What to Expect From Solana (SOL) in August?

Solana reaffirmed its domination as one of the large, resilient capitalization altcoins, on the widest market rally wave in July. Near the momentum at Bitcoin, Sol exceeded the $ 200 mark to a cycle of $ 206.19 on July 22.

This price rally has sparked a peak of activity on the chain through the Solana ecosystem, pushing its total locked challenge (TVL), Trading Dex volumes and the chain’s overall income. However, signs of exhaustion are starting to show. Sol has brought below the $ 190 threshold, faced with sales pressures suggesting that investors can turn after the logging of the July gains.

Sol’s Rally Powers Network Surge – But can we hold the dynamics in August?

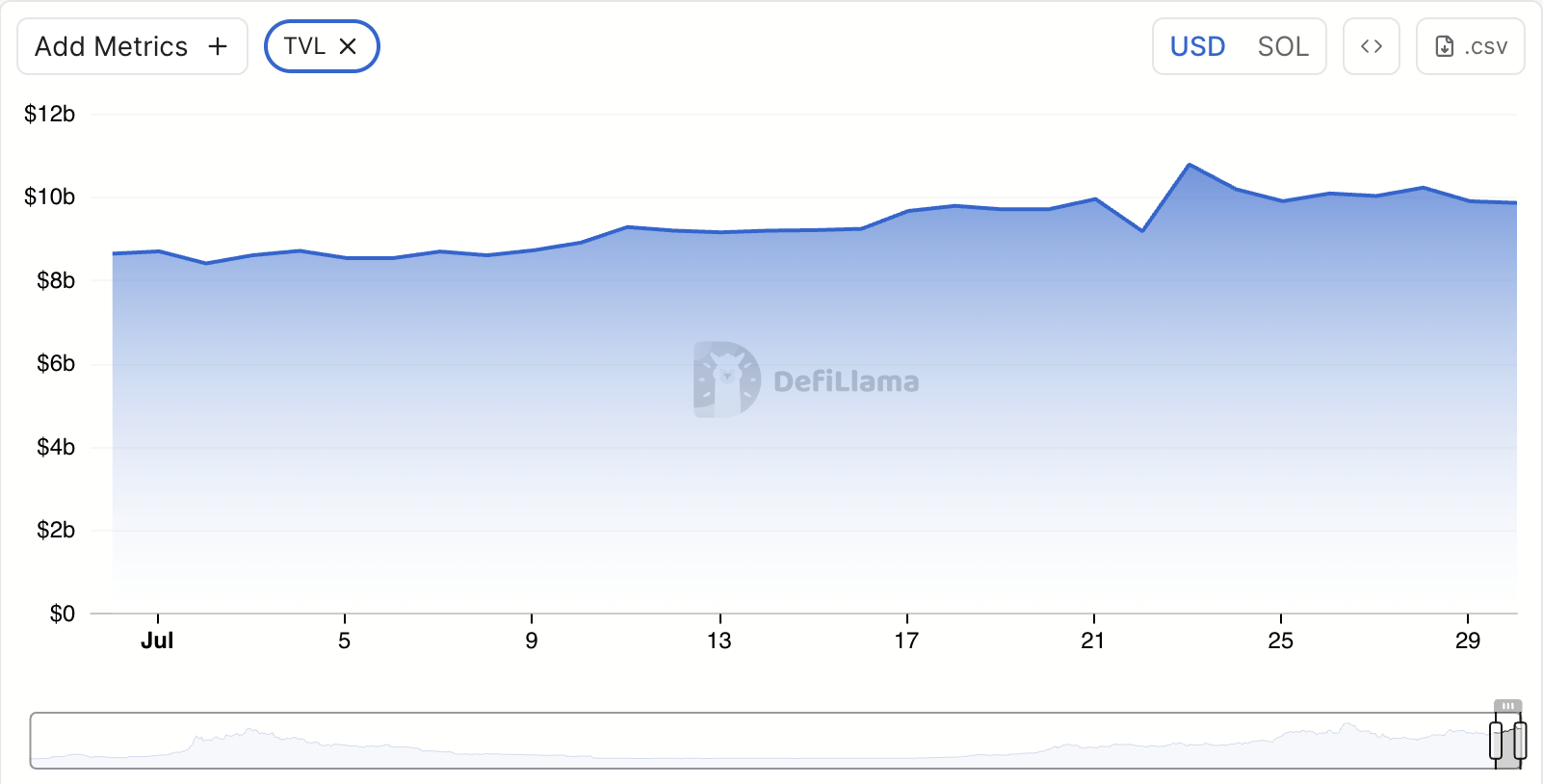

Between July 1 and 22, Sol has maintained a regular rally, increasing its value by 40%. While the soil price increased, the chain value of the tokens locked in loan pools and chests on the Solana network has increased, increasing the TVL of the network.

At the time of the press, Solana TVL is $ 9.85 billion, an increase of 14% compared to last month.

For TA tokens and market updates: Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

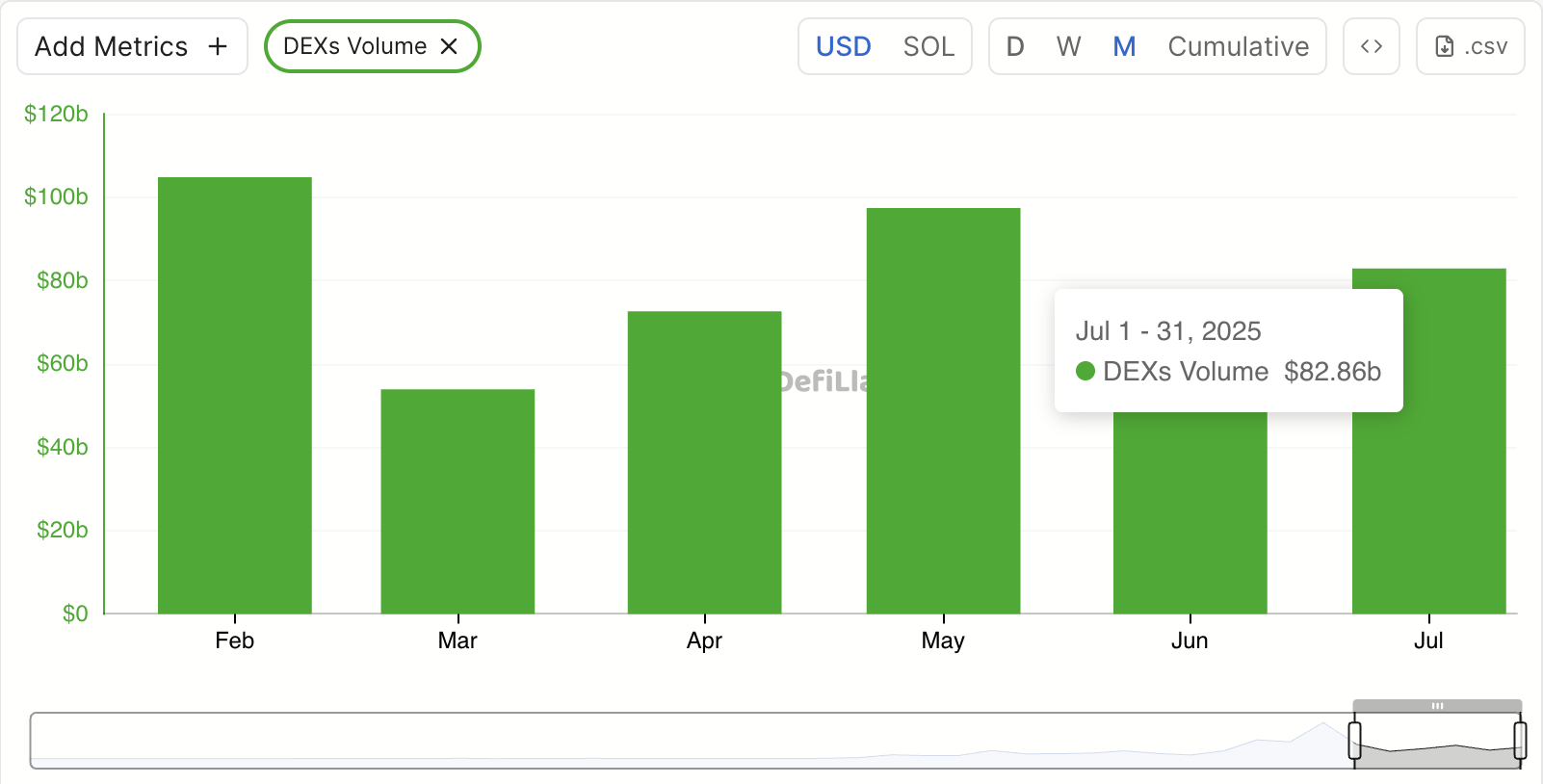

While the demand for soil climbed during this period, the commercial activity between dexes on the network also climbed. In the past 30 days, the volume DEX has jumped by 30%, commercial volumes worth more than $ 82 billion recorded so far this month alone.

This increase in activity has resulted in higher network income. According to Defilma, Solana has generated $ 4.3 million in income since early July, marking an increase of 13% compared to the $ 3.81 million recorded in June.

The Solana ecosystem cools as the price boxes and user activity are shrinking

However, as August approaches, the impulse fades on the Solana network. At the time of the press, Sol fell at around $ 180 and signs of weakening demand through the emerging network.

For example, the number of daily active addresses on Solana has dropped in the last seven days. According to Artemis, it decreased by 16% during this period.

A decrease in daily signals of active addresses of a network has reduced user engagement and chain activity. Fewer active addresses reflect a slowdown in transactions, the use of the DAPP and the overall demand for network services.

In the case of Solana, the decrease of 16% suggests that decreasing participation, which refers to a wider recharge time of network growth at the start of the new commercial month.

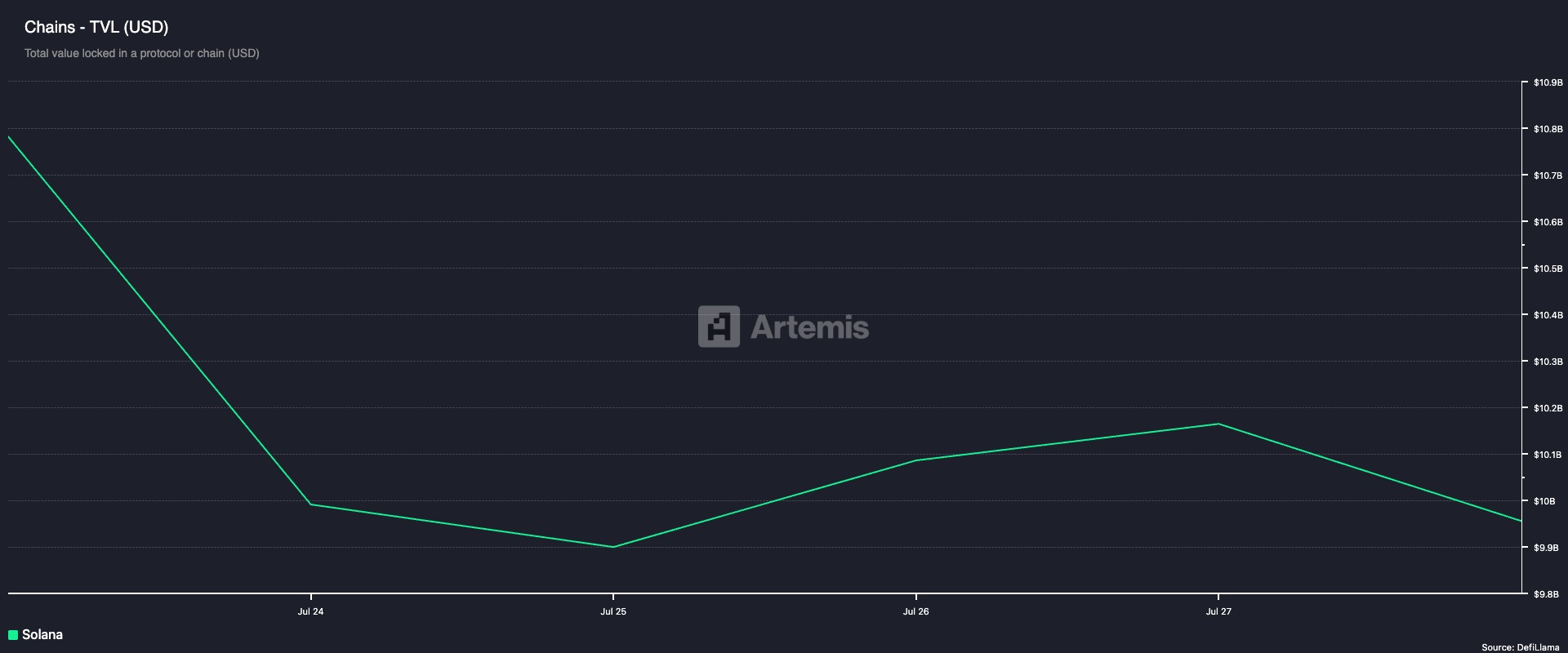

While the activity through the diving network, DEFI TVL of Solana has also started to withdraw. During last week, TVL dropped by 8%.

This indicates that users withdraw the assets of the DEFI protocols on the network or the value of these assets decreases due to market movements.

Solana Bears Circle as the price is close to the distribution point

The soil decline in recent days has increased its price dangerously close to its 20 -day exponential mobile average (EMA), which is a critical dynamic support line at $ 178.25. For the context, Sol is currently negotiated at $ 180.51.

The 20 -day EMA measures the average negotiation price of an asset in the last 20 days of negotiation, which gives more weight at recent prices. A decisive break below this level could potentially open the door for more decline, especially if it is accompanied by a drop in the volume and the activity of the network.

In this case, the soil price could drop to $ 171.78.

On the other hand, if the feeling of the market improves, this downward perspective will be invalidated. In this scenario, the medal prize could come together at $ 186.40. A successful violation of this level could propel the play around $ 190.47.

The message what to expect from Solana (floor) in August? appeared first on Beincrypto.