When Will Bitcoin (BTC) Break to New All-Time Highs?

Bitcoin (BTC) shows signs of a potential turnaround despite recent volatility, because key indicators on chain and institutional flows indicate an improvement in feeling. Multiple Mayer remains less than 1, referring to the undervaluation.

Meanwhile, institutional trust seems to come back, with the recent purchases of 2,660 BTC of BlackRock marking the biggest entry into Son Etf Bitcoin in six weeks. While the market stabilizes and adapts to macroeconomic pressures, the Bitcoin path to new summits is starting to take shape.

BTC Mayer multiple is always less than 1

Mayer Multiple Bitcoin is currently 0.98, slightly above its recent 0.94 recorded on March 10.

This reading suggests that Bitcoin is always undervalued compared to its historical standards, because it continues to be negotiated below its 200-day mobile average.

The indicator has oscillated below the 1.0 mark for a large part of the recent consolidation period, which raises questions about the moment when BTC could resume the momentum to push to new heights.

Multiple Mayer measures the current Bitcoin price report to its mobile average at 200 days, giving an overview of whether the asset is surprised or undervalued.

Historically, the values below 0.8 tend to point out that Bitcoin is highly updated and could be in a long -term accumulation area, while levels above 2.4 often indicate overheated euphoric conditions.

With current reading at 0.98, Bitcoin approaches a neutral threshold to evil.

The last time the Mayer multiple dropped to 0.84, Bitcoin quickly went from $ 54,000 to $ 65,000 in just two weeks. He then stabilized between 1.2 and 1.4 before going beyond $ 100,000 for the first time.

Although history is not always repeated, this current configuration could be an early sign that Bitcoin builds the basics of its next major major leg.

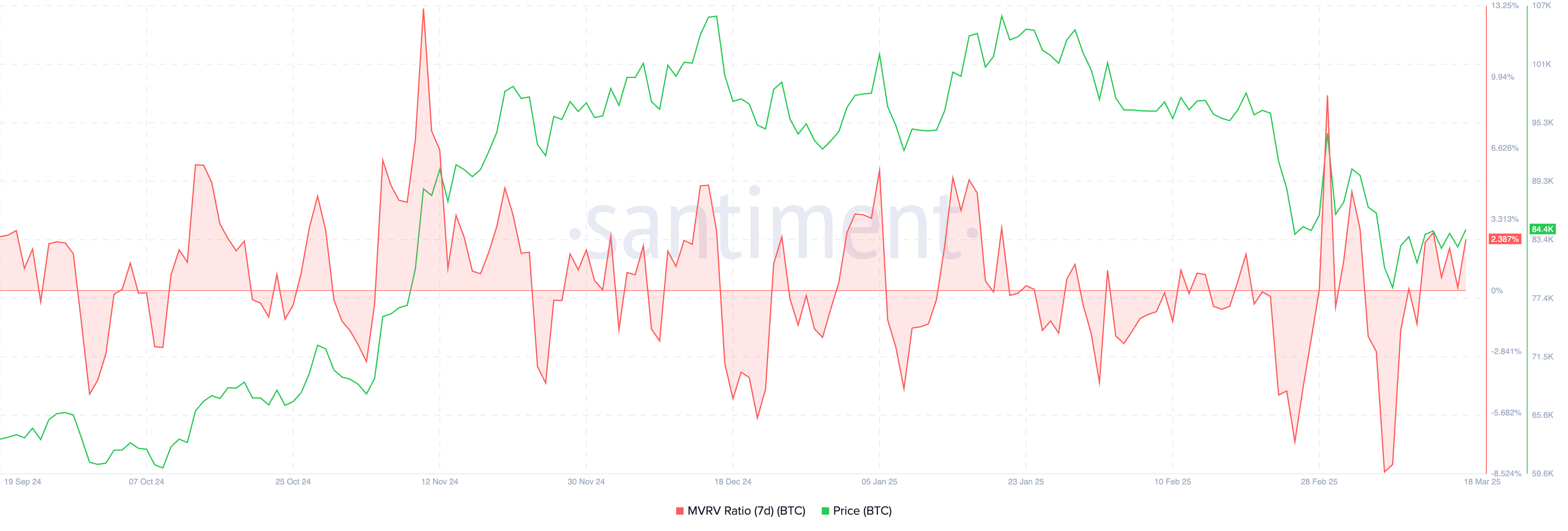

Bitcoin MVRV provides an important threshold

The 7 -day Bitcoin MVRV ratio (market value / value achieved) increased to 2.38%, recovering from a recent lower by -8.44% on March 8.

This rebound indicates that short -term holders are starting to see modest benefits, but historical models suggest that the stronger price dynamics generally follow once the 7D MVRV crosses the 5%mark.

At its current level, the BTC always seems to be in the transitional phase. The feeling evolves, but he did not completely return to a bullish rupture scenario.

The 7D MVRV measures the ratio between the market value of Bitcoin and the average price paid by short -term holders (generally those who have acquired BTC in the last 7 days). When the report is negative, it indicates that these carriers are underwater, while positive readings imply that they are seated on profits.

Historically, BTC tends to take an upward dynamic when the 7D MVRV exceeds + 5%, because it suggests that the confidence of short -term participants returns. Since the BTC is still below this threshold, it may require additional accumulation or consolidation before being convincingly able to create new heights.

If the ratio continues to climb and exceed 5%, this could trigger a renewed upper activity and a potential escape to new peaks of all time.

Will Bitcoin (BTC) soon create new heights?

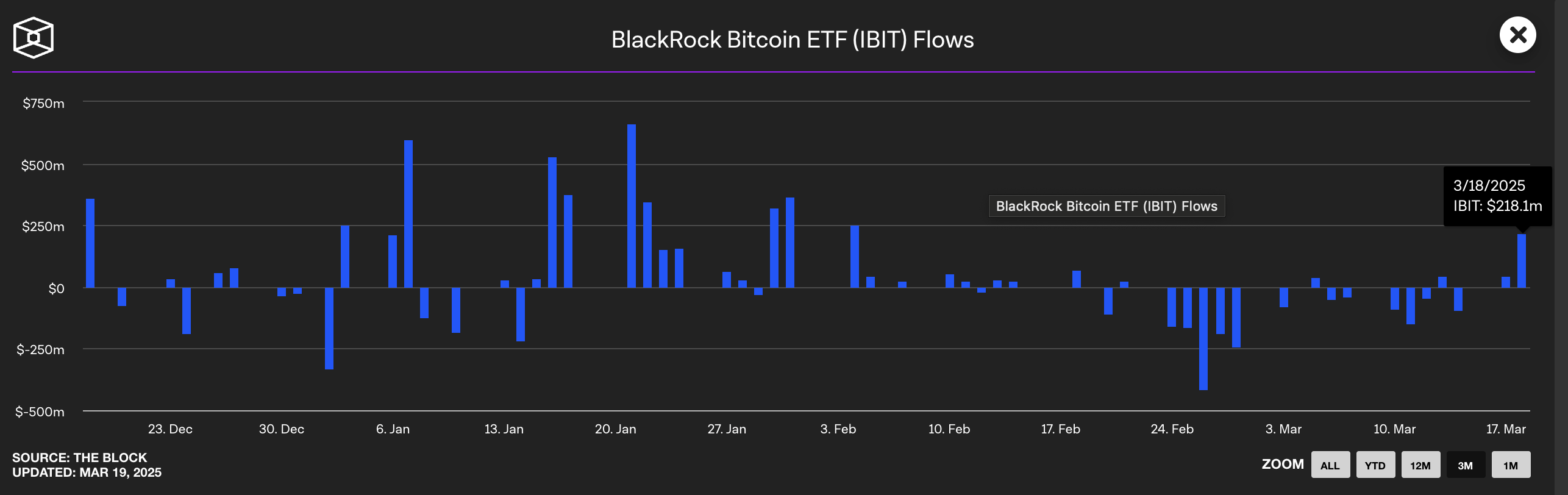

Despite the drop of 11.4% bitcoin in the last 30 days, the institutional bullish feeling seems to be back, with BlackRock signaling renewed confidence in the BTC.

The largest asset manager in the world recently added 2,660 bitcoin to its Ishares Bitcoin Trust (IBIT), marking the largest entry into the fund in the last six weeks.

This important purchase comes after a period of uncertainty in Ibit flows since early February, which suggests that institutions are positioned again for upward potential as market conditions are evolving.

The latest purchase of BlackRock could point out a broader change in feeling, because the great actors neglect the short -term volatility and the refocusing of the long -term Bitcoin value.

Institutional interest resumes again while the market slowly adapts to macro pressures such as the prices offered by Trump.

Despite the persistent uncertainty, the configuration of the price of bitcoin for the new heights becomes stronger as confidence returns. If the macro-wandings stabilize, Bitcoin could be ready for another push higher soon.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.