XRP Price Holds Steady as Whale Activity Declines

The XRP price dropped by 22% last week, with technical indicators showing both down pressure and potential stabilization signs. The RSI remains neutral after a net rebound in the levels of occurrence earlier this month, while the number of whales has stabilized after a brief increase.

Meanwhile, the exponential mobile mediums of XRP (EMAS) have formed a downstream cross of death, suggesting that lower risks remain unless a reversal takes shape. Adding to the wider narrative of the market, the ETF XRP now envisages the approval of the SEC after the 19B-4 deposit of CBOE, which could play a key role in the formation of the action of future prices.

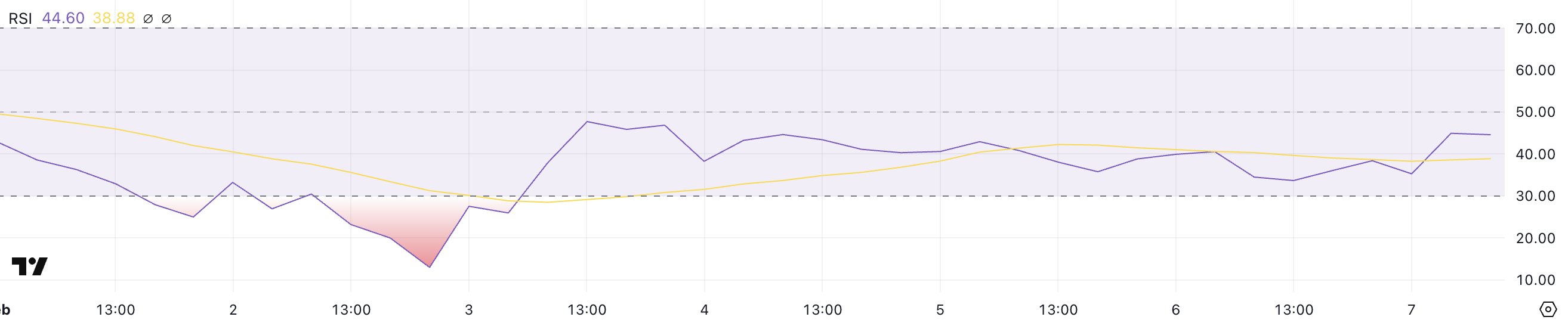

XRP RSI is still neutral, following the same scheme since February 3

The XRP relative resistance index (RSI) increased from 35.2 to 44.6 in a few hours, reflecting a change of momentum after recent weakness. This increase suggests an increase in purchase interest, although XRP remains in a neutral range.

RSI is a widely used momentum indicator that oscillates between 0 and 100. It helps traders to assess if an asset is exaggerated or occurred.

As a general rule, an RSI greater than 70 indicates exaggerated conditions, where prices may be due to a correction, while a RSI less than 30 signals has exceeded the territory, often a potential buying opportunity. The values between 30 and 70 are considered to be neutral, which means that the market is neither in a strong bullish or downwall.

Since February 3, XRP RSI has remained in neutral territory after reaching extreme stockings of around 13 February. This rebound suggests that the intense sales pressure which led XRP to the surveillance levels has calmed down, allowing the stabilization of prices.

With the RSI now at 44.6, the momentum is gradually moving towards the upper end of the neutral beach.

Although this is not yet a clear bull signal, this indicates an increasing demand, which could cause levels of resistance to XRP tests if the purchase pressure continues. A push supported above 50 would be a stronger confirmation of the bullish momentum, potentially opening the door to an upward advantage in prices’ action.

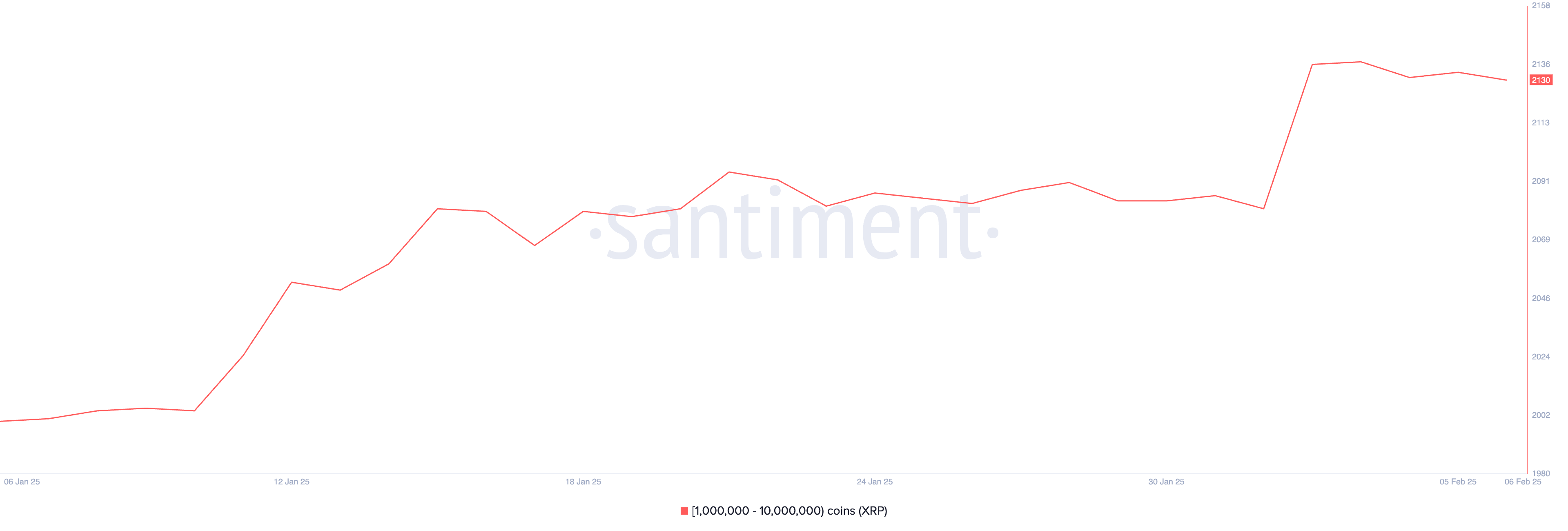

XRP whales slowly decrease after increasing 6 days ago

The number of XRP whales – address between 1,000,000 and 10,000,000 XRP – is currently 2,130. This figure has gone from 2,081 to 2,136 between February 1 and February 2, indicating an accumulation phase clear before the drop slowly.

The follow -up of these major holders is crucial because they often have the capacity to influence market trends due to the volume of XRP they control.

When the activity of whales increases, it can point out growing confidence among high shuttle investors, while a drop may indicate profits or a change of feeling.

With the current number of XRP whales stabilizing at 2,130 after a brief wave, the market seems to be in the consolidation phase. If the number of whales continues to drop, this could suggest that some major holders of their positions, potentially leading to short -term price low.

However, if the decline stabilizes or reverses in another accumulation phase, this could indicate renewed confidence in the perspectives of XRP. A sustained increase in the addresses of whales would be a bullish signal.

This suggests that institutional or large -scale investors see long -term value in XRP and are positioned for a future potential.

Price prediction XRP: Will XRP be negotiated above $ 3 in February?

The exponential mobile average lines of XRP (EMA) indicate a downward configuration, like a new cross of death formed two days ago. This happens when the EMA in the short term intersect below the long -term EMAs, signaling a sustained momentum.

Over the past seven days, the XRP price has decreased by 22%, strengthening the negative feeling.

If the downward trend persists, the main levels of support to be monitored are $ 2.32, with an additional drop in $ 2.20 and even $ 1.99 if the sales pressure is intensifying.

The continuous positioning of the EMA in the short term below the long -term EMA suggests that the Bears always have control, and a failure to hold critical support levels could cause new exploration down.

However, a trend reversal could change dynamism in favor of XRP, with the first level of resistance at $ 2.60. If buyers find the strength and push XRP beyond this brand, the following targets are at $ 2.82 and potentially greater than $ 3.

If the XRP price covered the bullish momentum observed in the previous months, potentially motivated by the approval of the ETF XRP by the dry, it could extend the gains to $ 3.15, a level which would indicate a renewed confidence in its trend upwards.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.