Aave Horizon RWA Product To Unlock Trillions in Tokenized Assets

Horizon, an initiative by Aave Labs, proposed a new financial product to introduce real assets (RWAS) in decentralized finance (DEFI) in a regulatory framework.

The initiative is expected to generate new sources of income for the Aave DAO, accelerate the adoption of GHO and strengthen the role of Aave as a key director in the space of increasing tokenized. In the midst of accelerating institutional adoption, projections suggest that RWAS on blockchain networks could reach 16 dollars of dollars over the next decade.

Horizon offers the RWA product as a license instance of aave protocol

In a press release shared with Beincrypto, Aave Labs Horizon proposed launching a RWA product as an approved instance of the Aave protocol. This initiative aims to allow institutions to use monetary market funds in Tokenized (MMF) as a guarantee to borrow stablescoins such as the USDC and the GHO of Aave.

This decision should unlock liquidity for stablescoins and extend institutional access to DEFI. More specifically, this would make it more accessible to regulated financial entities while benefiting the AAVE ecosystem.

The interest comes in the middle of a growing demand for real assets tokenized. Blockchain technology improves liquidity, reduces costs and allows programmable transactions.

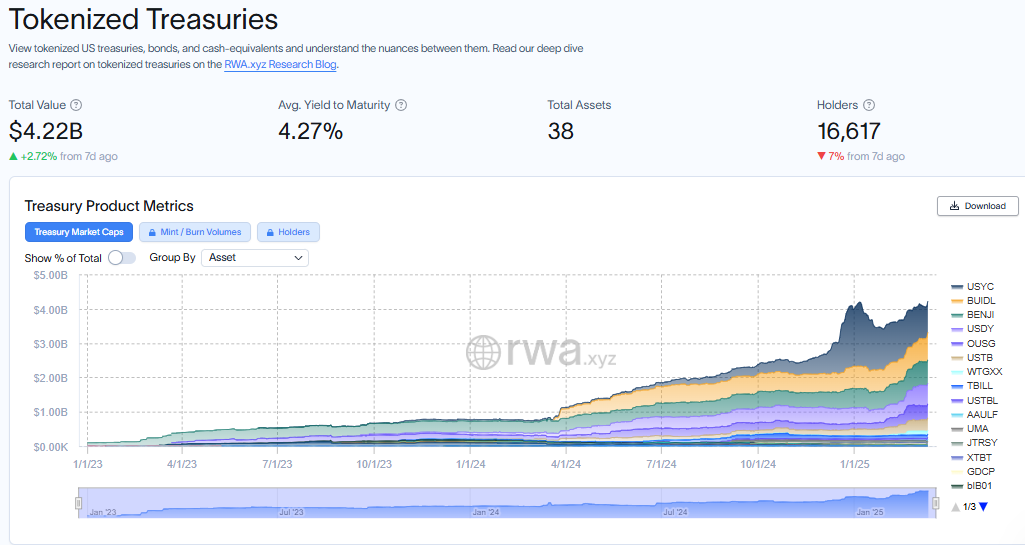

In addition, the blockchain tokenization has made traditional assets more accessible to the chain, with US Treasury Makes to Tokenized from 408% from one year to the next to reach $ 4 billion.

Subject to approval by the Aave DAO, the RWA product of Horizon will initially be launched as an approved instance of Aave V3. Later, he would go to a personalized deployment of Aave V4 when he is available. Horizon has proposed a structured profits to ensure long -term alignment with the Aave DAO.

“… A share of 50% income with Aave Dao during the year 1, in parallel with strategic incentives to stimulate the growth of ecosystems,” Horizon in Beincrypto told.

In addition, if Horizon launches its token, 15% of its supply will be allocated to incentives to the Aave Dao treasure and ecosystems. A portion will also be reserved for take-out roaches.

Meanwhile, Rwas’s rise in power transforms the rules of the financial game and the institutions take note. Tokenized assets emerge as a bridge between traditional finances (tradfi) and defi, offering investors new opportunities to access the assets bearing the yield. The main players include BlackRock (Build), Franklin Templeton and Grayscale.

Institutions to access the liquidity of the regulated stablecoin but without authorization

However, the open nature and without authorization to deffi poses regulatory challenges. He does not have the compliance executives required for large -scale institutional participation.

Institutional adoption remains limited without tailor -made solutions, and the integration of large -scale RWA remains an important challenge.

Horizon seeks to fill this gap by allowing institutions to access liquidity without authorization of Stablecoin. It will also meet the requirements of compliance and risk management of asset transmitters.

Tokenized asset transmitters can apply transfer restrictions and maintain controls in terms of assets. According to the ad, this would guarantee that only qualified users can borrow USDC and GHO.

“… The separate GHO facilitator will allow GHO strike with the RWA warranty, offering predictable borrowing rates optimized for institutions. This improves the security, scalability and institutional adoption of Rwas in Defi, “added Horizon.

The proposed product is based on the institutional framework established by Aave Arc. To ensure smooth integration, Horizon will implement an authorized token offer. It will also include withdrawal mechanisms, the borrowing of stablecoin for qualified users and authorized liquidation workflows.

The initiative should improve the security, scalability and institutional adoption of RWA in DEFI.

However, despite the design without permission of Aave being one of its greatest forces, the integration of Rwas presents challenges beyond the development of intelligent contracts.

An approved body of the Aave Protocol will require a legal structure outside the chain, regulatory coordination and active supervision. It is imperative to note that the Aave DAO is not designed to manage these functions independently.

Operationally, the Aave DAO and its service providers will supervise the RWA product functionality from Horizon. However, Horizon will retain independence in the configuration of the body and the management of its strategic management.

The proposal now calls on the Aave Dao to approve the Horizon RWA product as a license instance of the protocol.

The next steps are to refine the proposal with the Aave community and service providers. If there is a consensus on the future, the proposal will proceed to an instant vote.

If the vote is favorable, the proposal will go to the final governance phase for approval.

Beincryptto data show that the Aave price was negotiated at $ 173.44 to date, down 0.24% since the opening of the session on Thursday.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.