What Are Crypto Whales Buying After the Market Crash?

The whales bought Fet, Link and WLD in the middle of significant price corrections on the cryptography market. The strategic accumulation of these altcoins occurs even if the larger Altcoin market capitalization increased from $ 333 billion on January 19 to $ 245 billion currently.

The notable increase in large addresses holding these tokens suggests that the main investors see value at current prices. This accumulation model through FET, Link and WLD could indicate early positioning for potential recovery.

Artificial superintelligence alliance (FET)

The FET is currently undergoing significant correction. It is down 40% in the last 30 days, and its market capitalization is now $ 1.58 billion. This marks a sharp decline compared to more than $ 5 billion he reached in December 2024, reflecting a strong loss of momentum not only on FET but also in artificial Cryptos intelligence as a whole.

In addition, the FET has dropped by more than 9% in the last seven days, coinciding with a significant increase in accumulation among the FET whales.

Despite the current correction, this accumulation suggests that whales could benefit from lower prices, potentially positioning for a future rebound.

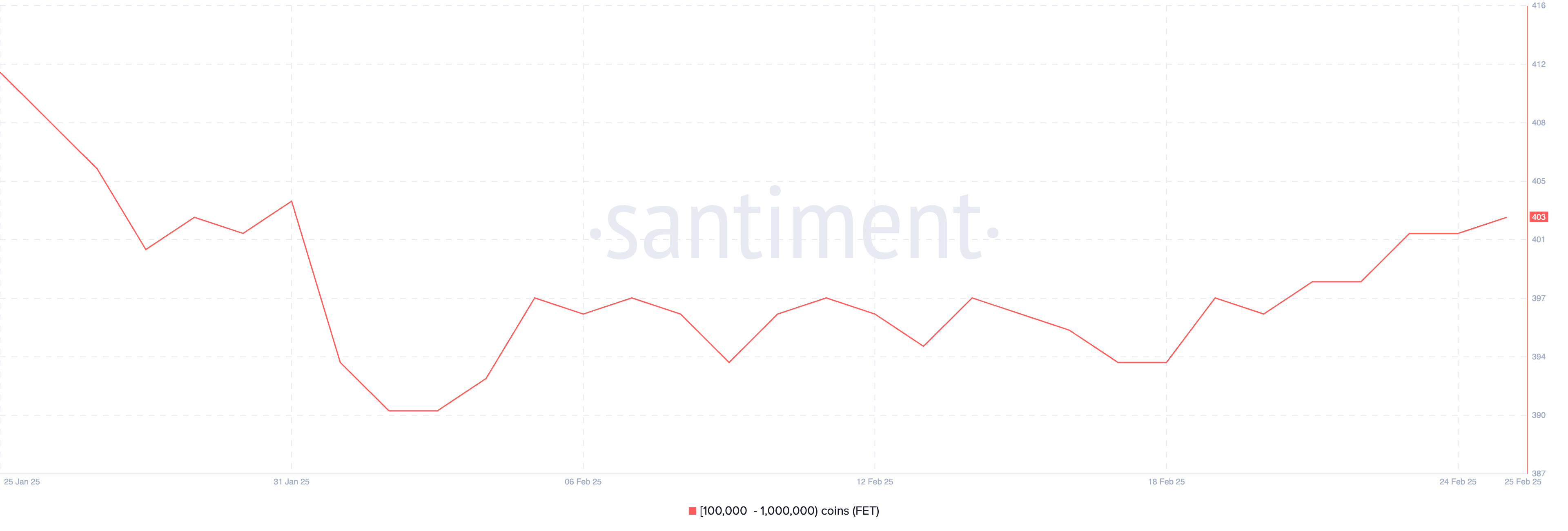

The number of addresses holding between 100,000 and 1,000,000 FET increased from 394 from February 18 to 403 on February 25, its highest level since January 31.

The whales purchased during a period of drop in prices indicate growing confidence among the largest holders, which may sign a stall phase. If this trend continues, it could provide support for the necessary purchase to stabilize the price of FET and finally trigger a reversal.

However, until the broader feeling of the market does not improve, the FET is likely to stay under pressure, the accumulation models used as a key indicator of the potential bullish impulse.

ChainLink (link)

Like other altcoins, ChainLink recently faced significant corrections, its value decreasing by more than 13% in last week.

This drop expelled the link of the first 10 cryptos by market capitalization, its total value falling below 10 billion dollars.

The pressure on the price of the chain was persistent. It remained less than $ 24 for almost a month, indicating a downward downward trend on the market.

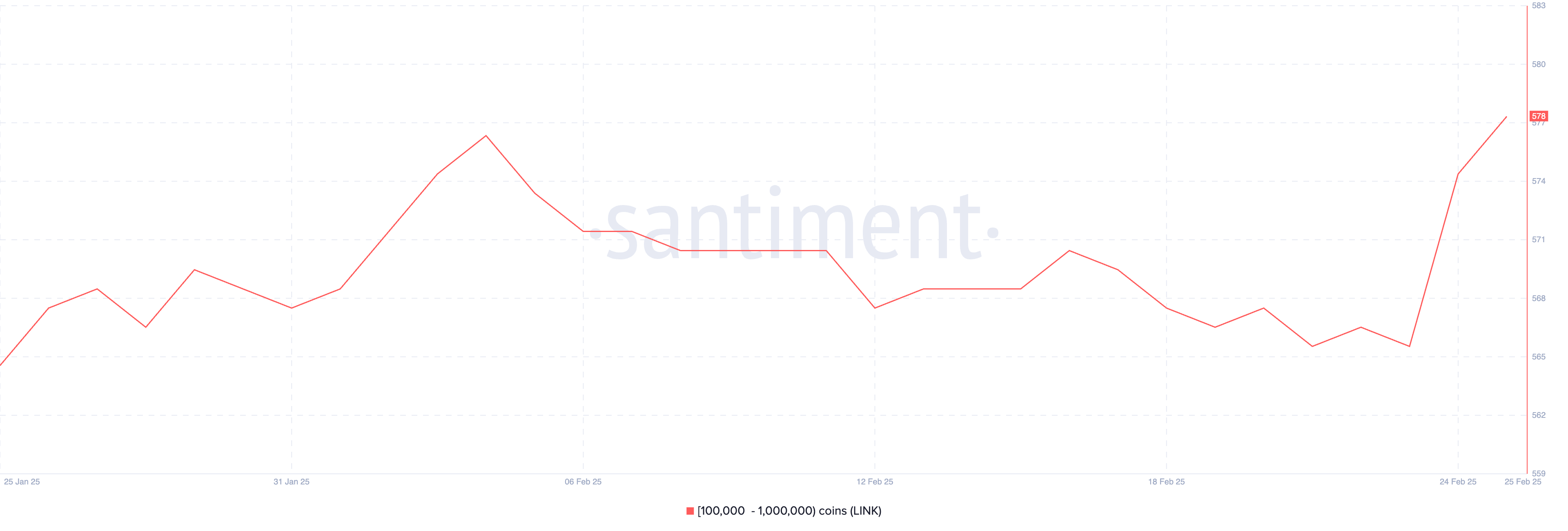

Despite this momentum down, potential signs of emerging recovery. While the number of liaison whales – addresses holding between 100,000 and 1,000,000 bonds – decreased from 577 on February 4 to 566 on February 23, a notable reversal occurred on February 25, when this figure rose to 578 while the whales bought a link.

This sudden increase in the accumulation of whales could point out renewed confidence among whales.

If this accumulation of whales continues, it could provide the upward pressure necessary to break the chain link price above the $ 24 resistance level which capped its performance for weeks.

Worldcoin (WLD)

Worldcoin Price experienced a strong market correction in the past month, its price dropped by more than 41%.

This spectacular drop had a significant impact on its market capitalization, which is now $ 1.17 billion – a substantial drop in its peak of almost $ 3 billion in December 2024.

Such a pronounced downward trend reflects considerable sales pressure and a confidence of potentially decreasing investors in the WorldCoin project during this period.

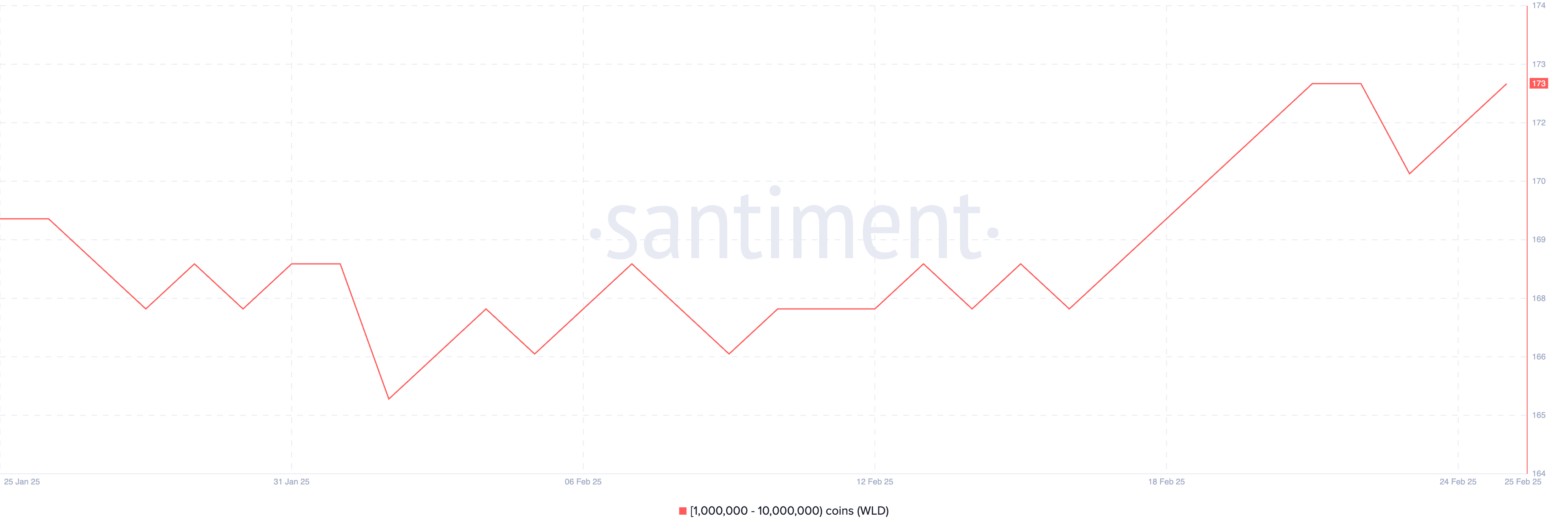

Interestingly, despite this sharp drop in prices, the behavior of whales suggests a potential change in the feeling of the market. While the world’s number of whales has remained relatively stable throughout the month, fluctuating closely between 170 and 166, a notable change occurred on February 16 when major holders started to accumulate WLD.

The number of addresses holding between 1,000,000 and 10,000,000 WLD has now increased to 173 – reaching its highest level since December 29, 2024.

This renewed accumulation of the main investors could point out that whales consider current price levels as an attractive entry point, potentially anticipating recovery.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.