Vlad Tenev Advocates Crypto Tokenization for Retail Investors

The CEO of Robinhood, Vlad Tenev, doubles the crypto potential to revolutionize investment in private markets. In a recent article on X, Tenev stressed that the United States is making progress in the adoption of cryptography and should further expand its understanding of what is possible.

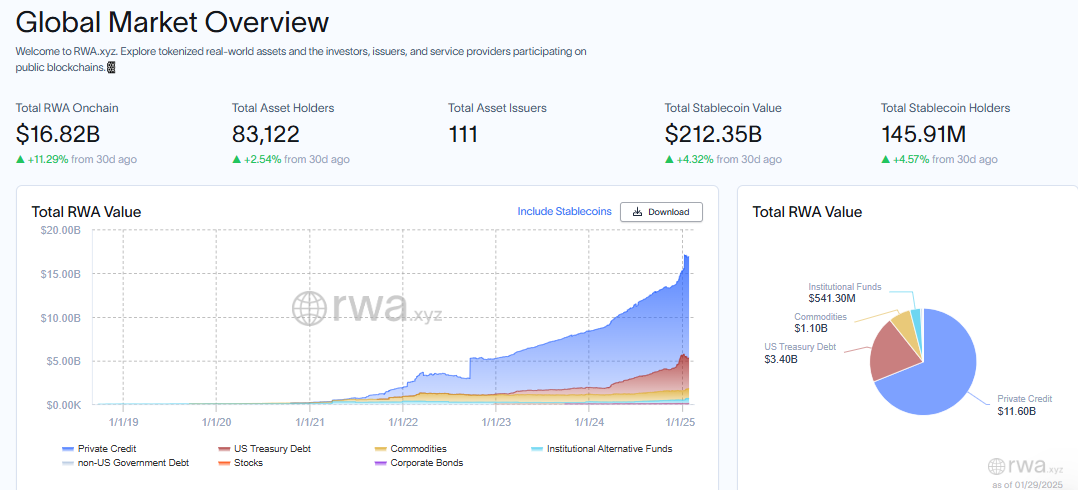

Its plea focuses on the tokenization of real assets (RWA), a transformative approach that could unlock investments in the private market for everyday investors.

Vlad Tenev lends a case for tokenization

In an opinion article published in The Washington PostTenev highlighted the gross investment gap in private markets, citing businesses like OpenAi ($ 157 billion assessment), SpaceX (350 billion dollars), Canva, Revolut, Stripe and Anthropic. According to Tenev, these companies remain in private, with investments in the start -up phase limited to a small elite of accredited investors.

Current regulations, such as the “accredited investor” rule, exclude around 80% of American households from these lucrative opportunities. According to Tenev, tokenization offers a solution.

“Finally, the United States compensates for lost time and takes cryptography seriously. So much promising progress forward. It is time to extend our understanding even more of what is possible, ”said Tenev on X.

Blockchain technology allows the creation of digital tokens representing property challenges in active worldmaking them negotiable on decentralized platforms. This approach would allow retail investors to access private actions before making themselves public, potentially benefiting from massive growth at an early stage.

“The actions of the private company would allow retail investors to invest in leading companies at the start of their life cycle before they are potentially public to evaluations of more than $ 100 billion,” said An extract from the publication.

In addition, he would provide private companies with a new avenue to raise capital without the burden of a traditional IPO.

Regulatory obstacles and need for reform

Despite the technological feasibility of tokenization, regulatory challenges remain. SECURITIES AND EXCHANGE Commission (SEC) oversees private company actions and securities in the United States. However, existing laws do not take into account blockchain technology. Likewise, the lack of clarity has hampered the development of tokenized titles platforms.

Meanwhile, other regions, including the European Union, Hong Kong, Singapore and Abu Dhabi, direct regulatory executives for security tokens. Tenev pleads for three key regulatory changes:

- Reform the rules of accredited investors – Change of criteria for qualifying measures based on wealth to assessments or self-certification based on knowledge

- Establish a safety token registration framework – Authorize American investors to access token titles while providing companies with a rationalized alternative to IPO

- Provide clear directives to brokers and exchanges -Ensure that platforms based on the United States can list and exchange security tokens legally and safe

Tenev’s push for tokenization aligns with the broader trends in industry. As Beincryptto reported, The Coinbase Layer-2 network, the basis, plans to bring Coinbase (corner) actions to tokenized to its platform. This decision highlights the growing interest in token actions. This also suggests that the main players explore ways to fill traditional finance with blockchain.

As the RWA tokenization market increases, more institutions should explore titles backed by digital assets. Such a result would increase accessibility and liquidity for investors worldwide.

While pleading for financial inclusion by tokenization, Robinhood was faced with a regulatory examination. The company recently agreed to pay the dry A regulation of $ 45 million on regulatory failures. This highlights Haim Haidles conformity The platforms focused on cryptocurrency must navigate.

Despite these challenges, Robinhood experienced solid financial performance, supported by the recent Bitcoin rally. In addition to Coinbase, the platform has experienced significant end-of-year gains, reflecting a renewal of investors’ interests for cryptographic markets.

Tenev’s vision for token is a paradigm shift in the financial markets. Taking advantage of Blockchain technology could make private investments more accessible, liquid and global. However, regulatory reforms are essential to carry out this potential.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.