Whale Accumulation & On‑Chain Strength in Focus

Aave (Aave) Price is negotiated 18% at $ 256 when writing the editorial’s time, after the support drawn from the EMA group of 200 days this week. This elevation poses that AVE remains in a bullish structure despite a correction of the recent swing.

The native token of the loan platform indicates the potential of a macro level break on the horizon. This optimism has increased as the integration of Aave with the SVR of Chainlink activated phase 3 after successful anterior phases.

Phase 3 now covers 75% of the secure Aave Total Ethereum value (TVS), which represents 95% of Aave’s relevant OEV televisions. This decision is extremely beneficial because this expansion is essentially a movement adjusted to the risk to pump the use by Aave de SVR. This decision makes it an optimistic indication for the long -term sustainability of its ecosystem and the price of the native token.

In addition, the growth of its ecosystems is reflected in the data on the chain, and the opinions of experts increase on the price of Aave cryptography which soon increases. Continue to read to find out more.

Chain metric signals of an increase in prices are imminent

A recent opinion of an X expert boasted that institutional investors understood that Ave is the undisputed leader in the DEFI space. This is one of the “coins” to use much more than in 2021, as evidenced by Ath TVL, which has been higher in H1 2025 since creation.

Alignment with the optimism of analysts, other measures on the chain such as increasing protocol costs and income also indicates a significant increase in its use.

- Read also:

- The forecast of Bitcoin prices for the weekend – the increase in volatility or the price can remain blocked around $ 107,000?

- ,,

In addition, the token terminal stressed that active loans increased to record heights, and Aave leads the competitive landscape with a market share of more than 62%, which shows a strong adoption and a base of confidence among users.

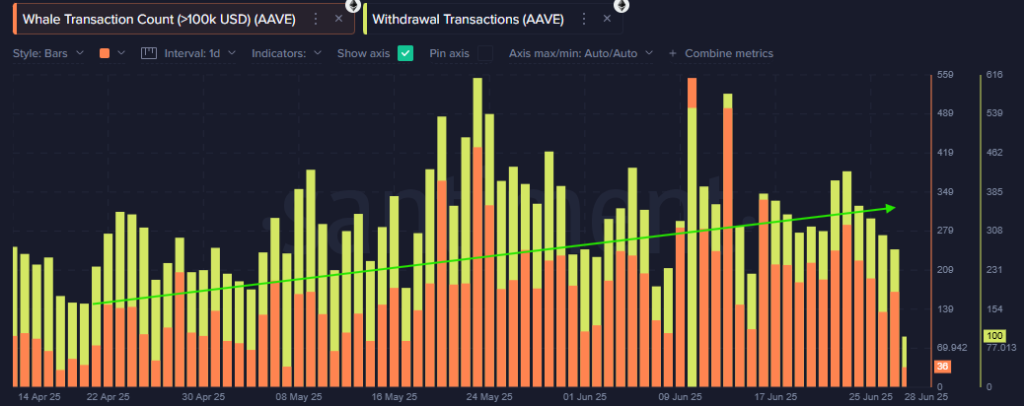

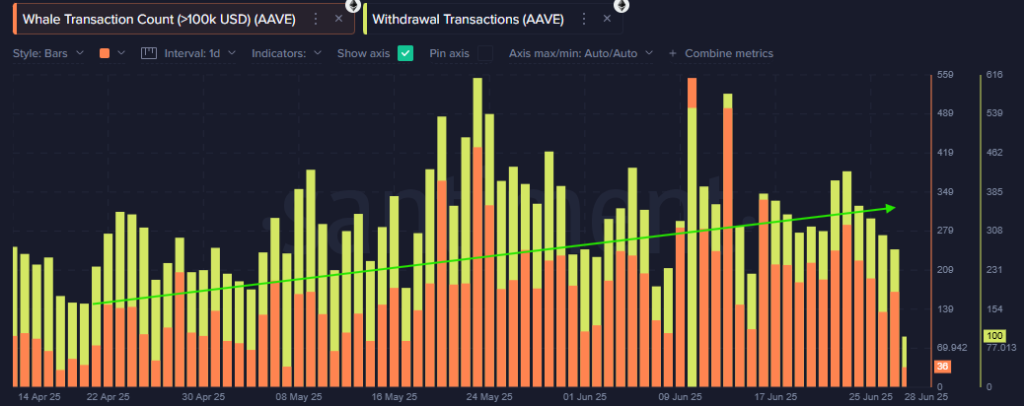

In addition, the use of addresses which withdrawn from exchanges has increased considerably from April, which signals a long -term accumulation trend. This accumulation trend has visible features in the number of whale transactions (> 100,000 USD), which has increased considerably compared to the lows of April.

These chain data indicate that they have become fundamentally strong and attends an accumulation of coherent whales, which suggests that the Aave price could soon increase in bullish circumstances.

AAVE PRICE PREDICTION: Aave should break $ 480

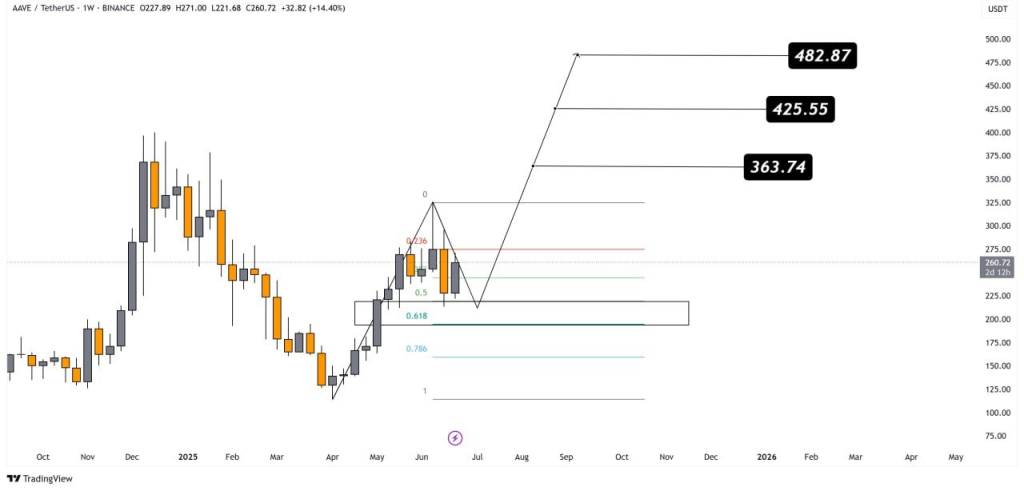

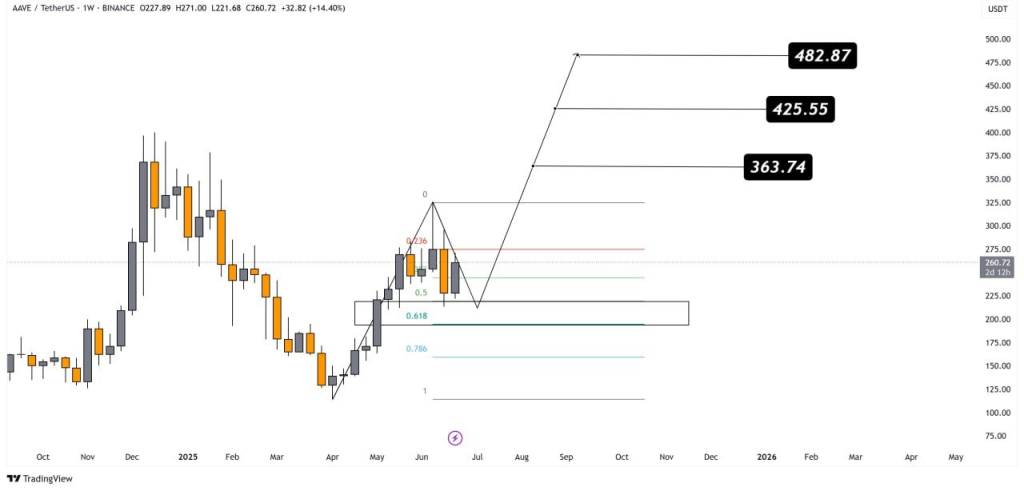

An article on X claims that on the weekly graphic, after a retracement of the T2 to a strong support, bullish views have opened because they show the symptoms of the formation of a continuation model in Q3.

He also said that a strong reaction from the support area could trigger a powerful rally after the confirmation level is reached above $ 275. Where the goal of up to $ 482 could be reached after managing the goal at $ 363 and $ 425.

Never miss a beat in the world of cryptography!

Stay in advance with the news, expert analysis and real -time updates on the latest Bitcoin, Altcoins, DEFI, NFTS, etc. trends

Faq

The price of Aave could reach a maximum of $ 526 in 2025.

The price of the Altcoin could degenerate at $ 1,161 by 2030 if the haus feeling is supported. Conversely, it could close the year with a hollow of ~ $ 800.

Given the fundamental principles of the protocol, Aave is a profitable investment if he is considered in the long term.