What’s Next for BTC Price?

The ascending momentum of Bitcoin could face a major obstacle in more than 613,000 BTC – billions of people, on the market, posing a significant sale risk. With Bitcoin looking at the level of critical resistance of $ 119,000, traders and investors move with caution. This potential supply of supply could block or even reverse the current optimistic trend, which raises concerns concerning short -term volatility.

Threat of volatility of for -lucrative sparks for bitcoin

In the past 24 hours, the Bitcoin price has been very unstable, the sellers pushing hard to keep it below $ 119,000. This has led to a large wave of forced sales, according to Coinglass data. In total, more than $ 55 million in posts have been liquidated, with more than $ 41 million from them from buyers who had bet that the Bitcoin price would increase.

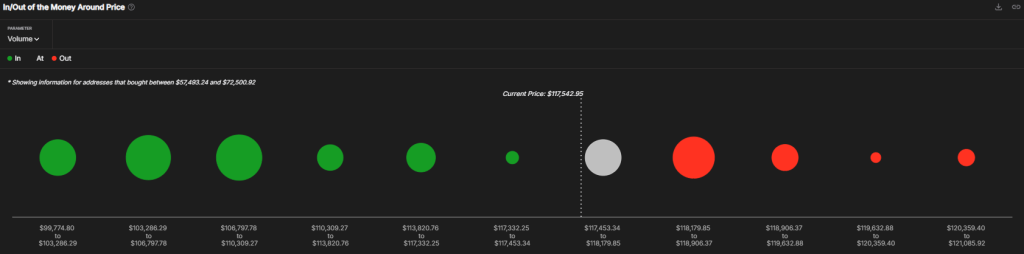

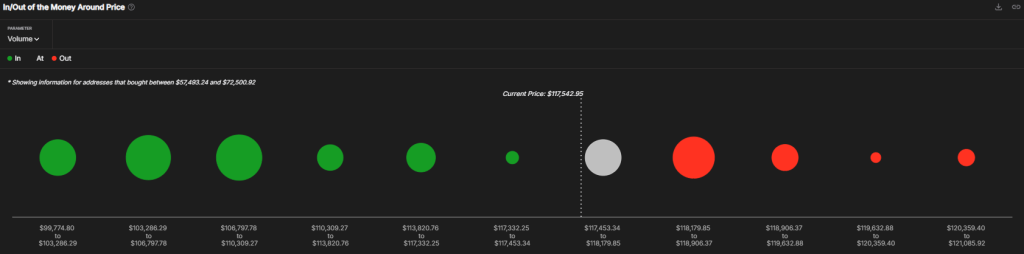

Intotheblock data show that many investors have bought Bitcoin around the level of $ 118,573, with around 613,200 BTCs held at this average price. Since the current price is lower than this, these holders are seated on losses. If Bitcoin tries to go up above $ 119,000, many of these investors could sell to reduce their losses, creating more sales pressure. This could make more difficult for the price to recover in the short term.

The recent increase in bitcoin to new heights has led to a significant change in the way investors behave. Long -term holders, who generally keep their bitcoin for more than 155 days, are starting to sell, which could report a turning point on the market.

According to data on the chain, these long -term holders have sold around 52,000 BTC since Bitcoin reached its last summit. On July 29, analyst Axel Adler Jr. underlined on X that this sale had occurred around the $ 118,000 mark, showing a clear passage from maintenance for sale, similar to past market cycles.

Read also: Does Galaxy Digital sell again? Chain signals indicate a bitcoin turning point

If Bitcoin manages to exceed its current price range, it could resume momentum and push for new heights. But if it falls below key support levels, it could lead to a higher drop.

What is the next step for BTC Price?

Bitcoin dropped below the 20 -day mobile average, but the long lower shade on the candlestick suggests that buyers intervened at lower prices. During the editorial staff, the BTC price is negotiated at $ 117,993, more than 0.3% in the last 24 hours.

Currently, Bulls are trying to push the BTC / USDT pair above a key resistance area between $ 119,119 and $ 120,220. If they succeed, the price could increase and increase around $ 123,000, with a potential target of $ 135,000 based on the current graphic model.

To run things up, sellers should defend $ 119,000 and drag the price below the level of support of $ 115,000. If this happens, it could catch too confident buyers with no and potentially send Bitcoin to the level of psychological support at $ 110,000.