Pi Coin Hovers Near $0.445 Support: Bounce or Break?

Pi Coin has oscillated dangerously close to a key support level after a week of slow negotiation. At the time of the press, Pi Price amounts to $ 0.4725, is struggling to maintain above the level of $ 0.44,452.

Although chain metrics do not show strong conviction anyway, some cracks in the bearish momentum begin to appear.

Open interest and financing rate report a break

Pi Price shows signs of hesitation. The open -minded interest in Coanyze (within 4 hours) ranges around $ 10.09 million and also shows no major directional conviction in the past few days. This means that traders do not aggressively build new long or short positions, suggesting an indecision.

Meanwhile, the aggregated funding rate has climbed to +0.0274, and the planned financing rate increased even more to +0.0516. In simple terms, this means that long coins are slightly dominant and ready to pay a bonus to hold their positions, generally a bull sign.

The open interest refers to the total number of unstable contracts on the market. An increasing open interest generally confirms that more traders enter the market, supporting the current trend. The financing rate is the periodic costs paid between long and short traders. Positive values mean that long is dominant; Negative shorts suggest that shorts are in control.

Overall, the interest open with an increase in funding rates shows a long light biases, but in the case of the PI room, it is without strong conviction.

The bear or the bear loses steam

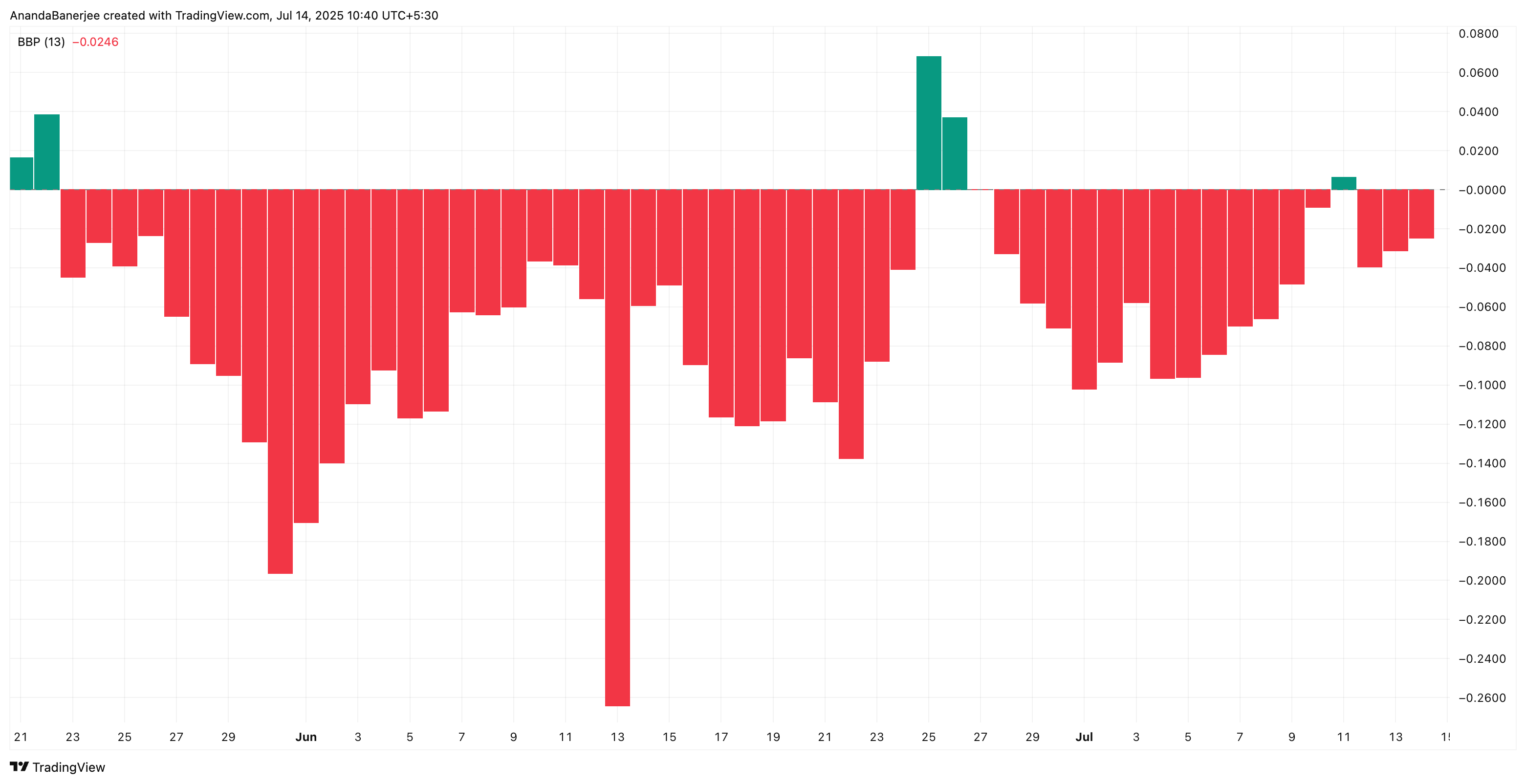

With increasing funding rates and an open interest remaining flat, the market is leaning a little long but without conviction. This hesitation is reflected in the power indicator of Bull Bear, which is part of the elder ray index, which follows the strength of buyers / sellers on the market.

At the time of the editorial staff, the power of the bear continued to weaken, indicating that the lowering momentum fades.

PI price analysis: key support always maintains

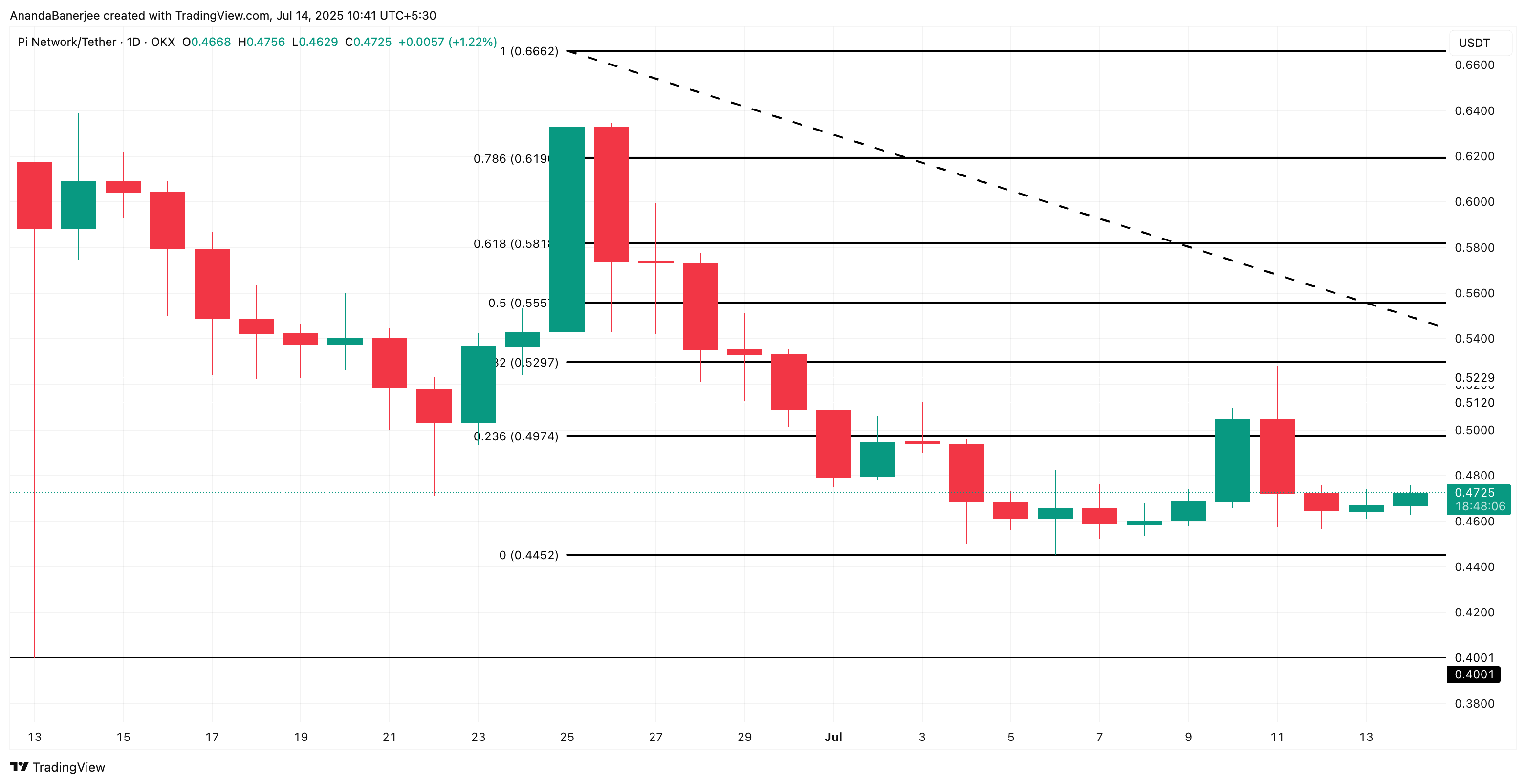

Pi Coin (PI) is currently negotiated at $ 0.4725, oscillating just above the level of key support at $ 0.44,452. This level was derived using the Fibonacci trace tool, from the end of June to the highest July 6.

Fibonacci Retalation is a technical tool that traders use to identify the levels of potential support and resistance by measuring how far the price fell from a recent movement.

So far, this support has been maintained despite the wider drop -down trend of PI. Ventilation less than 0.4452 could expose the PI part to a clearer correction to $ 0.4001, the next major support.

On the other hand, if the momentum is built, the next increase resistance is $ 0.4974, a level where the PI price has been rejected several times. A daily fence greater than 0.4974 could return the upward upper structure, invalidating the downward hypothesis.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.