Why Did MicroStrategy Pause Its Bitcoin Acquisitions Last Week?

The strategy (formerly Microstrategy) has not bought any bitcoin or sold ordinary stock this week, breaking a long -term sequence. The company officially revealed that it had $ 5.91 billion in unrealized losses due to slowdowns on the cryptography market.

Two probable scenarios explain this break: the strategy awaits either more favorable market conditions or is forced to cautious by these losses. Be that as it may, uncertainty can point out more apprehension among institutional investors.

Bitcoin purchase break from microstrategy: prudent signal or liquidity movement?

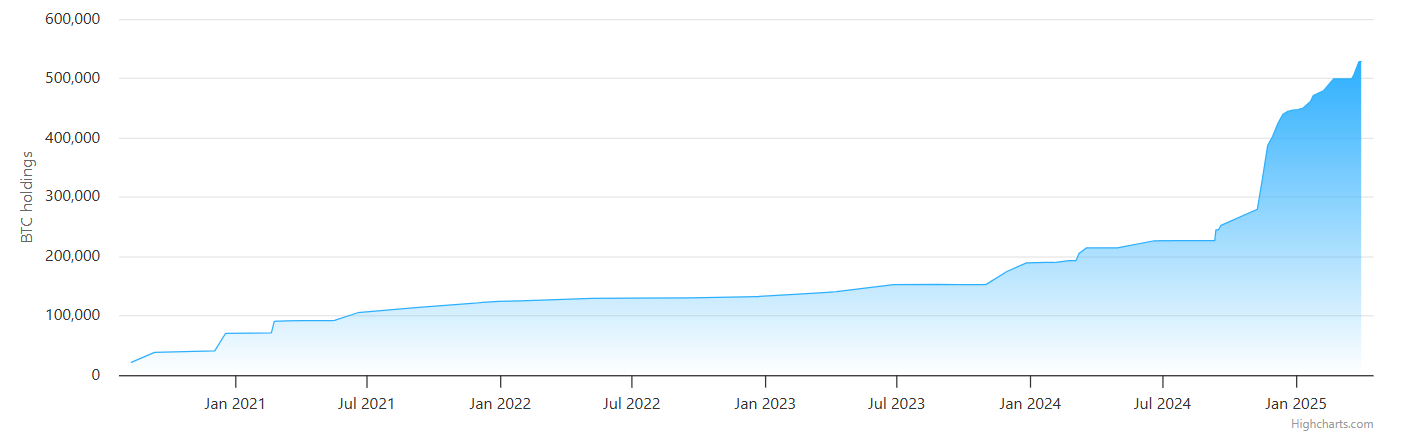

Since Michael Saylor directed the strategy (formerly Microstrategy) to start acquiring bitcoin, he has become one of the biggest BTC holders in the world. So far, this has been a major buyer in 2025, acquired about $ 2 billion in Bitcoin twice.

However, according to its most recent 8-K form, the strategy bought Zero BTC last week and I haven’t sold a stock either.

This is not the first interruption of Bitcoin’s Bitcoin purchases this year; He also interrupted the acquisitions in February. Unlike this incident, this time feels considerably different due to the fears of an American recession.

The break in the purchase of Bitcoin can suggest that the management of the strategy adopts an expected approach in the middle of the volatility of the current market, perhaps indicating that they believe that Bitcoin could further before resuming purchases.

Billions were liquidated from crypto and tradfi, and business bitcoin holders have suffered serious losses.

The company can also try to break its historic sequence of consecutive purchases to avoid a risk of additional drop until the lighter market trends are emerging.

However, some eminent voices adopt a much more critical approach. The same 8-K form shows that the strategy currently has $ 5.91 billion in unrealized losses in its Bitcoin holdings. Liquidity, the company’s tax obligations were already worrying and the company’s overexpacked debts.

Some members of the community wonder how Saylor can avoid a crisis:

“The base of the average cost of BTC by Michael Saylor is around $ 67,500. A drop of 15% puts microstrategy in the depths of red. It is the thin line between the visionary CEO ” and ‘lever with a leverage with a God’s complex,’ ‘said Edward Farina via social media.

What is the next step for the strategy?

Essentially, the strategy serves as a major pillar of confidence in Bitcoin. If the company sells, the market will notice it. The cryptographic ecosystem carefully documents minor differences in the company’s purchasing strategy of the company, and a sale would be very down.

Meanwhile, companies are already inventing new FNB tools to short-circuit the company, praying for its collapse. What is the best path to move forward?

So far, Saylor has been silent on these turns on the market. Microstrategy can wait for his time, planning to withdraw another huge purchase of Bitcoin whenever the market is at the bottom.

He can also be paralyzed, unable to act because of his crisis in debt and his unrealized losses. For the moment, uncertainty can point out a broader apprehension among institutional investors.

This prudent position can point out a broader apprehension among institutional investors concerning the current conditions of the cryptography market, referring to a potential break before a renewed accumulation phase if the basic markets improve.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.