VINE Risks a 50% Drop Despite Whales Buying the Dip

After a monthly increase of 300%, the price of the vine is now faced with its most severe reality control to date. The token has decreased by more than 24% in the last 24 hours, falling to $ 0.117, despite the whales that continue to accumulate parts during the drop.

The divergence between the confidence of the whales and the retail sales behavior, associated with a weakened money flow and with a fragile technical configuration, suggests that this rally may not have enough fuel to push higher soon.

Whales continue to accumulate as leaders for the exit

The data on the Nansen chain show that the first 100 addresses added 3.27% more vines on the last day, whale wallets increasing assets of 2.22%. Normally, this kind of purchase would leave a growing conviction among the great actors. But the image is not entirely optimistic.

Exchange sales jumped 3.03% during the same period, which means that retail holders sent tokens to centralized exchanges, probably preparing to sell themselves in force.

This behavioral division left Vine’s control books. Whales provide certain support on the purchase side, but the wider lack of participation is already starting to take momentum. When the retail trade flows while large wallets try to catch the drop in prices, the market base can quickly become unstable.

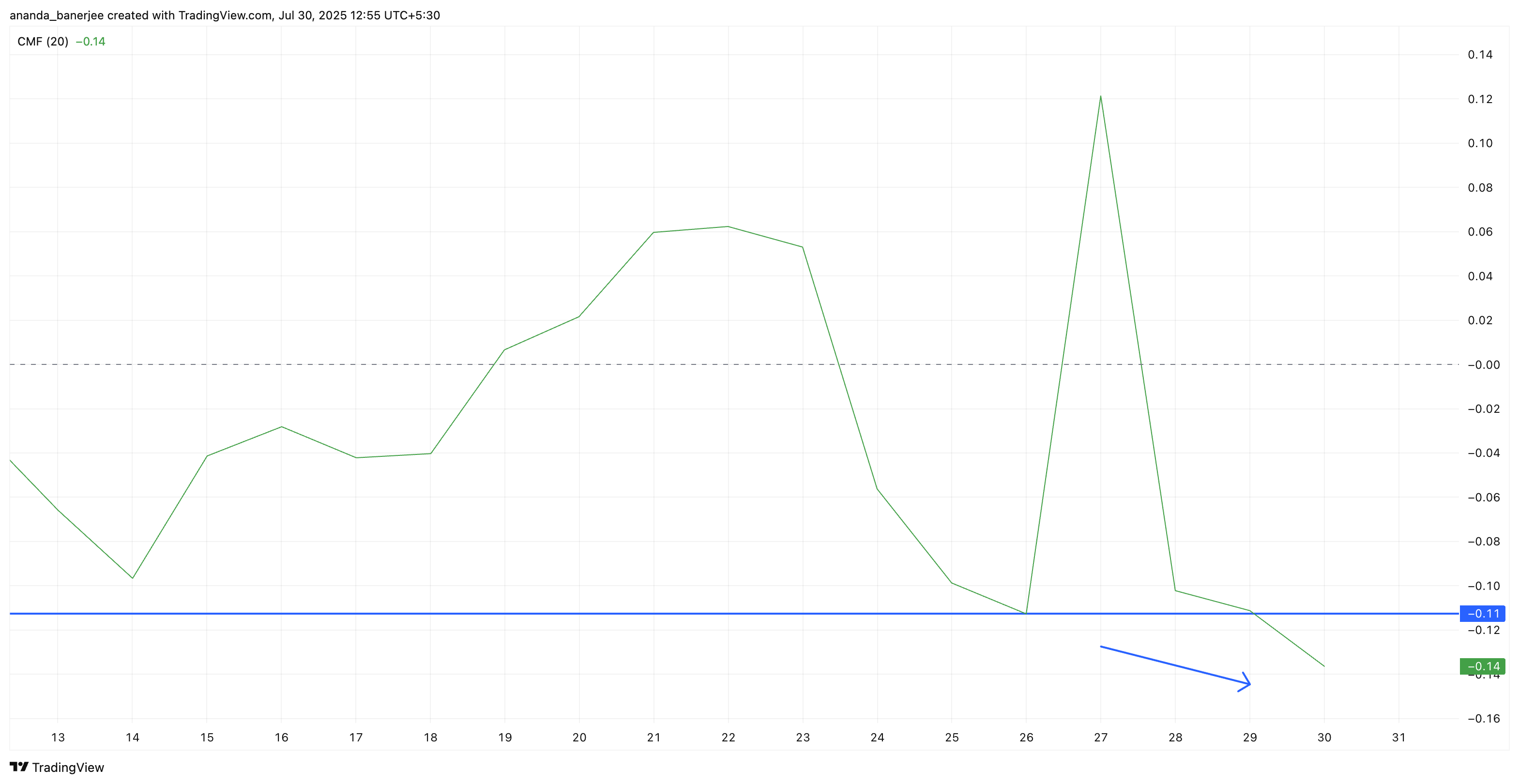

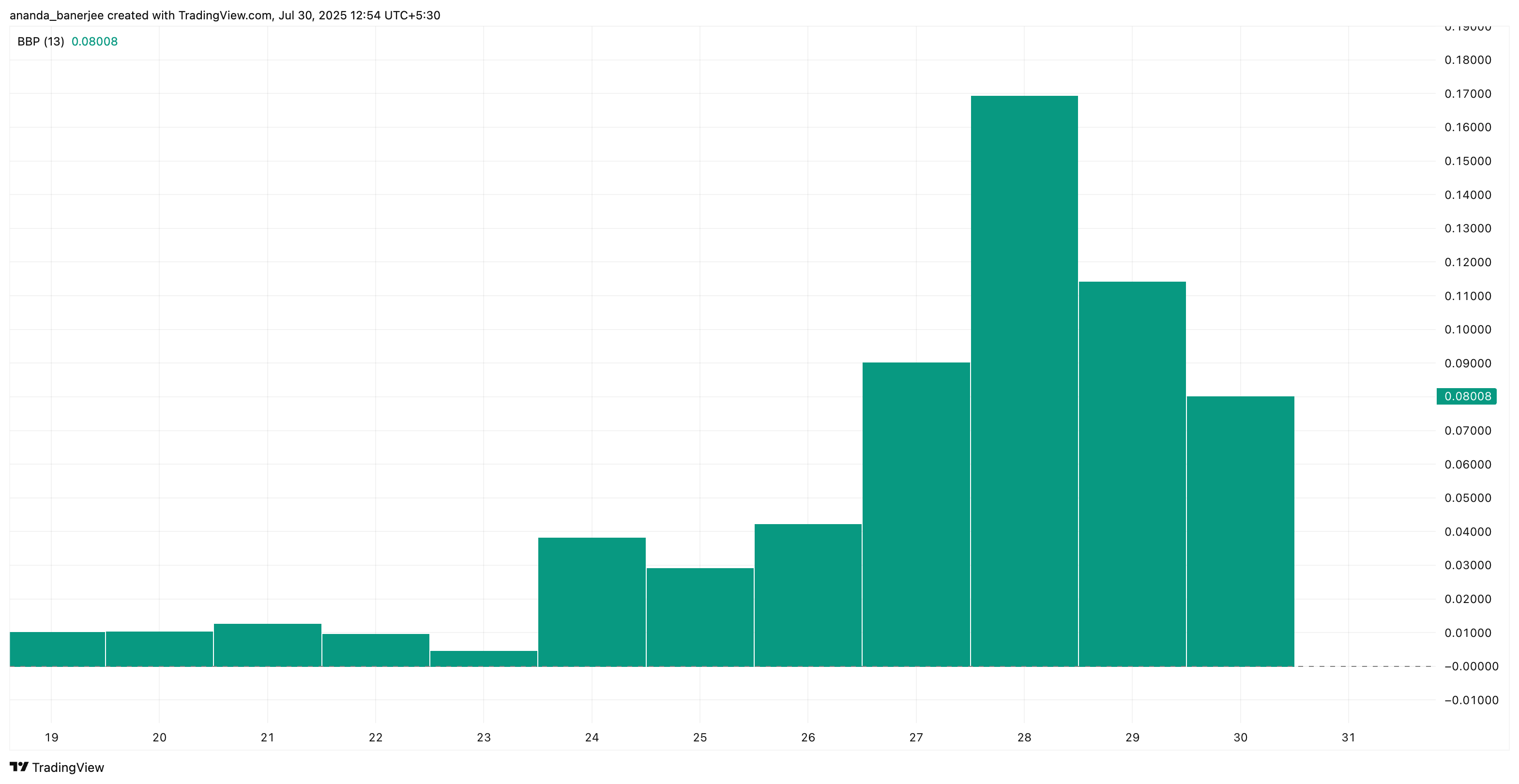

The monetary flow flows while the bullish impulse fades

The Silver Flow of Chaikin (CMF), which follows if the capital between or fate of the market, fell strongly at -0.14, even lower than the levels before the start of the Vine Price rally this month. This indicates a wave of sales pressure prevails over the pockets of the accumulation of whales.

At the same time, the Bull Bear Power (BBP) indicator, a measure of the purchasing force compared to the sale, has cooled significantly since July 28, showing that the bullish momentum is no longer built as it was in the past.

These readings suggest that Vine’s explosive race may have been more about media than sustainable. Fresh money has not entered the market and that sellers take control, the token shows signs of exhaustion, leaving the action of the vineyrable vine to sharper moves.

For TA tokens and market updates: Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

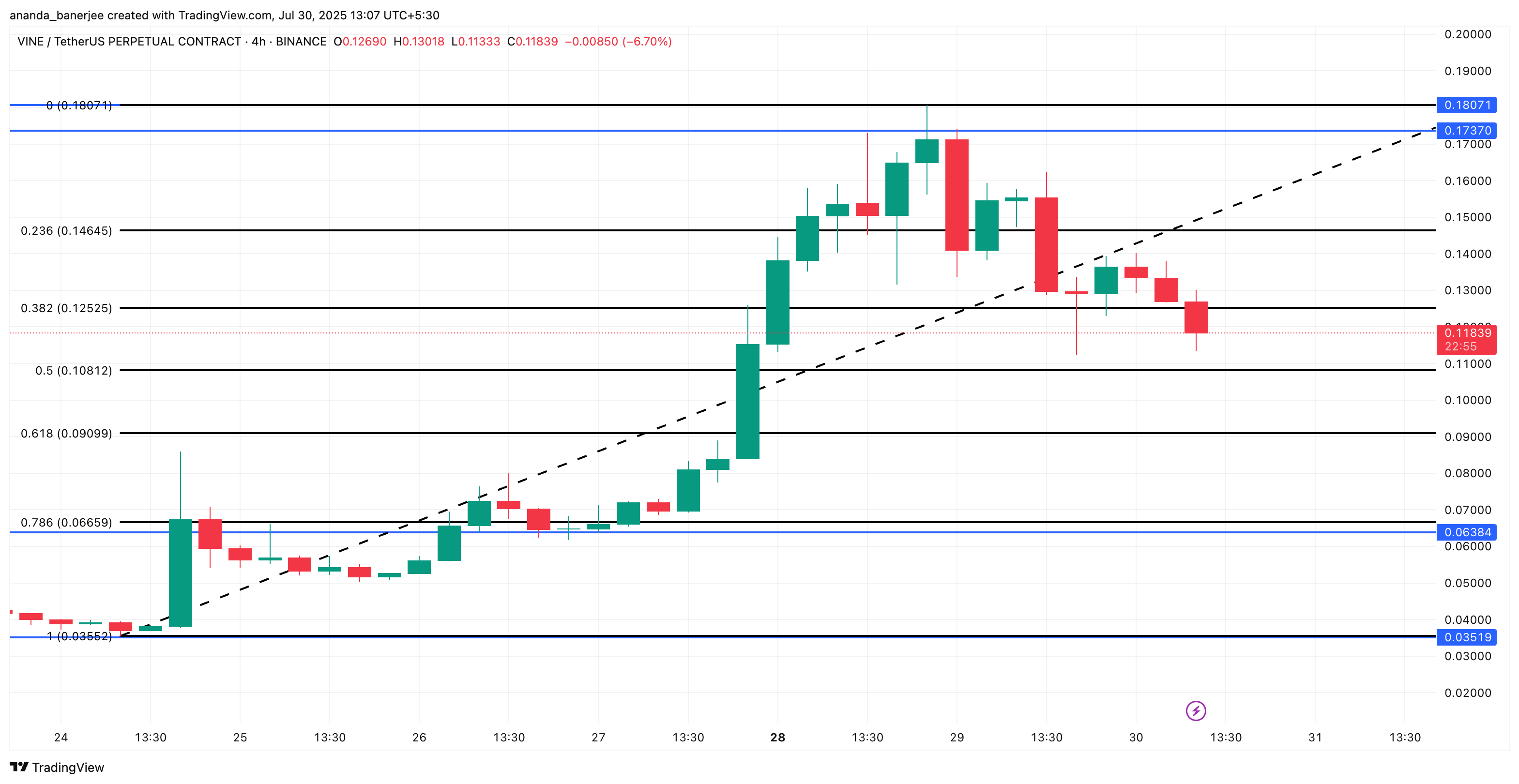

Vineyard price configuors

The 4 -hour Vine graph gives a clearer view of the short -term volatility, and the image is not encouraging. The price of the token forms an ascending corner, a model that often signals a downward reversal.

The price of the vine is now clinging to $ 0.1129. Ventilation here opens the path to the next major support around $ 0.063, or almost a drop of 50% compared to current levels.

Fibonacci levels on the same calendar highlight where bulls must intervene to change history. A return above $ 0.1465 could invalidate this downward perspective and relaunch the momentum upwards.

Until then, the path of the slightest resistance seems lower, the purchase of whales alone to stop new corrections.

Post-vine is at risk of 50% despite the whales that bought the decline appeared first on Beincrypto.