What Next After 22% Price Drop?

Onyxcoin (XCN) has extended his defeats, plunging another 22% in the last 24 hours. It is now negotiated at a 30 -day $ 0.015.

With an increasingly lowering bias towards Altcoin, its price can continue to drop. This analysis explains why.

Onyxcoin merchants remain lowered

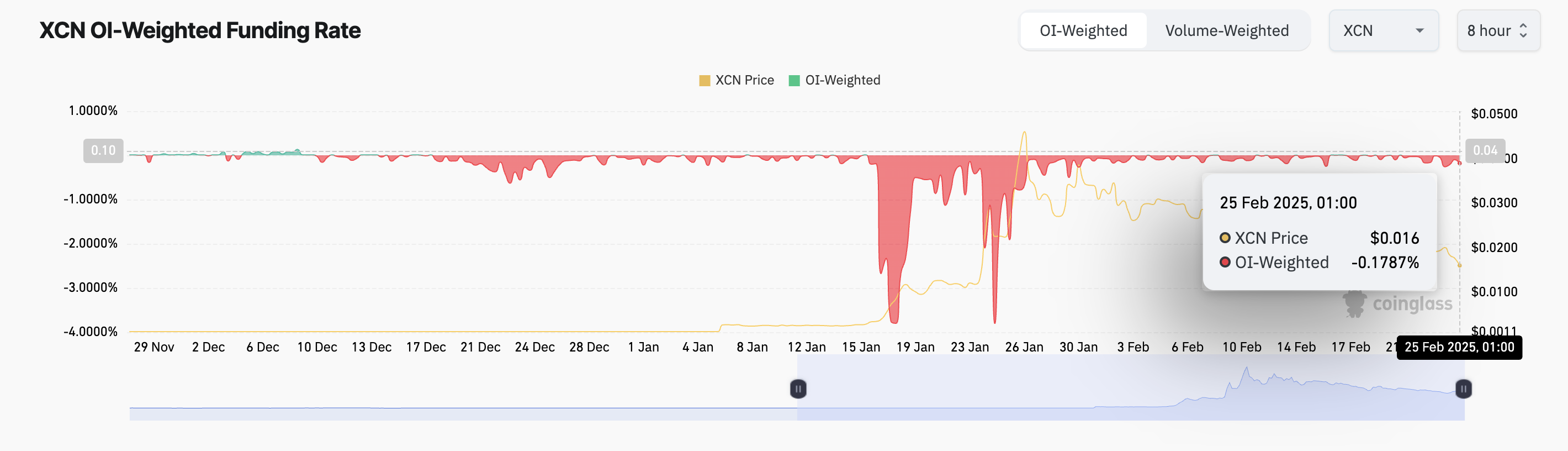

XCN’s persistent negative financing rate is a major indicator of the lowering bias against him. According to Correglass, the Altcoin financing rate has been mainly negative since December 9. At the time of the press, it rises at -0.17%.

The funding rate is a periodic cost exchanged between long and short traders in perpetual term contracts to maintain prices aligned on the cash market. When negative, short traders pay long merchants. This indicates that most XCN traders are downgraded and expect new price reductions to decrease.

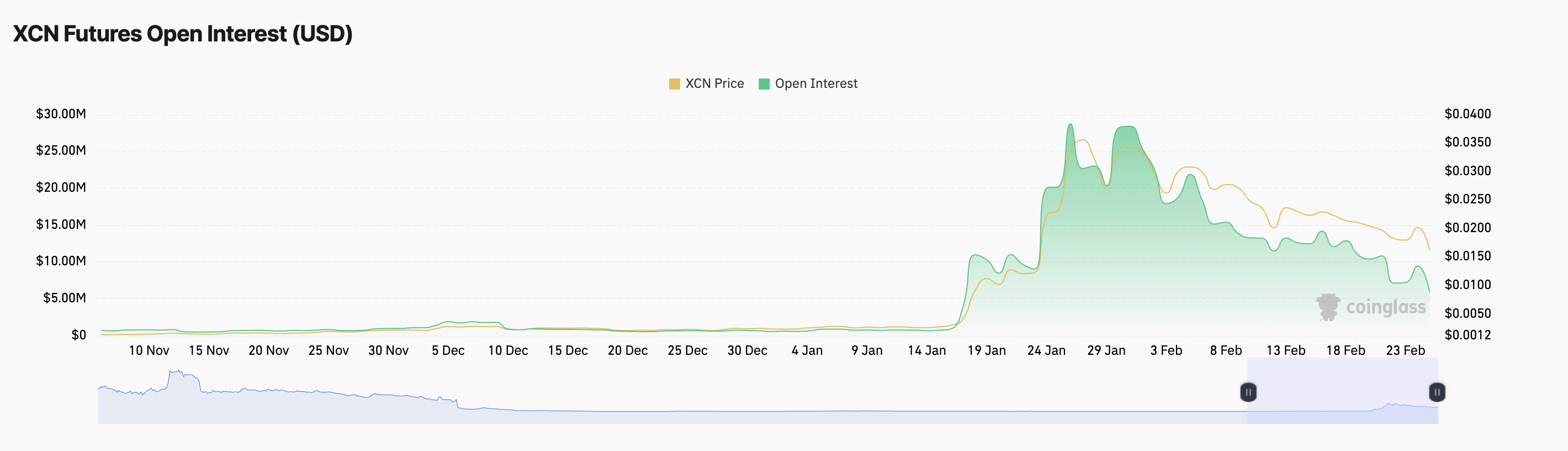

In addition, XCN’s open interest was in a downward trend, highlighting the poor demand for Altcoin among market players. According to Correglass, data, when writing this document, represents $ 6 million, marking its lowest level in 30 days.

The open interest of an asset measures the total number of its current derivative contracts, such as term contracts or options, which have not been set. When it falls next to the price of the assets, as in the case of XCN, this indicates a weakening of market participation, traders closing their positions rather than opening new.

This indicates that the drop in prices of XCN is driven by liquidation or taking profit rather than by a new uncovered sale, reducing the probability of a net rebound in the short term.

The lower clouds are looming on XCN

On the daily graphic, XCN is negotiated below the head stretches A and B of its cloud indicator Ichimoku. This momentum indicator measures market trends in an asset and identifies the potential support / resistance levels. When an asset falls below this cloud, the market is in a downward trend.

In this case, the cloud acts as a dynamic level of resistance for XCN. It confirms the probability that its price reduction continues as long as the price remains lower than the cloud and that demand continues to drop. If this trend persists, the value of XCN could decrease to $ 0.011.

On the other hand, if the purchase activity resumes, the value of XCN could move to $ 0.022.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.