SOL Price Falls Toward $190 as Selling Pressure Mounts

Solana (soil) Price has struggled to maintain levels above $ 200, its market capitalization now being $ 94 billion. The last price action shows that Sol has been faced with high resistance nearly $ 200 and has since decreased in the $ 190 range in recent days.

Technical indicators such as the Cloud Ichimoku and the DMI suggest that sellers remain in control, with growing lower momentum and weaken upward attempts. While Sol addresses the main levels of support, the question is now whether it will stabilize and try a rebound or pursue its decline towards lower price targets.

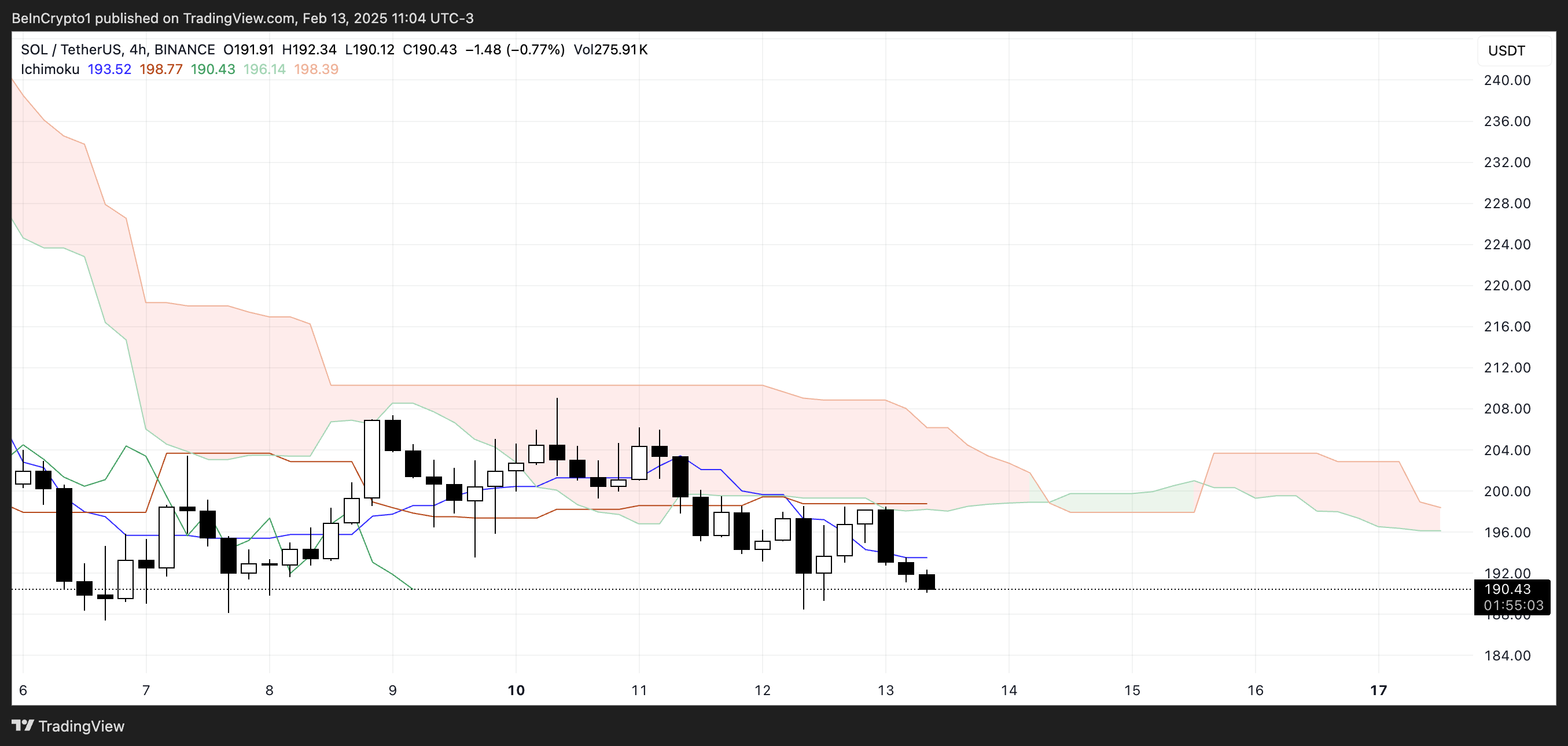

Solana Ichimoku cloud Shows a strong lower configuration

The Ichimoku cloud painting for Solana is currently displaying lowering features. Prices’ action remains below the cloud, indicating an impulse with a persistent decline.

The red cloud suggests that the lowering feeling was dominant and that the attempted movement towards the cloud was quickly rejected, strengthening the dominant trend.

In addition, Tenkan-Sen (blue line) is positioned under the Kijun-Sen (red line), signaling a continuous weakness of the price structure. The downward slope of both lines also supports the idea that the momentum promotes sellers rather than buyers.

The projected part of the cloud remains down, with the Senkou Span A (green line) under the Senkou Span B (red line), suggesting that the downward pressure is likely to persist.

The Span Chikou (Green Lagging Line) is also positioned below the last soil price action, confirming that the structure of the market continues to promote a lower perspective.

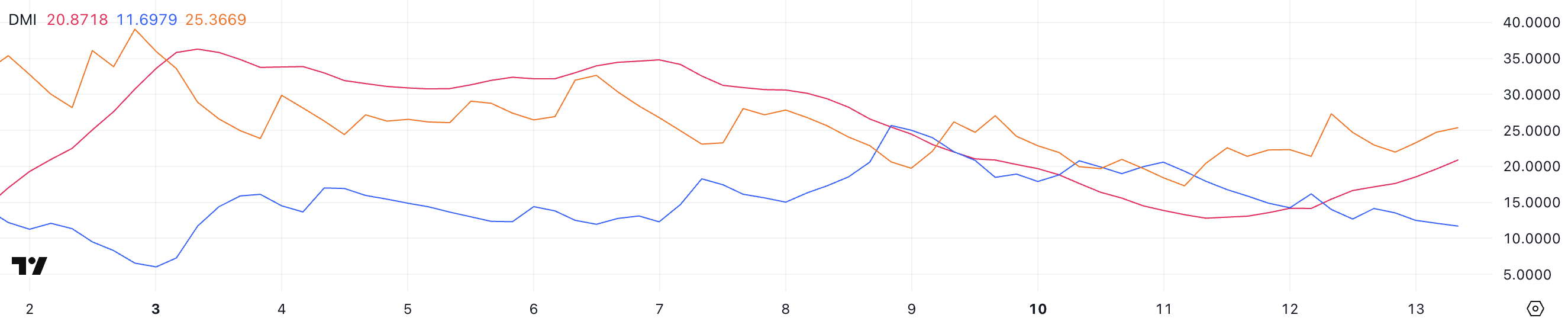

Sol DMI shows that the downward trend is gaining momentum

Solana DMI Chart shows that its ADX is currently at 20.8, from 12.7 barely two days ago. This increase suggests that resistance to trend is starting to build after a relatively low momentum.

Although ADX alone does not indicate the direction of the trend, its upward movement indicates that a more defined price movement is developing.

The transition from a lower trend to a stronger trend suggests that the recent market activity becomes more directional, which could lead to a continuation of the dominant trend.

The ADX measures resistance to the trend on a scale where values below 20 indicate a low or undecided market, while values above 25 suggest a strong and established trend. With ADX currently at 20.8 and increasing, the market is approaching a level where price action becomes more directional.

In addition to this, the + DI went from 17.9 to 11.6, while the -Di went from 20.4 to 25.3. This indicates that the lowering momentum is strengthened while sellers take control.

Since the -Di is now significantly above + DI and ADX increases, the downward trend of Solana is gaining ground. If this trend continues and ADX exceeds 25, it would confirm a stronger downward trend, which makes it more difficult for buyers to reverse the momentum in the short term.

Will Sol Price: Will Sol return to $ 200 or will it fall to $ 175?

Solana Price has recently failed to exceed the resistance of $ 200 and has since fallen to the $ 190 range. Its EMA lines remain positioned below the longer term trend lines, strengthening a wider lower feeling. This suggests that pricing is always leaning towards the disadvantage, the sellers keeping control over the momentum.

The inability to maintain levels above $ 200 indicates that the purchase of the soil pressure has not been strong enough to move the structure of the market in favor of an upward trend, keeping the lower lower perspectives.

If this downward trend persists, Sol could test support at $ 187, a key level where buyers can try to intervene. The loss of this support could open the door to a continuous drop around $ 175, strengthening the downward trend. However, if soil can maintain the level of $ 187 and stabilize, a potential rebound could follow.

A sustained recovery and a break in more than $ 200 could change feelings, allowing the price to contest the next resistance at $ 209. If the bullish momentum is further strengthened and erases this level, the next target would be $ 220, marking a significant change in the dynamics of trends.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.