What to expect from Bitcoin (BTC) in August?

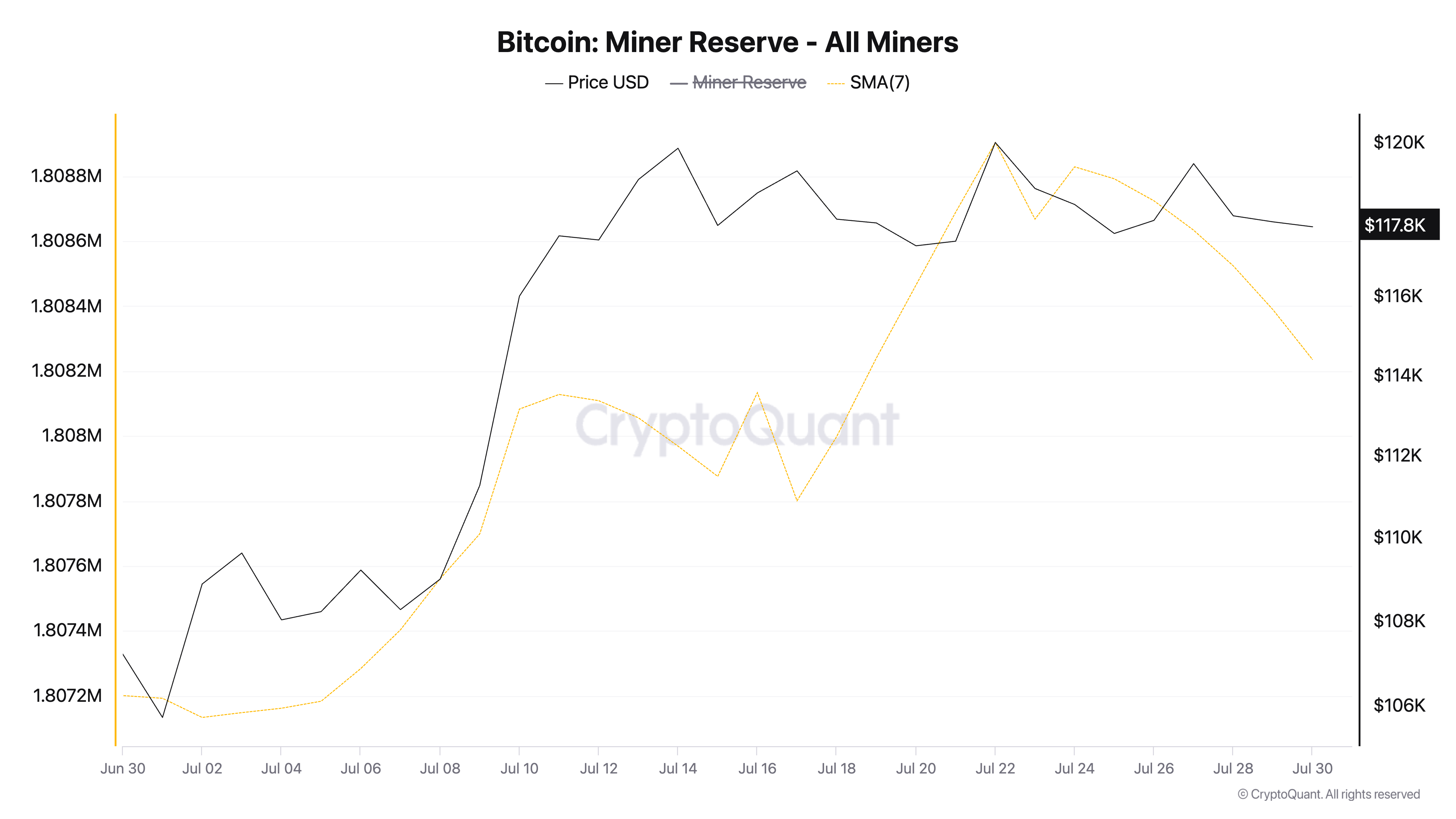

The Bitcoin minors reserve increased regularly between July 2 and 22, reflecting the accumulation while the piece went up to a new summit of $ 122,054 on July 14.

At the time, minors seemed confident in the bullish momentum of the medal, retaining their awards in anticipation of higher prices. However, BTC has struggled to maintain momentum since he hit this peak. In response, minors began to unload their assets to lock the profits. This change has new Winds for BTC in August.

Bitcoin bullish race stops while minors go from maintenance to sale

While the BTC value was starting to climb at the beginning of the month, the Bitcoin network minors also increased accumulation, reflected in the increase in the play of the room.

According to cryptocurrency data, this metric – was observed using a mobile average of seven days (SMA of 7 days) – Rose of 0.05% between July 1 and July 22, culminating at 1,808 million pieces.

For TA tokens and market updates: Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

The minor reserve metric follows the total quantity of BTC maintained in portfolios associated with mining entities. When the reserve rises, it indicates that minors keep their parts rather than selling, reflecting bullish feelings or expectations of continuous price growth.

However, after the BTC rally at its peak of July 14 and in the subsequent consolidation phase – in which it continues to negotiate – the unshakable feeling of minors began to decline. According to Cryptochant, the minor reserve tends to drop since July 22, indicating an increase in profits or reduced confidence in the short -term prices of the BTC.

Since minors control an important part of the newly issued offer by BTC, changes in their behavior can have an impact on the price management. A drop in minors’ reserves like this can worsen sales pressure, increasing the risk of correction of BTC prices in August.

Institutional entries could compensate for the sales pressure of minors in August

In an exclusive interview with Abdul Rafay Gadit, Co-founder and financial director of Zignaly, he declared that the recent increase in minor reserves earlier in July was “probably a short-term break rather than the start of an aggressive accumulation”.

“The increase in minor reserves suggests that they choose to keep their BTC, probably awaiting stronger market signals or more favorable price conditions. It does not yet reflect a large accumulation;

Asked about the relative influence of the activity of minors in relation to the institutional demand on the current performance of BTC prices and what to expect, gadit noted that:

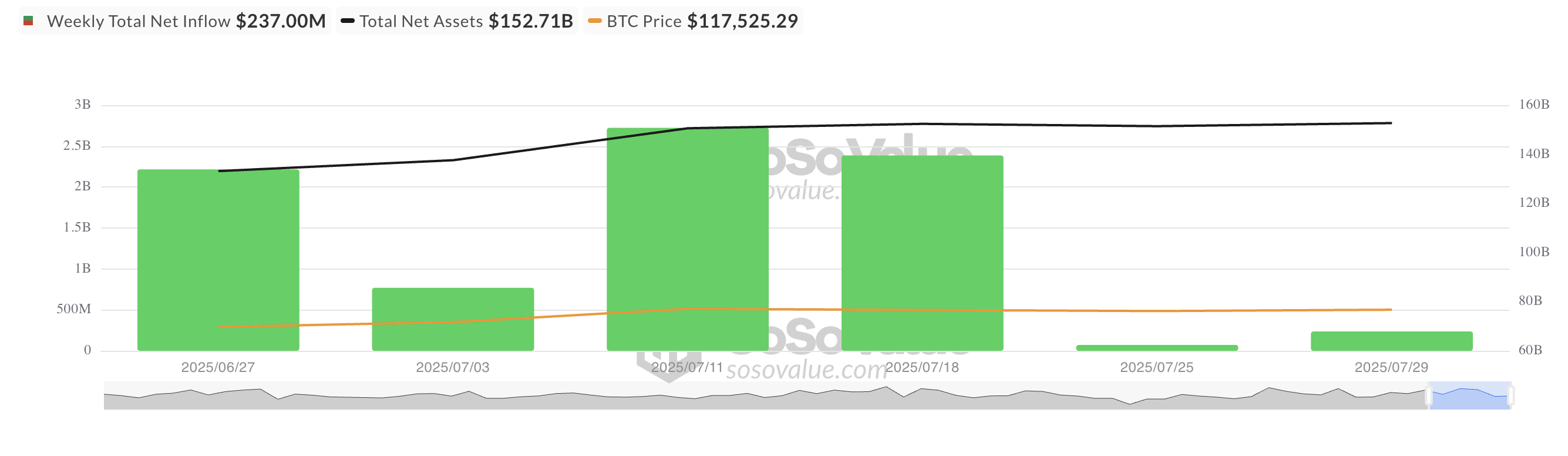

“Institutional demand is the real backbone of the current Bitcoin price structure. The FNB flows, in particular those managed by Blackrock, Fidelity and Ark, create a coherent structural offer that supports the price levels more effectively than the sale of reduced minors. ”

He added:

“While the behavior of minors plays a role in the softening of short -term supply pressure, the real force behind market management is shaped by institutional capital, wider participation and increasing expectations of a more favorable regulatory climate. The reality is that minors no longer define the pace; The institutions are. “

With the growing institutional demand of BTC – reflected in regular inputs in BTC FNB – all the potential pressure of the sale of minors could be effectively offset, which contributes to maintaining the price of the room in August.

According to Sosovalue data, the BTC ETFs have recorded 237 million dollars in net entries this week, despite the trade in coins mainly laterally.

This confirms the point of view of gadit that institutional capital, rather than the activity of minors, is the main force supporting the price of the BTC and could help to stabilize it in the coming month.

Can Bitcoin shake up the lateral trend?

At the time of the press, the BTC is negotiated at $ 117,826, oscillating between the support floor formed at $ 116,952 and the resistance at $ 120,811. If institutional demand increases and the general feeling of the market improves, it could push the price of the part beyond the resistance of $ 120,811 and to its record level in August.

On the other hand, if the lower pressure climbing, the part could break below $ 116,925 and fall to $ 114,354.

The message what to expect from Bitcoin (BTC) in August? appeared first on Beincrypto.