WeChat friends help crypto thieves, Korbit denies hack: Asia Express

Chinese influencers on social networks have been targeted in a wave of WeChat account hacks, with attackers suspected of exploiting the security functionality of the messaging platform intended to prevent them.

Since April, several victims claim that the pirates have had access to their WeChat connection identification information, then triggered the “friends” system of the platform. This security feature, one of the three connection options on WeChat, allows a user’s contacts to receive verification requests on their behalf when connecting to a new device. It is intended for a backup when authentication of the SMS or QR code is not available.

“Cos”, co-founder of the Safety Society of Blockchain Slowmist, broke down the method in an article on June 17 on X. It noted that the attackers seem to target contacts with whom the victims had a minimum interaction, increasing the chances that these users could approve without thinking and transmitting the code.

In a case reported by the user X “YYD8888” On April 15, the pirates would have used the “Moment” functionality – similar to Instagram Stories – to publish false offers to buy TETH (USDT) at 7.42 yuan per dollar. At the time, the real exchange rate was around 7.32 yuan, which made him a favorable affair.

Another X user, “Liangxiuiui”, also said that he was hacked on April 15, although he says that the hacker used the SMS verification method.

“The connection came from a device entitled” Chen Zhihi “, clearly meant making me suspect someone near me,” he wrote. “But I know that this person does not have the skills necessary to achieve it.” He said he had placed his account under emergency freezing and still does not know how many people may have been scammed using his name.

Cos warns WeChat users to avoid adding unknown individuals to WeChat.

Korbit denies that he was hacked after the 12 -hour emergency interview

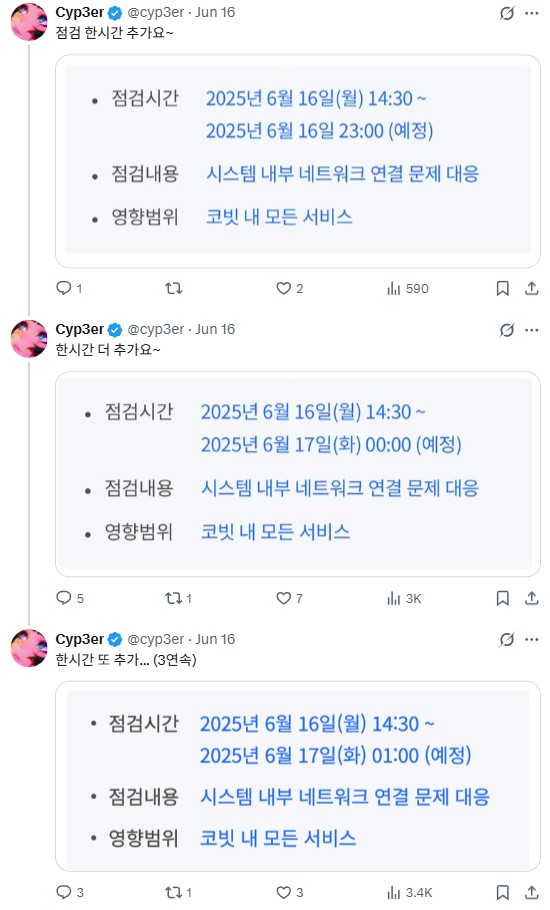

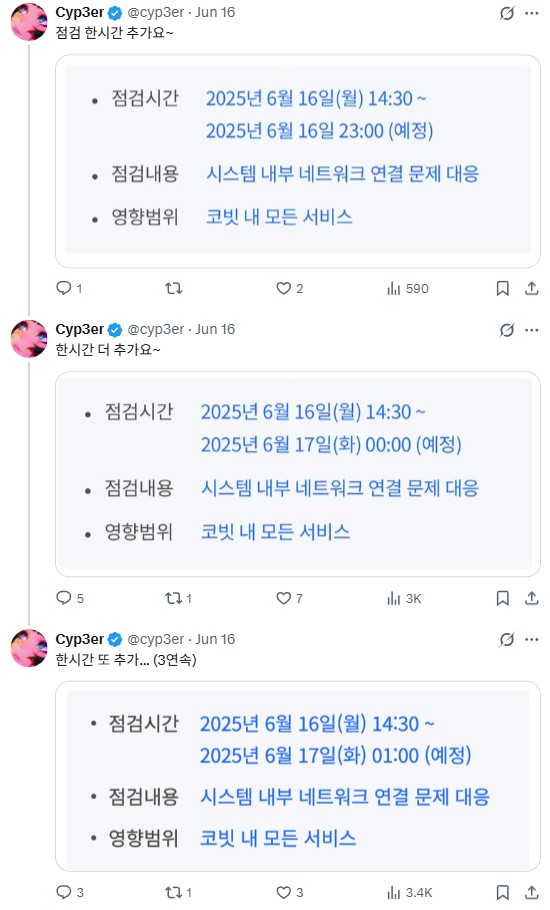

The South Korean exchange of Korbit cryptocurrencies denied having been hacked after an unexpected maintenance event on June 16 which left the users locked for half a day.

Sudden maintenance started at 2:30 p.m. local time on June 16 and was initially to end at 11:00 p.m. However, repeated delays pushed the resumption of negotiation at 3:00 am.

The company publicly said that the problem had been resolved and that user funds remain safe.

Internet users – a common term for members of the online community in the Eastern Asian countries – expressed their concern and even supposed if the exchange had been hacked and rushed behind the scenes.

“There was absolutely no problem linked to hacking, external attacks or data leaks,” said a spokesperson for Korbit Review. “The system disturbance was caused by the instability of the internal network and has now been fully resolved.”

Founded in 2013, Korbit is one of the oldest exchanges of cryptography in South Korea and one of the five local platforms legally authorized to provide crypto-fine services.

It operates under the NXC umbrella, which has a 61.85% participation in the exchange and recently lent 28.2 billion Koreans ($ 20 million) from Crypto to Korbit.

NXC also has Nexon, a South Korean game developer registered in Tokyo and currently the 21st largest Bitcoin restraint company listed in Bitcoin, according to BitcoinTareries.net.

Nexon also made waves on the Blockchain Games scene with the launch of Maplery N – a Blockchain revival of the classic lateral side rpg which was a success in the 2000s and early 2010s. The game was associated with a related cryptocurrency published on Avalanche.

Read

Features

Wild, Wild East: why the Boom of ICO in China refuses to die

Features

How to prevent the AI of “the annihilation of humanity” using the blockchain

Hong Kong Stablecoin rules set for August

Hong Kong financial secretary Paul Chan confirmed that the Stablecoin order, recently adopted by the Hong Kong Legislative Council, would take effect on August 1 as part of the city’s broader digital finance roadmap.

The law establishes an official regulatory framework for stablecoin issuers, which forces them to obtain licenses from the Hong Kong Monetary Authority (HKMA) and to demonstrate real use with clear economic utility.

In a blog article on June 15, Chan said that licensees will be authorized to fix their stablecoins to a variety of fiduciary currencies, not just in the Hong Kong dollar.

“This approach is conducive to the attraction of a diversified range of institutions around the world to issue stabbed to Hong Kong, pulled by real uses. This will considerably improve the liquidity and competitiveness of the Hong Kong market, “wrote Chan.

The new regime is involved in growing world interest in stablecoins. In the United States, the guidance and the establishment of national innovation for the United States Stablecoins Act (Genius) have adopted the Senate and now heads for the House of Representatives. President Donald Trump expressed the urgency, declaring that he wanted the bill on his office as soon as possible.

In China, although the central government has not made an official declaration on the Stablecoins, a large political reflection group supported by the State recently warned that the American stablecoins could constitute a threat to the monetary sovereignty of China. Meanwhile, the Chinese electronic commerce giant JD.com would intend to request stablecoin permits in several jurisdictions.

Read

Features

Blockchain games take the dominant current: here’s how they can win

Features

The fear and doubt of the legislators lead to cryptographic regulations proposed in the United States

Infinity stops the Stablecoin card activity

The Crypto Payments payment startup, based in Hong Kong, announced on June 17 that it ended its card services, only six months after the launch.

The company had offered Visa and Mastercard brand cards funded via stable stables deposited in user accounts. These stablecoins could be used for the generation of elements and daily payments, with an asset conversion managed behind the scenes. Users paid with stablecoins, while traders received a local fiduciary currency.

The service allowed cryptographic payments without requiring an output ramp and was compatible with third-party applications such as WeChat and Alipay in China, even if cryptocurrency transactions are prohibited on the continent.

Infini underwent a feat of $ 50 million in February, but the company said that the closure of its card services was not directly linked to the incident. Instead, the leaders cited the unbearable economy and the burden of heavy compliance with the exploitation of payment cards funded by Crypto.

CEO Christian Li has declared that the company will now focus on the development of decentralized payment solutions and asset management products.

Get down

The most engaging can be read in the blockchain. Delivered once a week.

Yohan Yun

Yohan Yun has been a multimedia journalist covering the blockchain since 2017. He has contributed to Crypto Media Outlet Forkast as an editor and covered Asian technological stories as an assistant journalist for Bloomberg BNA and Forbes. He spends his free time cooking and experimenting with new recipes.

Read

Columns

Shanghai Man: American senators tell athletes to avoid the digital yuan, the bounce of Chinese exchange volumes … and more

3 min

July 22, 2021

Geopolitics surrounding digital currencies are starting to fight with athletes for Olympic projectors, and the Infinity Axie token is adopted by Chinese merchants.

Learn more

Hodler digest

Us dry Survey on Binance ICO, Metaverse’s cryptographic assets increased by 400% in annual shift and Stepn faces

6 min

June 11, 2022

The best (and worst) quotes, the salients of adoption and regulation, the main parts, the predictions and much more – a week on Cointelegraph in a link!

Learn more