Treasury operations.

Chainlink launches data flows on American actions in real time for deffi

ChainLink has unveiled data flows for American actions and FNBs, providing institutional quality prices to blockchain networks. The service provides real -time data for active ingredients such as Spy, Nvidia, Apple and Microsoft on 37 blockchains. The protocols DEFI GMX, Kamino and others have already integrated the flows.

The infrastructure includes the application of market hours, the detection of staliarity and the logic of circuit breakers with latency lower than the second. This deals with a critical gap in the infrastructure in Tokenized equity, which was late despite the RWA tokenization market of $ 275 billion. Useing cases include perpetual future, chain loans with actions collateral and synthetic ETFs.

The business director, Johann Eid, noted that the launch allows “token financial products ready for production linked to American actions” directly on the channel. This decision is aligned with increasing regulatory acceptance, including the recent adoption of the Act on Engineering supporting token financial instruments.

The Nomura digital laser wins the Dubai license for free -free crypto derivatives

Digital laser, the nomyura cryptocurrency subsidiary, obtained the first licensed free-free crypto options under the regulated free part of the pilot framework of the Dubai virtual asset regulatory authority. The company becomes the first entity regulated by VARA offering Crypto OTC options oriented towards direct customer in the emirate.

The regulatory environment of Dubai crypto continues to attract major players, the discomfort belonging to Coinbase also plans operations. Product manager, Johannes Woolar, praised the detailed justification process of Vara but a flexible execution approach. Digital laser will initially focus on the main cryptographic tokens thanks to means of medium dated within the framework of ISDA agreements, keeping the simple structures before developing in the performance and loan improvement services.

Shigeki Mori and Shota Oba contributed.

Non-liability clause

All the information contained on our website is published in good faith and for general purposes only. Any action that the reader undertakes on the information found on our website is strictly at their own risk.