What It Means for BTC’s Price

The main piece, Bitcoin, has been negotiated in a narrow range since early February. He struggled to get out of consolidation because the purchase and sale of pressures remain moderate.

The chain data suggest that this period of movement laterally could persist due to the weakening of activity on the Bitcoin network.

Bitcoin could face a laterally prolonged movement as network activity decreases

According to a recent report by the pseudonym analyst of the crypto -Avocado_onchain, the activity of the Bitcoin network has regularly decreased, contributing to recent BTC close price movements. If this continues, “we must consider the possibility of another prolonged consolidation phase, similar to what started in March 2024,” explains the analyst.

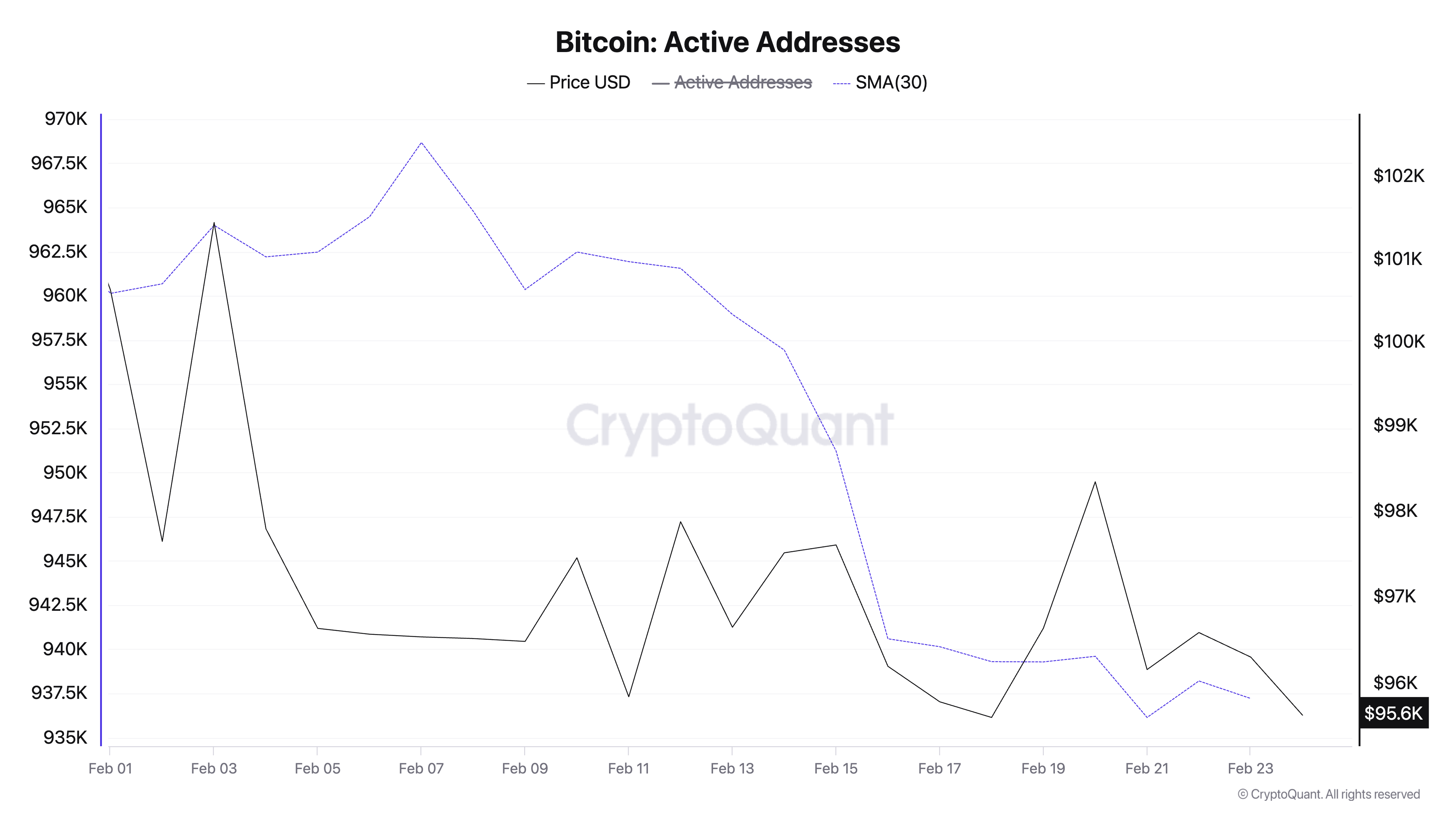

One of these lawyers is the number of daily active wallet addresses on the Bitcoin network. According to cryptocurrency data, when observed using a small mobile average (SMA) of 30 days, the daily number of addresses which has made at least one BTC transaction has dropped by 2% since February 1.

A decrease in daily active portfolios on the signals of the Bitcoin network has reduced user demand. This can contribute to downward price pressure on the medal, because the drop in network activity is generally aligned with lower purchasing interests.

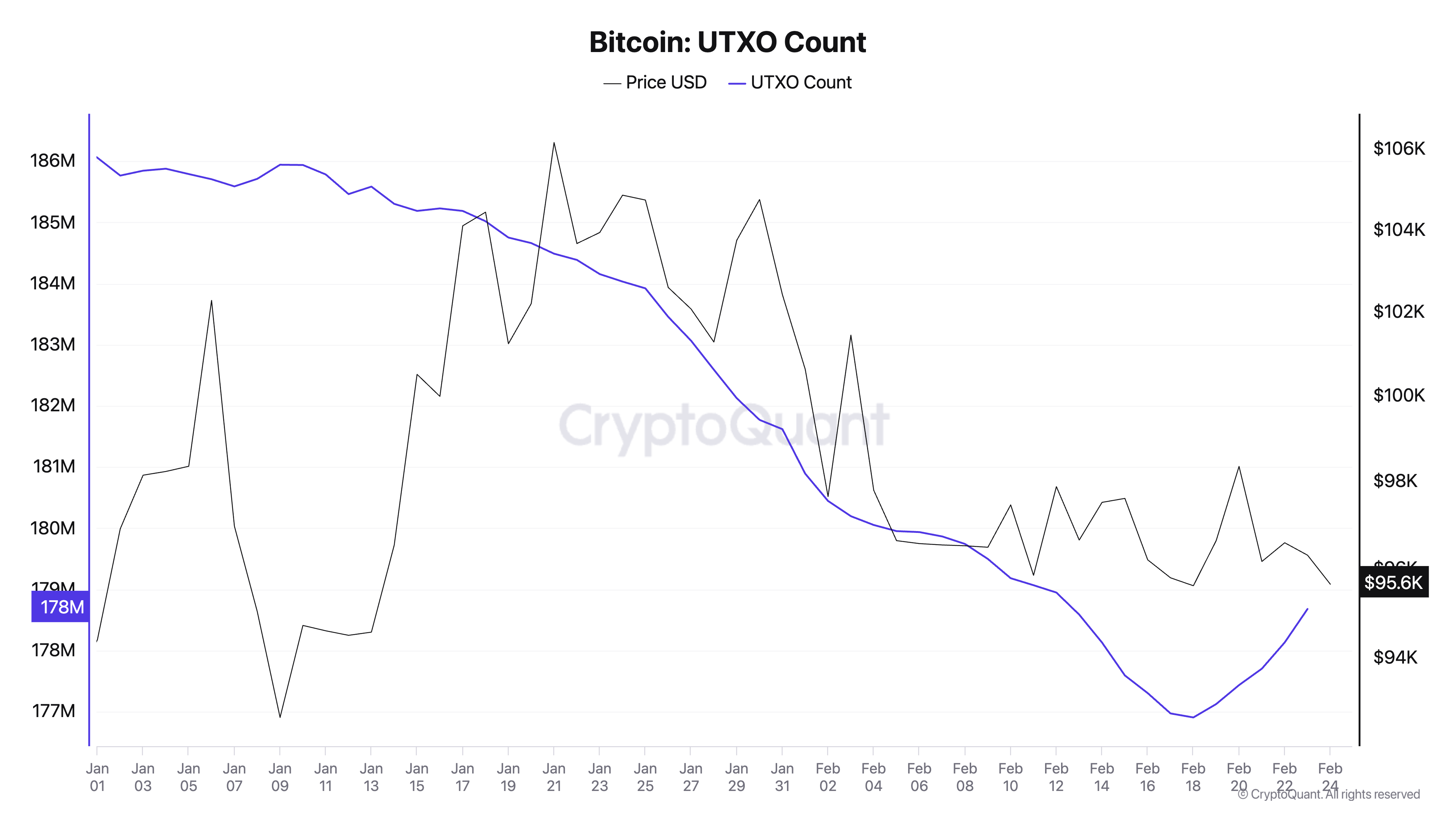

In addition, the lawyer reports that “the number of utxos also decreases, with the extent of the decline similar to the correction period of September 2023.”

The unspected transaction output (UTXO) follows the Bitcoin amount on the left after a transaction, which can be used as input for future transactions. It represents the available balance that can be spent on the network. When the number of utxos decreases, less new parts are distributed or moved, which suggests a reduced transaction activity. This indicates a period of consolidation, where investors hold rather than spending their parts.

“If this trend continues, we could see signs of exodus of investors similar to the peak of the 2017 market cycle. However, a simple drop in utxos is not sufficient to confirm the end of the current cycle, because Other indicators always suggest an increased perspective, ”writes Avocado.

Bitcoin hovers near the key support-will it pull or break?

To date, BTC is negotiated near the support line of its horizontal canal at $ 95,527. If the activity of the Bitcoin network decreases, also affecting the demand for the king’s part, its price could break below this level. In this scenario, BTC could increase to $ 92,325.

On the other hand, if market trends change and the purchase pressure is gaining momentum, the part could rally at the resistance at $ 99,031 and try a crossover. In case of success, BTC could reach $ 102,665.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.