What Will Be ETH Price’s Next Big Move: $3,067 or $4,000?

In the past two weeks, the wider market of cryptography has shown dull performance, keeping Ethereum in a tight trading range.

Since July 21, Altcoin has repeatedly tested a resistance almost $ 3,859 while finding support at $ 3,524, has trouble detaching itself from this area. With the discoloration of the momentum, key measurements on the chain now suggest that ETH can deal with a prolonged lateral consolidation period or a potential price rupture.

The great players of Ethereum are retreating

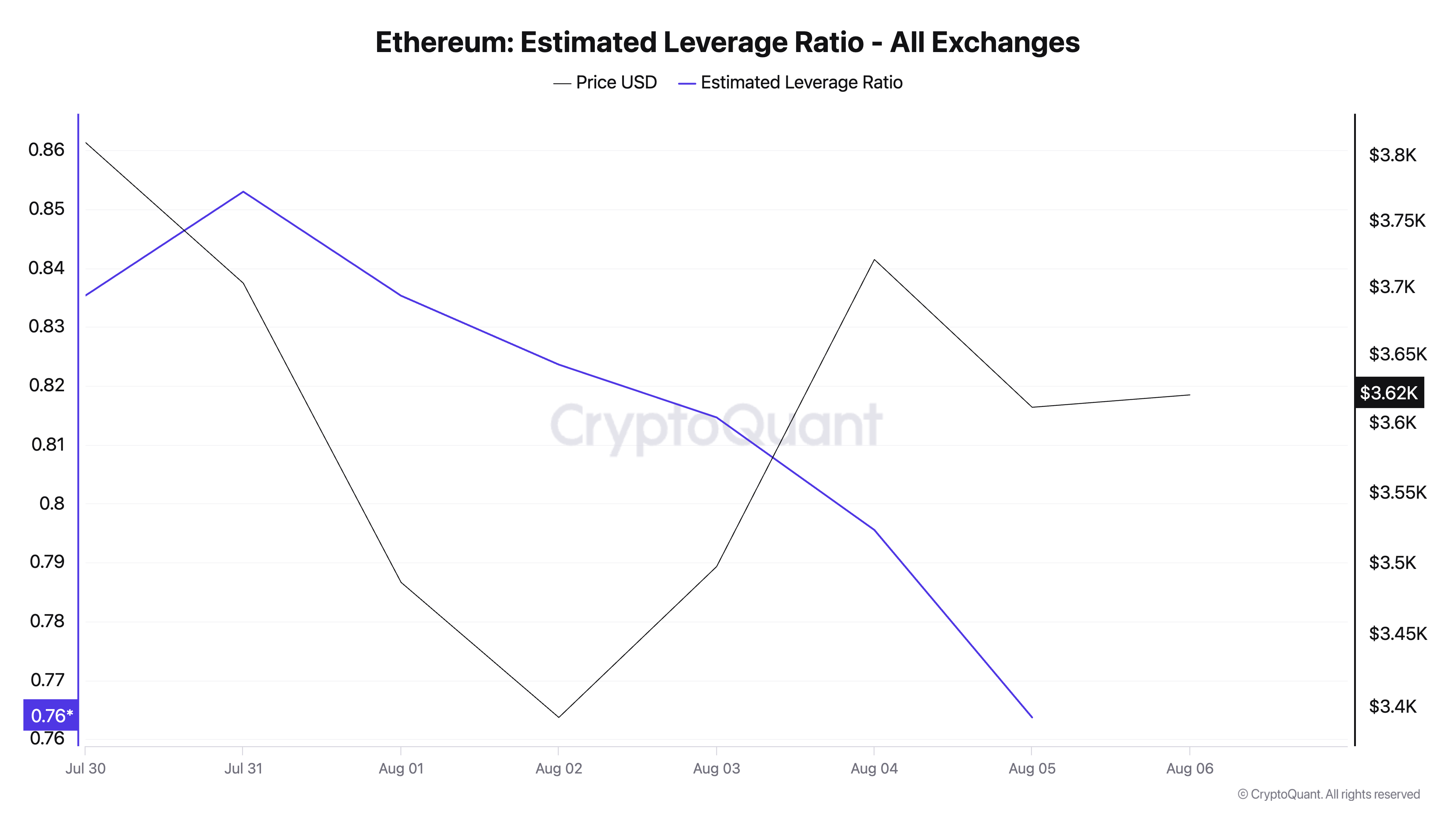

According to Cryptochant’s data, the fall of the Estimated Levio Ratio (ELR) of the ETH in all cryptocurrency exchanges reflects the confidence of decreasing investors and a drop in risk appetite among its long-term merchants. According to the data supplier, Eth’s Elr is now at a weekly rate of 0.76.

For TA tokens and market updates: Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

The ELR metric measures the average amount of leverage used to execute transactions on an asset on a cryptocurrency scholarship. It is calculated by dividing the open interest of the assets by the reserve of the exchange for this currency.

The drop in ETH signals a market environment where traders avoid high -effect betting. Its investors become cautious about the short -term prospects of the medal and do not take high lever effect positions which could amplify potential losses.

If this decline in speculative activity continues, this will reduce the probability of a short -term escape and increase the chances of remaining at ETH.

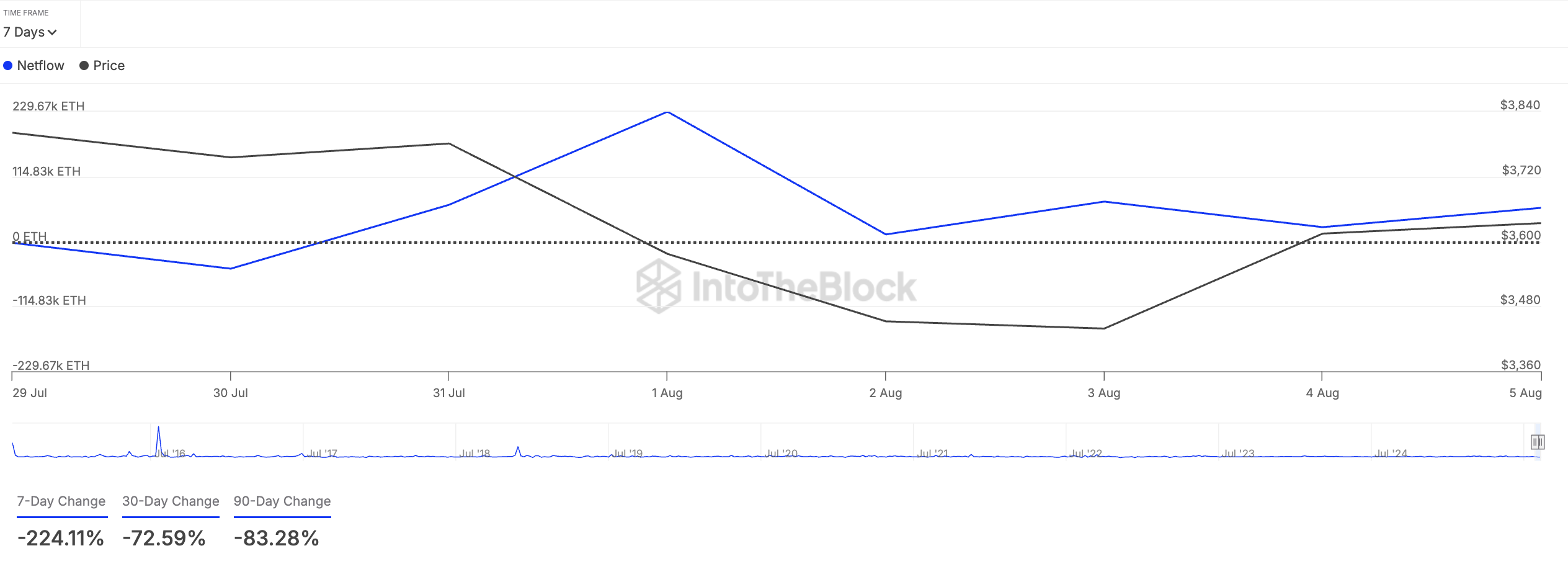

In addition, ETH whales also reduced their accumulation over last week, perhaps to lock profit. According to Intotheblock data, the Netflow of the big holders of the part is down 224% in the last seven days, showing the retreat of the main ETH holders.

Large supports are whale addresses controlling more than 0.1% of the supply of an asset. Their Netflow follows the difference between the parts they buy and the amount they sell over a specific period.

When large holders of an asset increase, the whales buy more of its parts / tokens on exchanges, potentially in anticipation of a price rally.

On the other hand, as for ETH, when it decreases, it signals a reduced activity and profits among these key investors.

Will the bulls and bears clashed: will $ 3,524 keep or break?

The above metrics highlight confidence in short-term price gains in ETH and reluctance among its main holders of important capital on the market at the moment. If that persists, the lower pressure on the medal will increase, potentially triggering a support violation of $ 3,524.

If this happens, the part could extend its drop to $ 3,067. However, if the Bulls resume domination, they could lead to a break over the resistance at $ 3,859. In case of success, the ETH price could reach $ 4,000.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.