Why are Ethereum ETFs Suddenly So Popular After Pectra?

US SPOT ETHEREUM The FNB recorded 15 consecutive negotiation days of net entrances, Amount 837.5 million dollars since May 16.

The entry sequence started a week after the Ethereum Pectra upgrade, which increased the EIP-7702 transactions to almost 1,000 portfolio characteristics per day and improved without address changes.

ETHEREUM EARFS struck $ 837.5 million in ignition sequence

These entries have been around 25% of all net entries since the launch of funds in May 2024. The sequence marks the longest uninterrupted period of ETF ETF since the end of 2024.

According to Sosovalue data, it positions ETHEREUM at their highest cumulative input value to date, now totaling $ 3.33 billion.

The ETHA of Blackrock leads the ETF ETF market to individual entrances, contributing nearly $ 600 million during this increase. While Etha has the highest entries, the double offers of Graycale, Ethe and ETH, hold a larger asset base, with $ 4.09 billion in AUM compared to the total of Etha.

Meanwhile, Fidelity’s offer is $ 1.09 billion, while other funds remain below the $ 250 million mark. In particular, overvoltage coincides with a gathering of 38% of the price of ether in the last 30 days.

The main engines include a renewal of institutional interests, optimism around the long -term fundamentals of Ethereum and the recent network upgrade of the network. Against these funds, analysts are optimistic about the prices of Ethereum prices.

Despite this, JPMorgan analysts noted that if institutional allowances increase, user activity on the Ethereum network has not yet accelerated significantly.

“Neither the number of daily transactions nor the number of active addresses have seen an increase in equipment after recent upgrades,” wrote JPMorgan analysts led by Nikolaos Panigirtzoglou in the recent report.

If the current rate continues, the sequence could cross the $ 1 billion mark next week. Such a result would further highlight a net pivot in feeling after a relatively deaf start for ether ETF.

Bitcoin ETF retirement after record

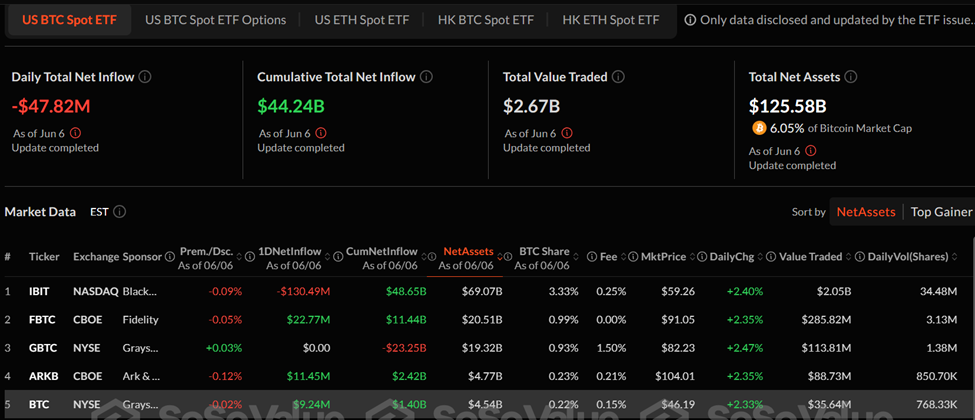

While the ETHEREUM ETHEREUM continues to take a momentum, it cannot be said of their Bitcoin counterparts. The Bitcoin Spot ETF saw their last most recent intrigue sequence on May 29, when $ 346.8 million left the market in one day.

Since then, Bitcoin ETF flows have become volatile and cumulative entrances have dropped more than a billion dollars. This represents $ 45.34 billion on May 28 at 44.24 billion dollars from the negotiation session on Friday.

The Ibit of Blackrock remains the leader in the category by a large margin, managing $ 69 billion in assets. The FIDLY FBTC and GRAYCAL GBTC follow with $ 20.51 billion and $ 19.32 billion in AUM, respectively.

The market has also experienced brief turbulence after an online animated exchange between President Donald Trump and Elon Musk sparked a wider sale on cryptographic and actions.

Spotlight on ETF’s development and innovation

As the interest of investors in ETF Ether accelerates, some analysts maintain that future entries will depend on the introduction of the ignition functionality. James Seyffart, ETF analyst at Bloomberg, recently highlighted regulatory bypass solutions used to launch ETF compatible with stations.

The supplier ETF Rex Pares has already deposited ETHEREUM and Solana ETF, and the first products of this type can arrive in the United States in a few weeks.

The growing demand is also reflected in wider Ethereum adoption measures. According to Santiment, Ethereum holders have now exceeded 148 million.

This signals a long -term conviction in the assets. Compared, Bitcoin has 55.39 million holders, while other popular assets such as Dogecoin, XRP and Cardano bring between 4 and 8 million holders.

With Ether ETF now offering their strongest performance to date, the spotlights are firmly on the question of whether this momentum can persist.

Perhaps offers compatible with an exercise could lead the next wave of institutional adoption.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.