What to Expect from Hedera (HBAR) Price in August 2025

Hedera (Hbar) has just ended in July with 85% gains, marking its strongest monthly performance of the year. However, August was not historically kind to Hbar.

In the past five years, the average yield of the token in August is -3.26%, with a median of only 0.31%, making it one of the lowest months for the assets. The question is whether this August can break the trend or if history is repeated.

The story of August alludes to a trembling month

By thinking about the graphic of monthly yields, August only delivered a strong green closure once in 2021, while most of the other years ended flat or negative.

This backdrop gives a cautious tone for merchants before this month. Even after the overvoltage in July, the story suggests that the Hbar prices rally could cool, especially if profit comes into play.

Hedera whales continue to buy, but the increase becomes crowded

Channel data show that major holders with 1 million Hbar tokens increased their share by 64% to 77% in July, while 10 million tokens have reached 96% of the total supply.

This regular accumulation was a key engine of July earnings. However, with whales already strongly allocated, there could be limited fresh capital to maintain the same pace in August. Or they might again want to intervene once the price is starting to dip!

Any slowdown in the purchase of whales could open the door to a step back.

For TA tokens and market updates: Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

The positioning of derivatives, the feeling of obv and bull are slightly bullish

The Bitget liquidation card shows that the long lever wins widely on shorts (122.75 million dollars against $ 49 million), which means that the market is still positioned for the rise. This adds risks: if prices drop, liquidation clusters close to $ 0.2182 could speed up the sale.

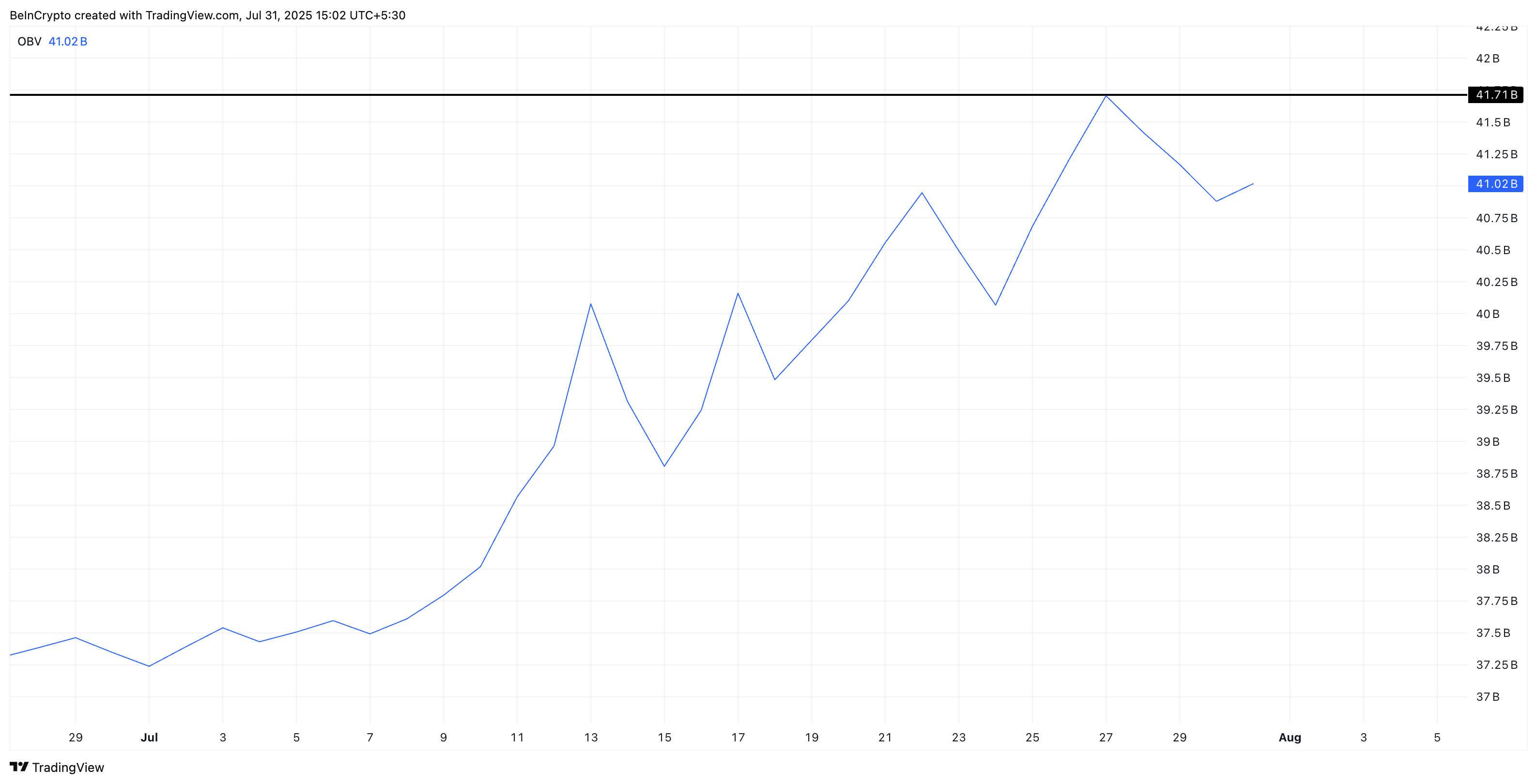

Meanwhile, the volume of equilibrium (REBR) continues to rise up, confirming that the purchase activity always prevails over the sales activity overall. However, even if revised higher peaks, it must remain above the 41.71 billion bar to maintain the Hbar price dynamics in August.

The volume of balance (REBR) is a momentum indicator which follows the volume of cumulative trading to show if the purchase or the sale is dominant. An increased revised suggests that buyers control, while a decline in signals increasing the sales pressure.

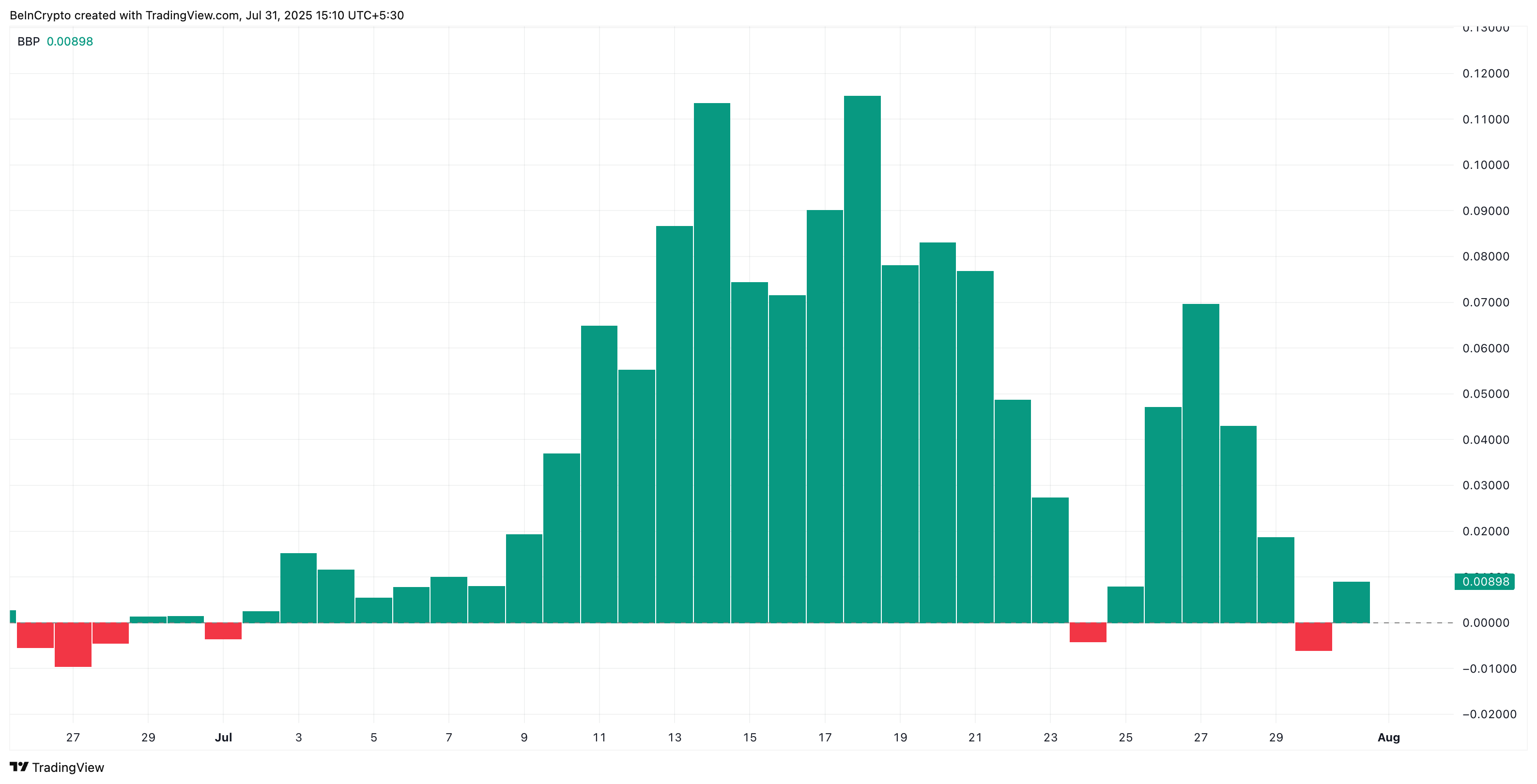

The Bull-Bear Power (BBP) indicator, which measures if the bulls or bears have a stronger momentum, which has become briefly negative in a single session last week but quickly turned into green.

This shows that the bulls manage control for the moment, but the handle is not unshakable. Therefore, prudence to come!

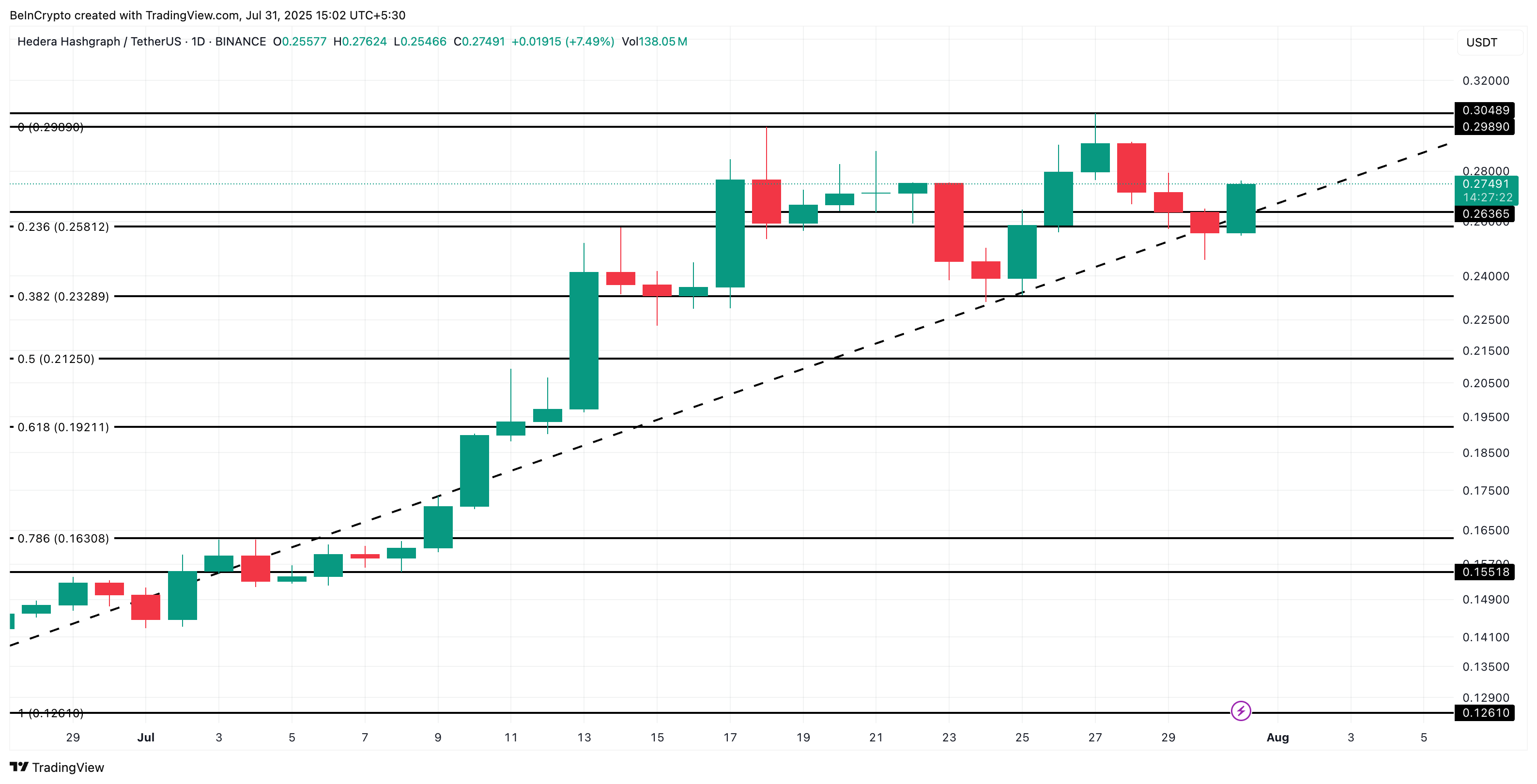

Hbar Fransles structure price between the weekly triangle and daily supports: who wins?

The weekly graphic depicts a mixed image, with Hbar consolidating itself inside a descending triangle, a formation which generally leans the lowering even during an upward trend. If the price fails to exceed the upper trend line of the triangle close to $ 0.30, the story suggests that August could make a correction.

Currently, two levels, $ 0.26 and $ 0.23, support support. If they break, the entire structure can become down, fairly quickly.

On the daily graphic, Fibonacci’s retraction levels highlight the main battlefields.

The immediate support is at $ 0.26 (identical to the weekly graphic), followed by $ 0.23 and $ 0.21. If the bulls defend these areas, a retest from $ 0.29 to $ 0.30 is possible. A clean break above $ 0.30 would be the clearest sign that August could challenge his downward history.

The position to expect from Hedera (Hbar) Price in August 2025 appeared first on Beincrypto.