Why Analysts are Calling Ethena (ENA) the Biggest Altcoin Bet This Cycle

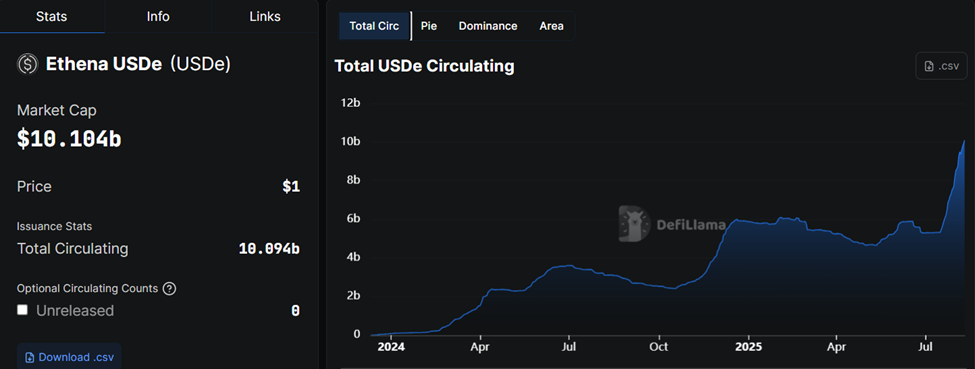

Ethena’s synthetic dollar, USDE has reached a market capitalization of $ 10 billion in just 500 days. The movement cements its position as one of the stablescoins with the fastest growth in the history of cryptography.

However, skepticism remains about the USDE, some analysts suggest that this could be the UST of this cycle.

The milestone of $ 10 billion from Ethena and the Stablecoin USDE $ 10 billion for the next growth phase

Ethena broke on Sunday 10 billion dollars on TVL (total locked value), dubbing almost less than a month. Last week has marked one of the most generating weeks of ethène fees to date, and the protocol has generated more than $ 475 million in fees.

The offer doubled in only the last month, a trajectory that has investors looking at a future potentially explosive phase.

According to Analyst Crypto Stream, ENA, governance and Ethena protocol token can be about to unlock a new powerful income engine. Four of the five governance conditions to activate Ethena’s pricing change have already been met.

Ethena’s governance framework describes strict thresholds for activating the distribution of costs:

- USDE offer more than $ 8 billion – Mets.

- Protocol income greater than $ 25 million – have reached more than $ 43 million.

- Reserve fund of at least 1% of the offer – MET.

- Susde Apy spread in the range of 5.0 to 7.5% – is currently around 10%.

- The integration of the USDE out of three of the first five derivative exchanges – not yet encountered.

The analyst indicates that this opens the way to the distribution of protocol income to ENA holders. The last obstacle is a list on the Binance or the OKX Exchange.

“The questioning of the costs on: Ethena is a income monster. At one point, the income will be channeled in ENA,” said Crypto Stream, calling for their greatest punctual position.

OKX and the exchange of binance remain the missing integrations. Regulatory problems within the framework of EU Mica (markets in cryptographic assets) initially prevented the Binance of the USDE list.

However, users excluding EU integration earlier this month can erase the way to a global USDE list on popular exchanges.

Converge could transform Ethena into power power

Although the cost change marks an important step, some see an even more important price to come. Analyst Jacob Canfield underlined Ethena’s long -term plan to launch her blockchain, converges, with ENA as a protocol token.

In this model, ENA holders could reach tokens to the validators and gain a percentage of the value of the transaction. This would transform ENA into an asset bearing the yield linked to the economic activity of the network.

Meanwhile, Ethena’s roadmap goes beyond cryptocurrency growth. Crypto Stream highlighted the planned list of the Nasdaq of Stablecoinx (TCO) in the fourth quarter, potentially giving institutional investors exposed directly to the Ethena ecosystem.

The past success of Circle with the USDC demonstrates a significant demand for regulated stable vehicles of traditional finance (tradfi).

Meanwhile, Arthur Cheong, founder of Defiance Capital, believes that the Great Funds underestimated Ethena because of her chip unlocking calendar.

“You simply have no idea of the number of funds … Disinptantly rejected $ ENA with a simple reason for” too much unlocking “and has ignored the potential growth to come and the execution of the level team,” said Cheong.

However, despite all this, the dazzling climb of Ethena made comparisons with the unhappy UST of Terra, which collapsed in 2022.

He follows the USDE becoming the third largest stablecoin after the adoption of the engineering law. Critics warn that synthetic stables are faced with inherent fragility, especially under stressed market conditions.

However, the founder of Ethena, Guy Young, set by pointing integrated risk controls and a diversified challenge of challenge designed to mitigate the risk of screening.

If the integration of Binance or OKX of the Stablecoin USDE occurs and the cost switch activates, Ethena could see the income of the protocol redirects to ENA holders, as are the Winds Macro-Tails aligning.

In such a scenario, lower federal reserve rates (Fed), historically inversely correlated with the financing costs of cryptography, could increase the profitability of Ethena.

The parts can be set up in the middle of an increasing adoption of the USDE, a growing reserve and the imminent converting chain.

When writing these lines, Ethena was negotiated at $ 0.7759, up more than 3% in the last 24 hours.

The post why analysts call Ethena (ENA) The largest Altcoin bet this cycle appeared first on Beincrypto.