Bitcoin ETF Inflow Cools as BTC Falls Below $104,000

On Tuesday, the funds negotiated in exchange Bitcoin (ETF) recorded more than $ 200 million in entries. Although this has marked a net afflux net in these funds, it also represented a sharp drop compared to the $ 421 million seen the day before.

The cooling interest occurs while the BTC slipped to an intra -day hollow of $ 103,371 on Tuesday, signaling increasing caution between investors. If the decline persists, FNB’s entries could weaken more, while the institutional feeling continues to take a hit.

The FNB BTC see a crisis in daily entrances

On Tuesday, the FNB bitcoin FNB of the United States American list recorded net entries of $ 216.48 million, which indicates that the interest of investors remains intact. However, this marked a sharp drop of 47% compared to the $ 412 million displayed the day before, reporting a slowdown in the momentum.

The drop in entries coincided with the drop in BTC prices during the day’s negotiation session. He fell to an intraday hollow of $ 103,371 in a case of weakening request. The slowdown has weighed on the feeling of the market and seems to have blocked a new capital of the ETF entrance to the BTC.

Yesterday, the Ibit of Blackrock led the pack with the highest daily entries, totaling $ 639.19 million, bringing its total historic entrance to $ 50.67 billion.

On the other hand, the FBTC of Fidelity witnessed the strongest net output among these ETFs, with $ 208.46 million out of the fund.

BTC faces renewed pressure

Today, the BTC has extended its downward trend, losing an additional 2% while the wider cryptography market faces renewed sales pressure. The drop in prices was accompanied by a drop in open interest in the medal (OI), suggesting a slowdown in leverage commercial activity.

This amounts to $ 70.24 billion at the time of the press, lowering 3% in the last day. This withdrawal indicates that traders reduce their exhibition and could classify positions, a trend reflecting increasing prudence of the market.

The open interest refers to the total number of current contracts in progress which have not yet been set. When he falls during a price drop like this, this indicates that traders come out of positions rather than opening new ones. This is a sign of weakening of conviction and a reduction in speculative appetite in BTC term traders.

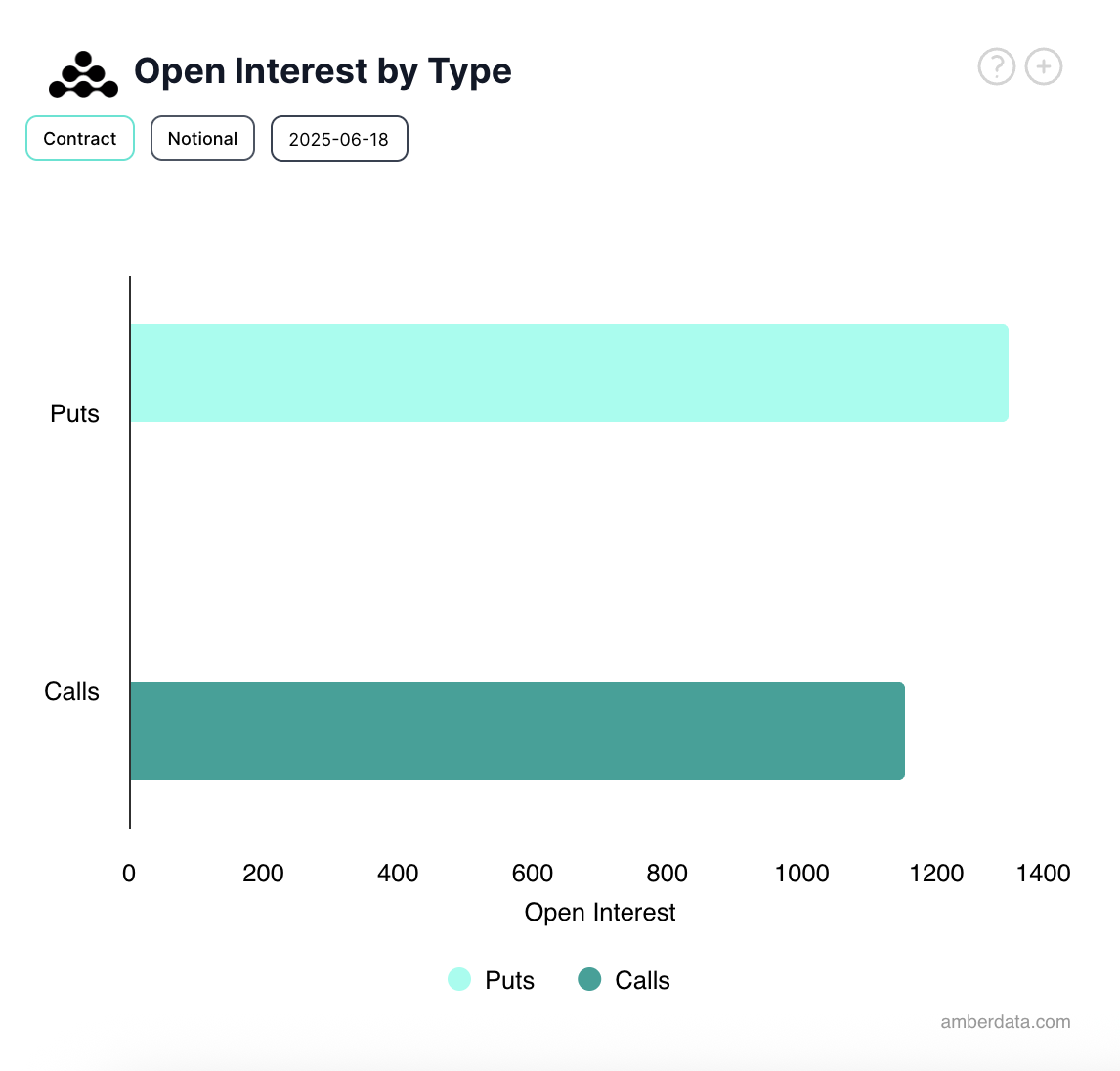

In addition, the lowering feeling continues to dominate the market of options, as evidenced by the increased demand for installation contracts on calls, by drinking. This imbalance suggests that an increasing number of merchants are positioning to benefit from a new drop in the price of the BTC.

The combination of cooling FNB entries, the decline in open interests and a downward tilt on the options market suggest that if institutional interest has not disappeared, the drop in capital flows and commercial behavior means that many investors are preparing for a new decline, or at least pending lighter signals before reinstating the market.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.