What To Expect From Bitcoin (BTC) Price In June?

Bitcoin experienced a massive rally in last month, marking a new summit of all time (ATH) at $ 111,980. This significant price wave raised questions about the sustainability of Bitcoin momentum in June.

Although some investors are optimistic about additional gains, others wonder if the price will cool or if Bitcoin holders will take a more prudent path.

Bitcoin investors strongly acquire

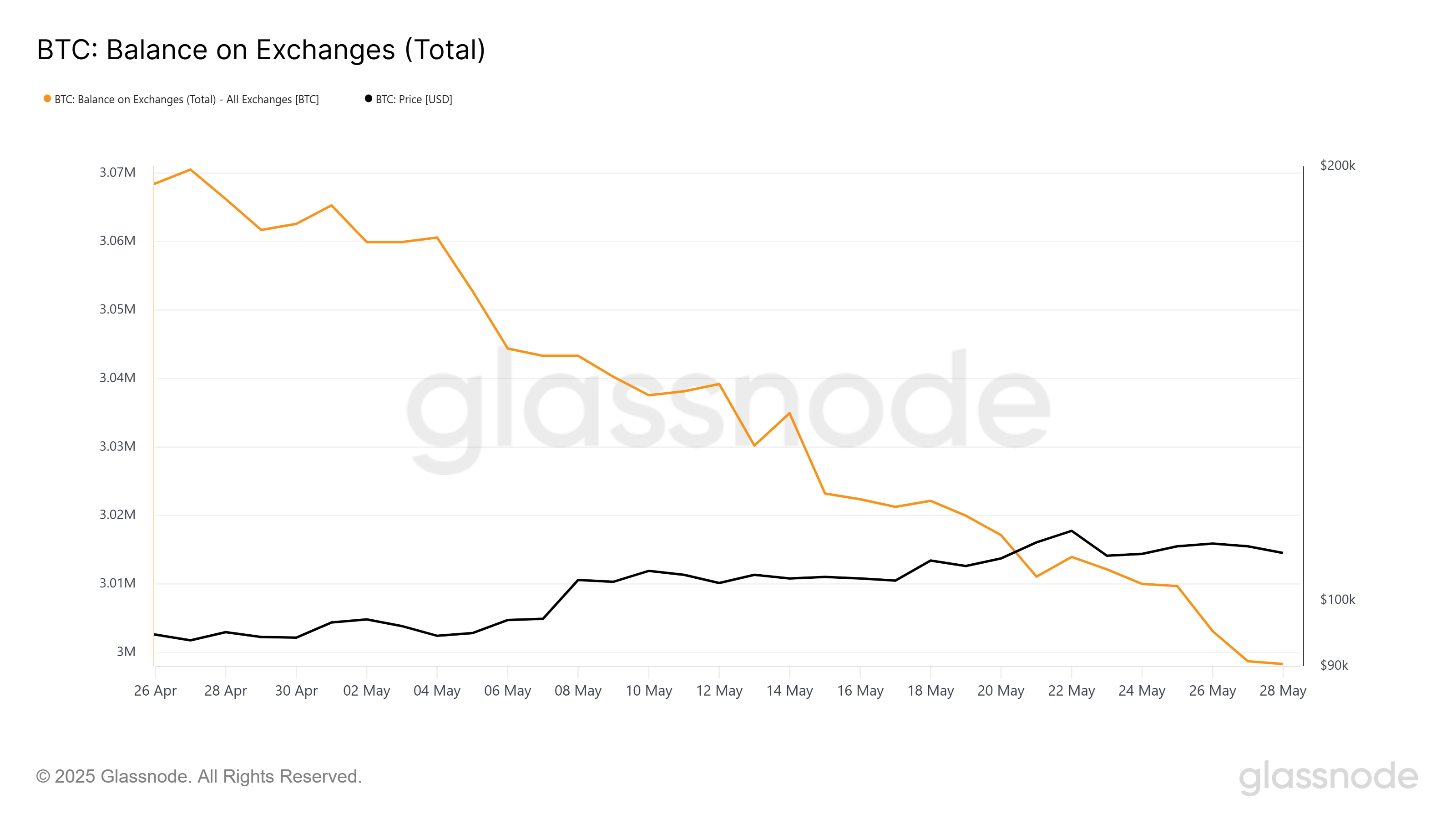

The feeling of the Bitcoin market is currently motivated by strong accumulation. The balance on the scholarships dropped 66,975 BTCs, worth 7.2 billion dollars, indicating that investors move their assets of exchanges and in private wallets. This significant drop in bitcoin available on trade suggests increasing confidence in assets and belief in additional price increases.

The accumulation is partially motivated by the FOMO (fear of missing), while new investors rush, but it is also supported by an increasing conviction in the long -term potential of Bitcoin. However, Juan Pellicer, vice-president of research in Sentora, recently discussed with Beincrypto how factors beyond simple accumulation influenced the overvoltage of bitcoin prices.

“The will of investors to reach the risks this spring has been shaped by a tight set of macro currents which all move in a direction” of the final limits “at the same time. Inflation slides, central liquidity is back on the table, real yields and the dollar slip, all risks of liquidity are risks, bitcores and forces are also open. The BTC Prize was strongly correlated at the S&P 500 to May, ”noted Pellice.

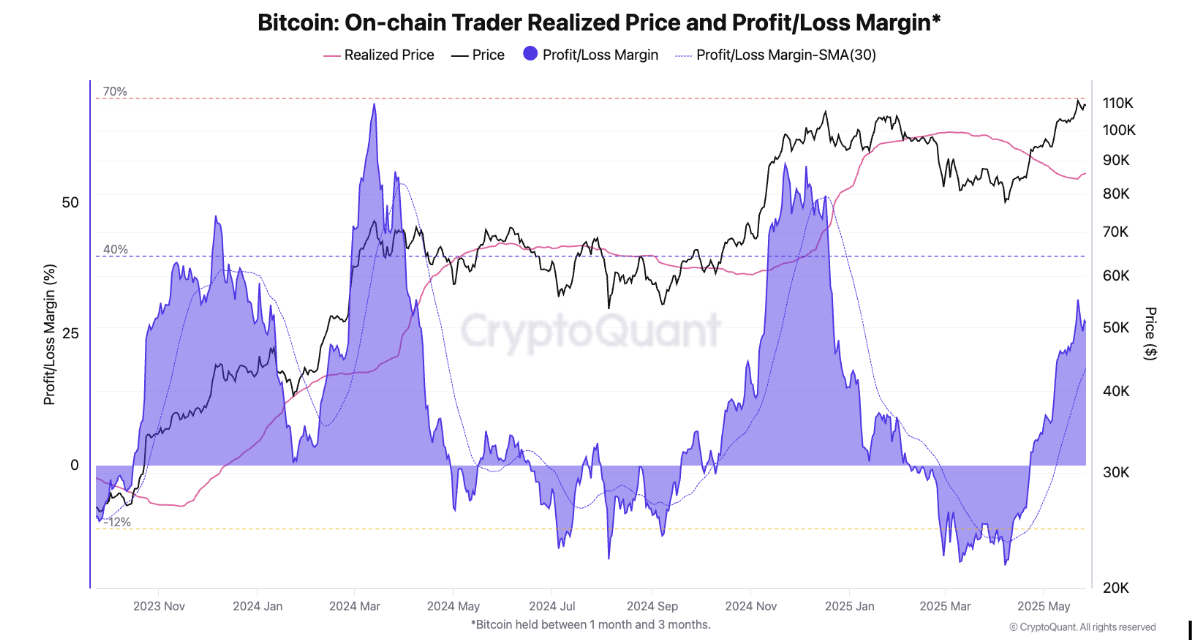

The data on the chain reveal key indicators that suggest that Bitcoin’s macro moment remains strong. The chain merchant realized that the price and the profit / loss margin have been brought, indicating that Bitcoin investors, in particular those who bought 1 to 3 months ago, are seated with significant unrealized profits. This data helps to assess the behavior of investors and indicate that many are still holding, anticipating new price increases.

Julio Moreno, research manager at Cryptokant, discussed Beincrypto how the increase in profits among these short -term holders could threaten Bitcoin.

“In the short term, there could be profits from traders because their unrealized beneficiary margins are approaching overheated levels around 40%. See the table where we estimate the beneficiary margin of Bitcoin traders reaching 31% in recent days (Violette zone),” said Moreno.

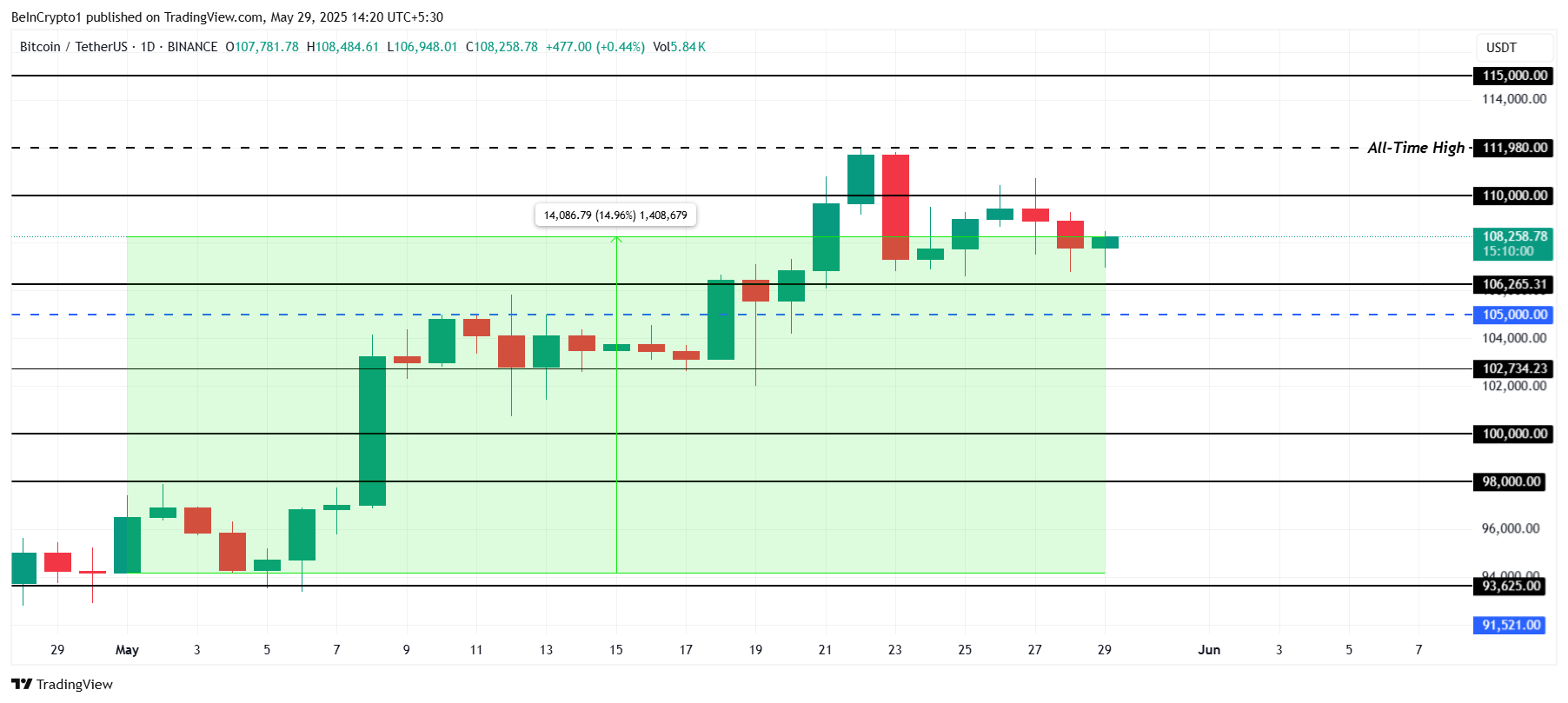

BTC Price targets a new summit

The Bitcoin price jumped 14% throughout May, reaching a new summit of all time of $ 111,980. Currently, a merchant at $ 108,258, Bitcoin is testing the level of resistance of $ 110,000. The next few days will be crucial to determine if Bitcoin can maintain its momentum.

If the accumulation in the hands of institution and retail holders continues in June, the price could maintain its upward trend.

In addition, the “sale in May and disappear” strategy turned out to be ineffective for stock markets in the past year, the markets continuing to increase despite the seasonal trend. The correlation of bitcoin with the stock markets, in particular in the light of macroeconomic conditions, suggests that it could continue to feel a dynamic upwards until June. Given Bitcoin resilience, it is likely to push higher, even in a broader uncertainty of the market.

Bitcoin price could possibly rape $ 110,000, which established it as a solid level of support before exceeding ATH to target $ 115,000. However, if taking advantage intensifies, Bitcoin may be correction. Although a net slowdown seems unlikely, Bitcoin could face a certain consolidation before continuing its upward trend, with support levels at $ 102,734 and $ 106,265 providing a stamp.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.