What’s Next for ETH Price?

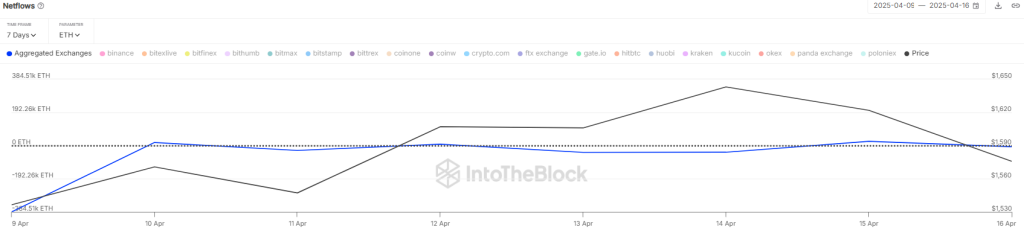

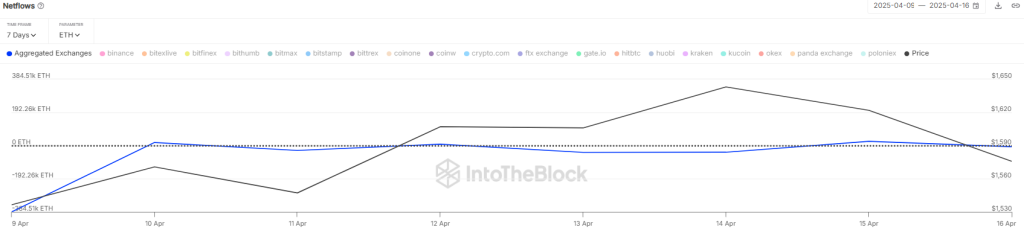

Following the comments of the president of the Federal Reserve Jerome Powell, the price of Ethereum is in difficulty because it does not validate a clear rise. On April 16, during a speech in Chicago, Powell said that the federal reserve was not in a hurry to reduce interest rates, highlighting a prudent “to see” approach which depends on new economic data. This announcement led to an increase in Ethereum exchange entries, reporting increased chances of a potential bearish correction.

Ethereum faces growing lowering threats

The price of Ethereum was downward, affected by the prudent prospects of the federal reserve on the economy, which attenuated the feeling of investors. According to Coinglass data, Ethereum has experienced around 40.6 million dollars in liquidations in the last 24 hours. From this, the long positions represented around $ 26 million, while short positions represented approximately $ 14.6 million.

The recent drop in prices coincided with a sharp increase in exchange reserves. Only the day before, more than 77,000 ETH were transferred to derivative exchanges, marking the largest net entrance in one day in several months. This sudden increase in supply increases the pressure potential.

Read also: will Ethereum entrances hit Ethereum: will the price of the ETH drop again?

However, intotheblock data reveal that the Netflow metric remains negative, around -6,800 ETH. This indicates that the overall outputs have exceeded the entries, which suggests that many investors accumulated Ethereum in the middle of the drop in prices.

Corceglass also reveals that an open interest in Ethereum has increased despite the downward pressure. OI metric jumped more than 3.87%, earning more than $ 18 billion. However, the funding rate was trendy in the negative region at 0.0015%. Consequently, bears are still controlled to consolidate ETH with immediate FIB support levels.

However, the current drop could soon be a solid rebound. According to a cryptocurrency analyst, Ethereum is negotiated near its price made, a level which has often pointed out major rebounds in the past. The price made, now about $ 1,585, is considered a high point for the purchase of value.

What is the next step for the ETH price?

The attempt of Ether of price recovery loses its momentum around the EMA trend lines because the bears strongly defend the EMA20 level. Consequently, the price ranges around the descending resistance line. Currently, the ETH price is traded at $ 1,588, down more than 1.5% in the last 24 hours.

If the sellers manage to generate the price of less than $ 1,400, this could trigger a deeper drop towards the end of the downward channel at $ 1,130. This level should arouse purchasing interests, but if the lower time remains strong, a new decline to $ 1,000 is possible.

Uplining, a decisive break and closing over $ 1,700 would be the first indication that buyers would regain control. Such a decision could open the way for a gathering around $ 2,000. Although the 50 -day SMA can slow down recovery, it is probably exceeded if the opponent momentum is built. A strong push above $ 2,000 would suggest that the downward trend can be reversed.