Why Crypto Bulls Are Targeting Quant’s QNT Token

The native token of ENT, QNT, has become one of the most efficient altcoins today. Its price has climbed 6% while wider market difficulties.

This decision aroused a renewed increase in bullish interest, data on the chain pointing towards a more potential advantage in future sessions.

Sponsored

Sponsored

Rallies of tokens when with increasing confidence of trafficking

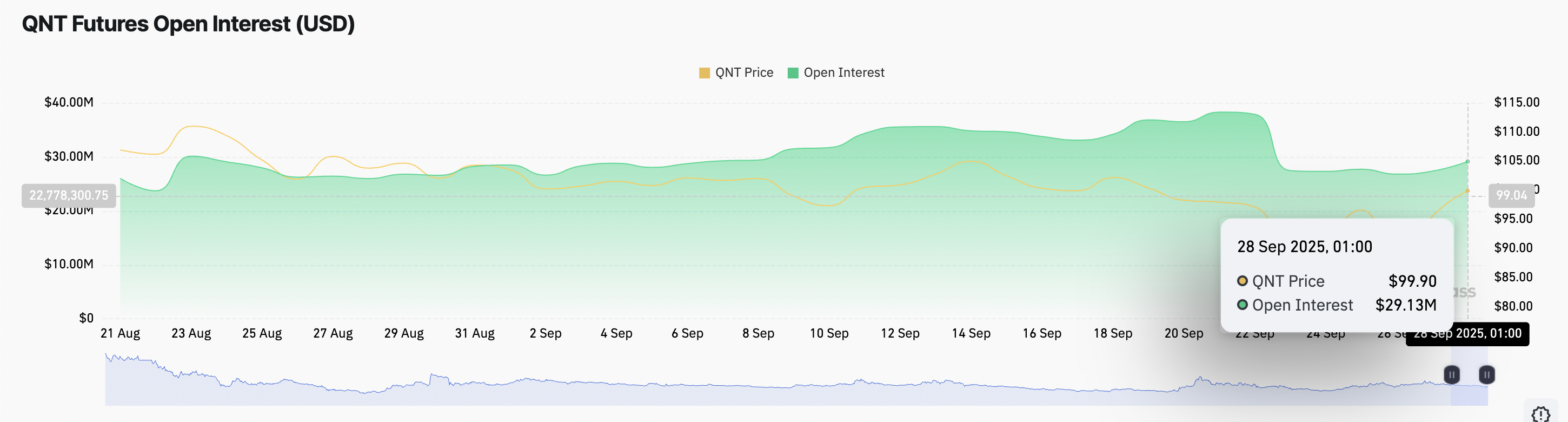

QNT earnings during the day were accompanied by an increase in its open interest in the long term, indicating that traders penetrate more and more new positions rather than executing those existing. According to Corclass, this is currently 29.13 million dollars, up 7% in the last 24 hours.

Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

The open interest refers to the total number of current contracts in progress which have not yet been set. It serves as a key gauge in market activity and the participation of merchants, so when it increases in parallel with a price increase, this indicates that new funds take place on the market, strengthening the trend.

For QNT, this indicates growing confidence among its merchants that the current bullish momentum has room to continue.

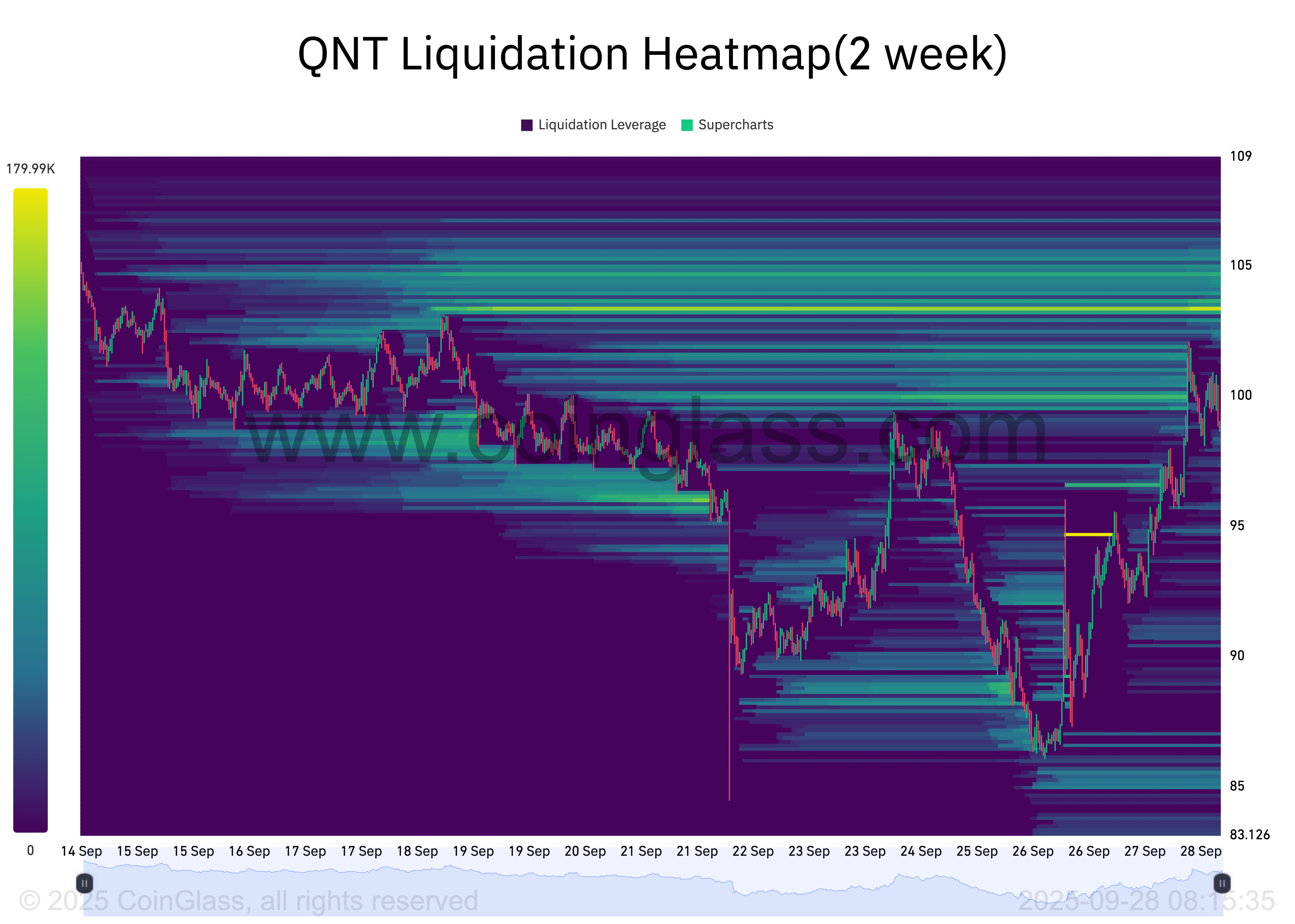

In addition, the QNT liquidation thermal card highlights a liquidity concentration above current levels at around $ 103.

Sponsored

Sponsored

Thermal liquidation cards are visual tools that traders use to identify the price levels where large clusters of leverage positions are likely to be liquidated. These cards highlight the high liquidity areas, often coded by color to show the intensity, with brighter areas representing a greater liquidation potential.

Such areas are often described as “price magnets”, drawing punctual activity and derivatives towards them while traders seek to exploit potential compressions. This configuration suggests that QNT can continue its upward trend towards the liquidity cluster, provided that the market dynamics hold.

The upward trend of QNT gains steam

On the daily graphic, the Silver Silver Flux indicator (CMF) is upwards, supporting the case for a sustained rally. To date, this momentum indicator is 0.02.

The CMF measures the capital flow in and outside an asset by analyzing the price and the volume. A growing CMF as this reflects the increase in the pressure of the purchase, strengthening the case for an upward action sustained for the QNT.

If the request remains high, it could trigger a resistance violation at $ 101.87 and climb to $ 107.68.

However, not supporting the momentum can leave the price of QNT vulnerable to profit, especially if a wider weakness on the market is deepened. In this scenario, it could reverse its current trend and fall to $ 85.37.