Why Is the Crypto Market Up Today?

The new year appears to be starting on a positive note, with the total crypto market cap (TOTAL) and Bitcoin (BTC) in green on the daily chart. Fartcoin (FARTCOIN) led altcoins to gains, rising 16% over the past 24 hours.

In the news today: –

- Switzerland is considering adding Bitcoin to its national reserves alongside gold, requiring 100,000 citizen signatures by June 30, 2025 to advance the proposal. This initiative, led by crypto advocates, aims to change legislation to include Bitcoin as a reserve asset.

- Binance Labs is rebranding, hinting at new priorities for 2025, including biotech, AI, and crypto projects with strong fundamentals. The company remains focused on investments with real use and sustainable business models.

Minor Crypto Market Gains

The total crypto market cap saw sharp increases over the past 24 hours, reaching $3.19 trillion. Although the increase was modest, the market managed to hold above the critical support level of $3.1 trillion.

The next target for the total crypto market cap is to break through and turn the $3.28 trillion resistance into support. Reaching this milestone would create the foundation for a $3.5 trillion recovery. Such progress would likely restore investor confidence and strengthen overall market sentiment.

However, if the market fails to surpass $3.28 trillion, consolidation above $3.1 trillion is expected to continue.

This scenario would temper bullish optimism and delay any significant upward movement. Maintaining support at $3.1 trillion remains crucial to avoid further declines.

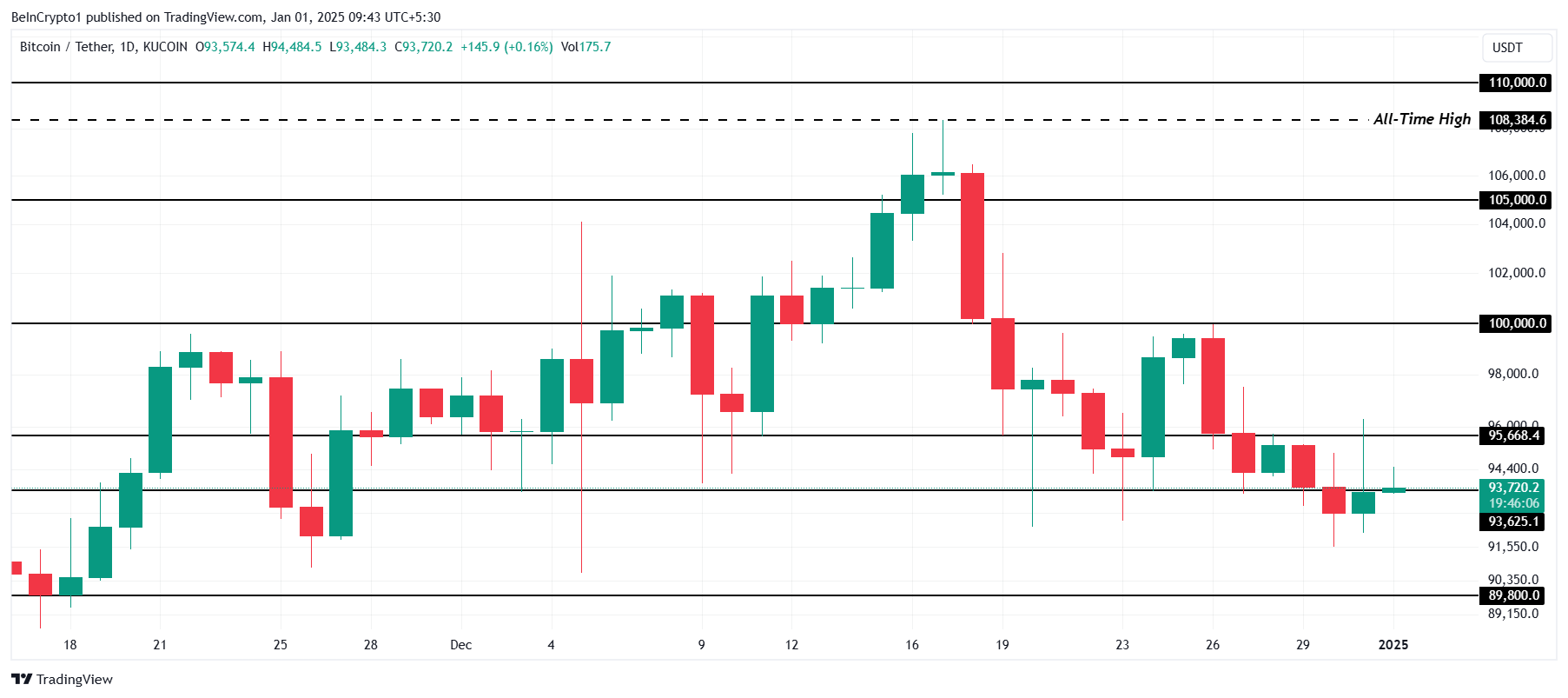

Bitcoin Aims to Reclaim Support

Bitcoin is looking to reclaim the $93,625 support level, a crucial step towards crossing $95,668. This key resistance forms the final barrier between BTC and the psychological milestone of $100,000.

To maintain this momentum, Bitcoin will need strong bullish signals over the coming year. Reversing $95,668 in support would open the way for BTC to extend its rally, potentially setting the stage for new highs.

However, losing support at $93,625 would expose Bitcoin to a potential decline towards $89,800. Such a decline would dampen bullish sentiment and delay any near-term recovery. Maintaining key support levels is essential to preserving Bitcoin’s positive outlook.

Fartcoin leads the pack

Fartcoin price surprised investors with a 16% increase, climbing to $1.02 at the time of writing. This upward move allowed the meme coin to reclaim the crucial support level of $0.98, strengthening its short-term upward trajectory and sparking renewed interest from market participants.

Despite this rise, Fartcoin remains significantly below its all-time high of $1.30. Reaching this milestone would require sustained bullish momentum throughout the month. Consistent demand and favorable market conditions are essential for the meme coin to continue its upward trend and move closer to its previous high.

However, if Fartcoin loses the $0.98 support level, the price could fall to $0.81. Such a decline would invalidate the bullish outlook, potentially leading to significant losses. Maintaining key support levels is essential to preserve investor confidence and avoid a deeper correction.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to providing accurate and unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decision. Please note that our Terms and Conditions, Privacy Policy and Disclaimer have been updated.