PEPE Poised For 40% Rally, Here’s Why

Pepe (Pepe), the popular and the third largest piece of cryptographic memes, managed to form a bullish price action model, attracting significant attention from crypto lovers. Today, on March 18, 2025, while feeling through the landscape of cryptography begins to change and the active ingredients take on the rise up, Pepe has reached the level of escape from his Haussier price action model.

PEPE (PEPE) Technical analysis and upcoming levels

According to Coinpedia’s technical analysis, Pepe has formed a bullish reversed head and shoulder model over the four -hour period and is currently on the point of an escape. After the market has witnessed the upward momentum, the meme’s room climbed considerably and reached the rupture area.

Based on the recent quantity of price, if PEPE leaves the model and closes a four-hour candle above 0.0000075, there is a high possibility that it can rise by 40% to reach the next level of resistance of $ 0.00001050505050 in the coming days.

In trade and investment, a successful escape from a reverse head and shoulder model is always considered a bullish sign and often moves the global feeling of the market.

Optimistic expert perspectives

Looking at the upward perspectives, an crypto expert shared an article on X (formerly Twitter), with an eight -hour pepe graphic that seems to violate a falling corner model. The expert has also noted that if the meme piece successfully bursts, Pepe could go up from 50% to 60% in the coming days.

Current Momentum of Prices and Surrendent Levels

Pepe is currently negotiating nearly $ 0.00,000,733, recording overvoltage of more than 13% in the last 24 hours. Meanwhile, its negotiation volume has climbed 45%, indicating increased participation of merchants and investors. In addition, the graph has formed a bullish model and is ready for the upward momentum.

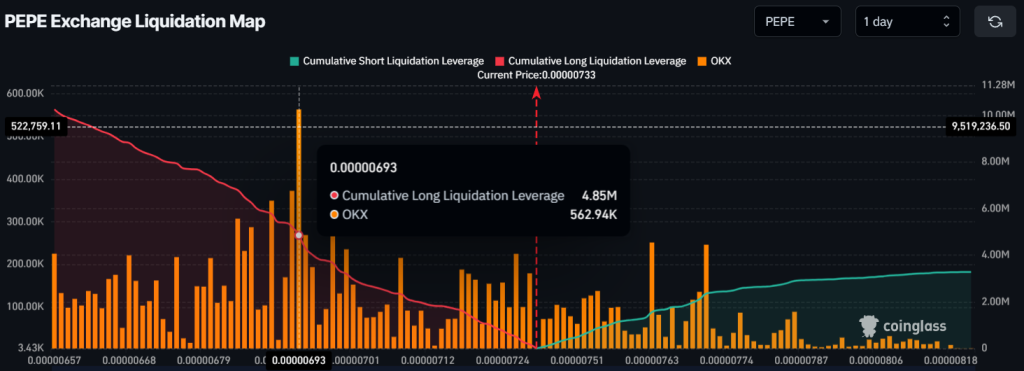

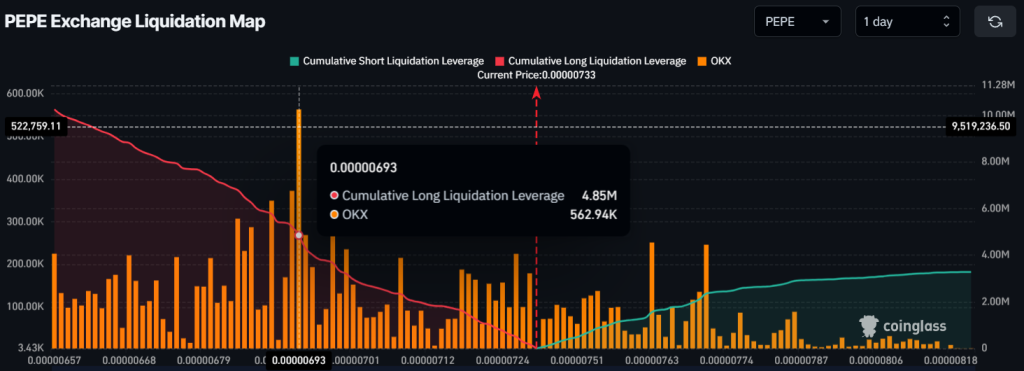

With upward perspectives, traders are betting strongly on the long side, as reported by the analysis company on Coiginglass chain.

The data reveals that traders are currently over-placed at $ 0.00,000,693 on the lower side and $ 0.00,000,7771 on the upper side, holding $ 4.85 million respectively and $ 2.35 million in long and short positions. These data on the chain particularly confirm that the bulls are currently dominating.