Why Does XRP’s Holder Ratio Outperform Solana’s?

The first half of 2025 experienced significant changes in the structures for the holding of cryptographic assets. Among the notable changes, there was that the XRP holder report was halved. However, he continued to surpass Solana in the global market share.

Despite the drop in holders, the feeling of investors towards XRP remained positive, as evidenced by the latest data on the June channel.

The XRP support numbers just halved – so why still beats Solana?

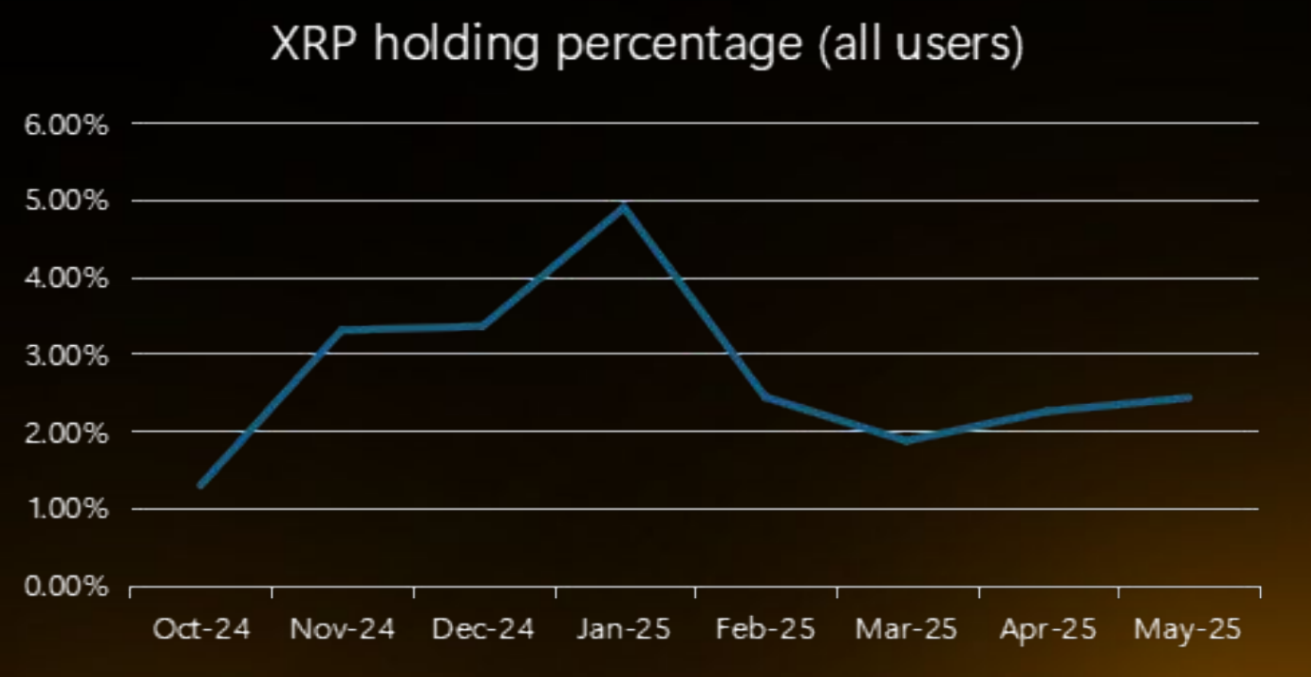

According to the “asset allocation report 25h1” by Bybit, the percentage of XRP holders almost doubled from October 2024 to May 2025, from 1.29% to 2.42%.

However, when the period isolation in H1 2025, the report increased from 5% to 2.42%. These contrasting figures highlight how the conclusions can vary depending on the time.

The number of XRP holders has shown significant volatility, closely following fluctuations in the price of XRP. Consequently, although the long -term trend indicates growth, short -term figures can undergo high drops.

In comparison, the Solana support ratio increased from 2.72% in November 2024 to 1.76% in May 2025. Bybit allocated part of this drop to the rotation of soil investors to XRP in the midst of increasing optimism on the potential approval of an ETF XRP.

“The point of view of the crypto investment industry is that the approval of the FNB Ripple Spot is probably ahead of such an approval for an ETF Solana Spot. As such, we have observed a partial capital allowance on the part of soil institutions in XRP,” said the report.

On a larger scale, retail investors seem to have moved away from Bitcoin in favor of altcoins perceived as offering a higher increase in increase, in particular XRP.

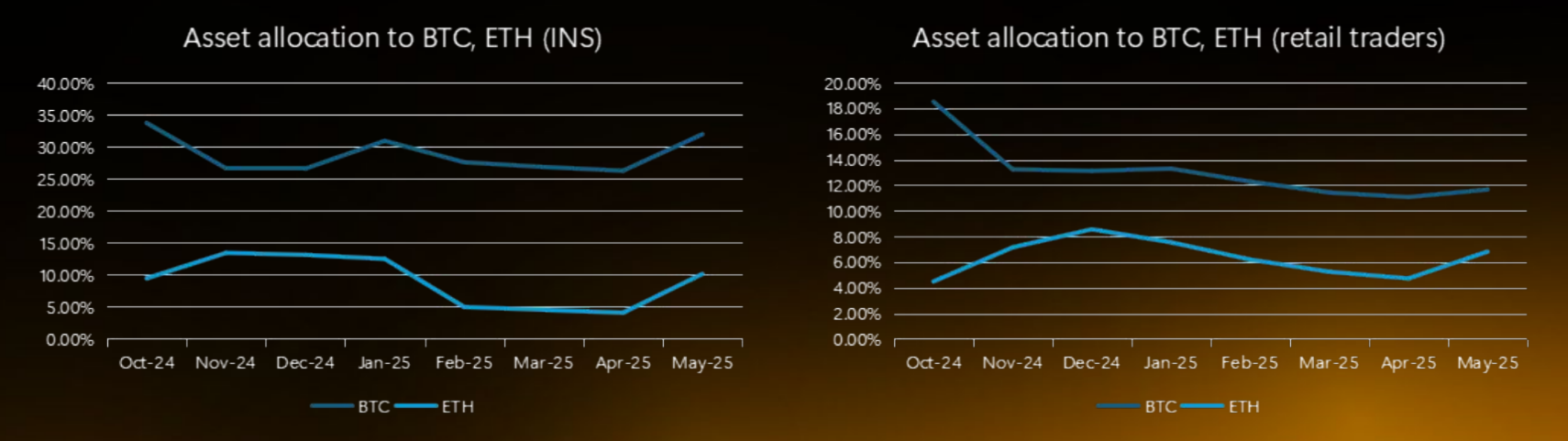

Bybit’s analysis showed that between November 2024 and May 2025, Bitcoin Holdings among retail merchants decreased, while institutional Bitcoin holdings have remained stable.

“Based on a more in -depth analysis, it is likely that retail traders have eliminated their Bitcoin operations in order to buy altcoins, such as XRP, and have more stablecoins than usual,” noted the report.

Supporting this trend more, Beincrypto recently reported that the number of XRP whale portfolios had exceeded 2,700 in June, marking a 12 -year summit. The increase indicates the growing confidence of large -scale investors.

These developments suggest that XRP emerges as a rare case, arousing supported interests on the part of retail and institutional selling segments.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.