XCN Token Sees 20% Surge as Smart Money Pushes for $0.03

Onyxcoin (XCN) jumped 20% this week, marking a two -digit gathering that attracted the attention of institutional investors.

While the price of Altcoin rises, the technical analysis reveals an increase in the accumulation of large investors, often called “intelligent currency”, signaling increased optimism with regard to the growth of the short -term token prices.

Institutional confidence in XCN increases

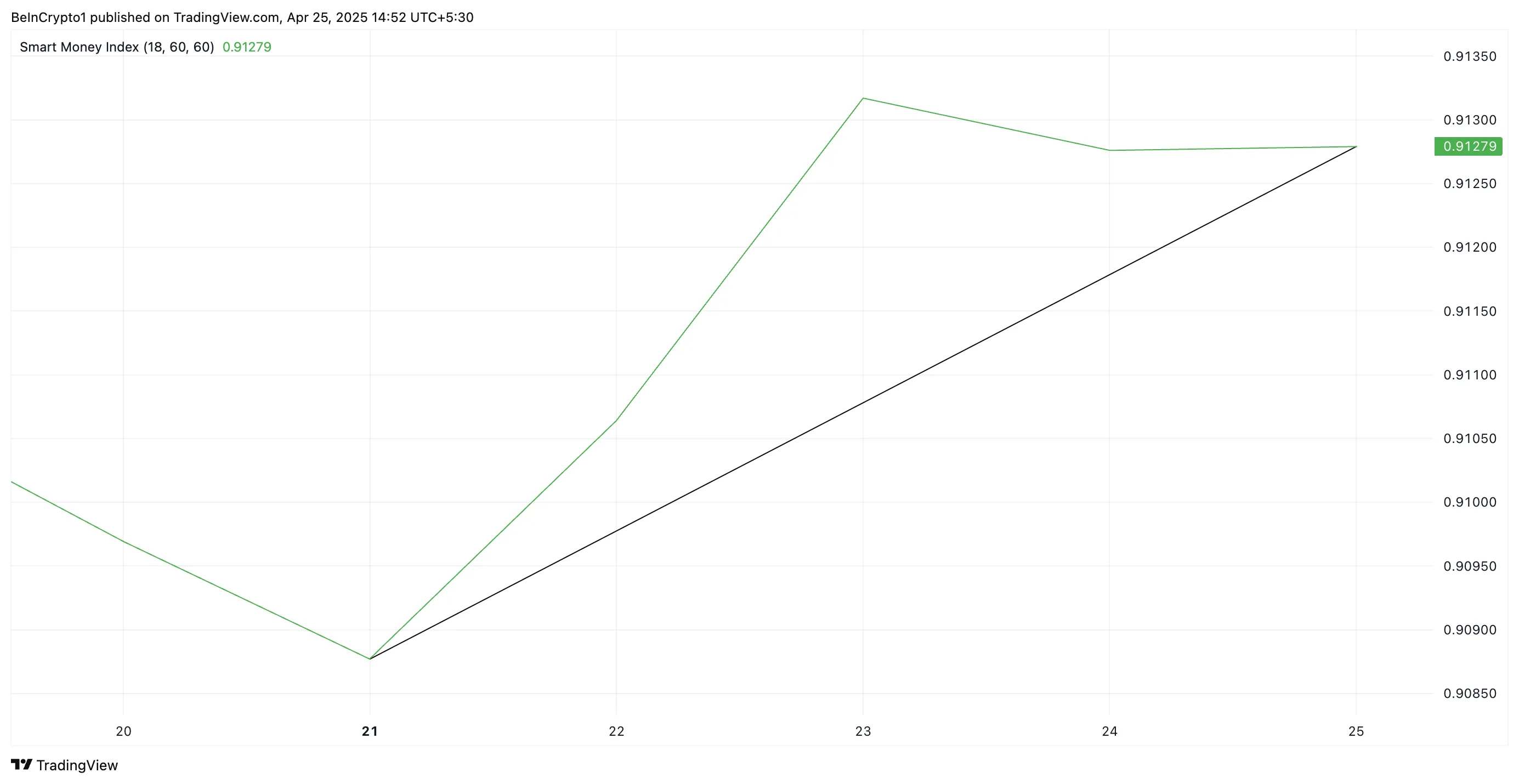

The sharp increase in institutional interest is obvious in the intelligent XCN climbing index (SMI). While the price of the token has rallied in last week, its SMI has also climbed and is currently at 0.91.

The SMI indicator follows the commercial activity of institutional investors, often considered to be “smart money”. He analyzes the movements of intraday prices, focusing on the first and last hours of negotiation.

When the SMI rises alongside the price of an asset, the main investors accumulate positions, indicating confidence in the upward trend. This alignment between the XCN SMI and its price rally is a bullish signal, reflecting a strong market feeling and the potential of a continuous price increase.

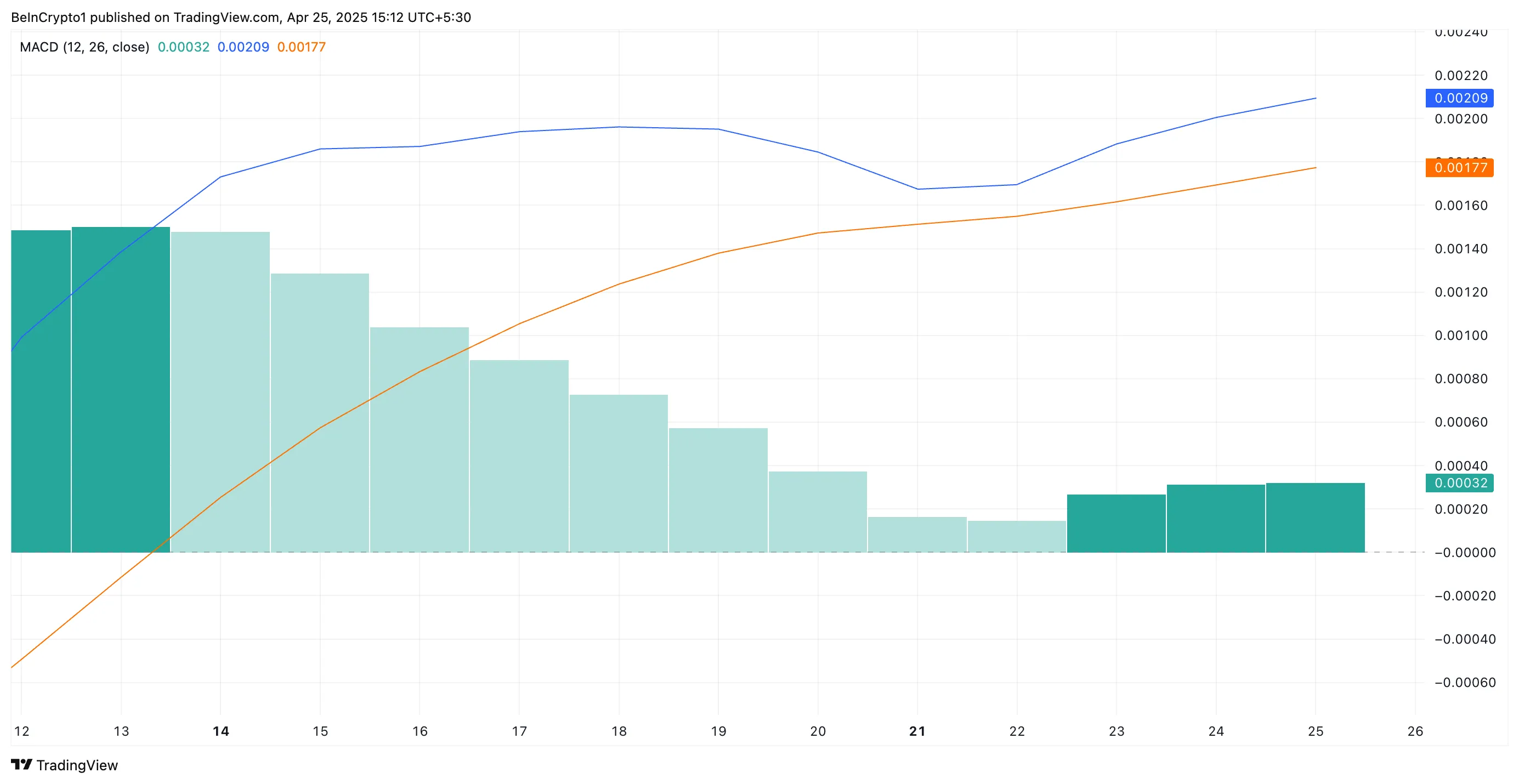

In addition, the readings of the indicator of the average convergence of XCN (MacD) support this upward perspective. At the time of the press, the MacD line of the token (blue) rests above the signal line (orange).

This crossover is generally interpreted as a bullish signal, suggesting that the ascending momentum is gaining strength. This indicates that the recent Pressure Pressure of XCN exceeds historical averages, which could cause continuous price gains.

XCN bulls hold the line

On the daily graphic, the XCN token rests solidly above its 20-day exponential mobile average (EMA). This key mobile average forms the dynamic support below the price of the token at $ 0.017.

The 20 -day EMA of an asset measures the average price of an asset during the last 20 days of negotiation, which gives weight to recent prices. When the price of an asset is negotiated above this indicator, the bulls have market control, because the purchase pressure prevails over sales.

If this trend persists for XCN, its price could collect resistance at $ 0.023 and climb to $ 0.028. If the Bulls return this level in a support floor, XCN could recover $ 0.033.

However, an increase in for -profit activity will invalidate this bullish projection. In this scenario, the value of the XCN token could dive below its EMA from 20 days to 0.017 $ and fall to $ 0.0075.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.