Why Ripple’s US Banking License Bid Isn’t a Clear Bullish Signal for XRP

This week, Ripple asked for a national banking license in the United States, an important decision that positions the company closer to the regulated financial current. But the market response was silent – and for a good reason.

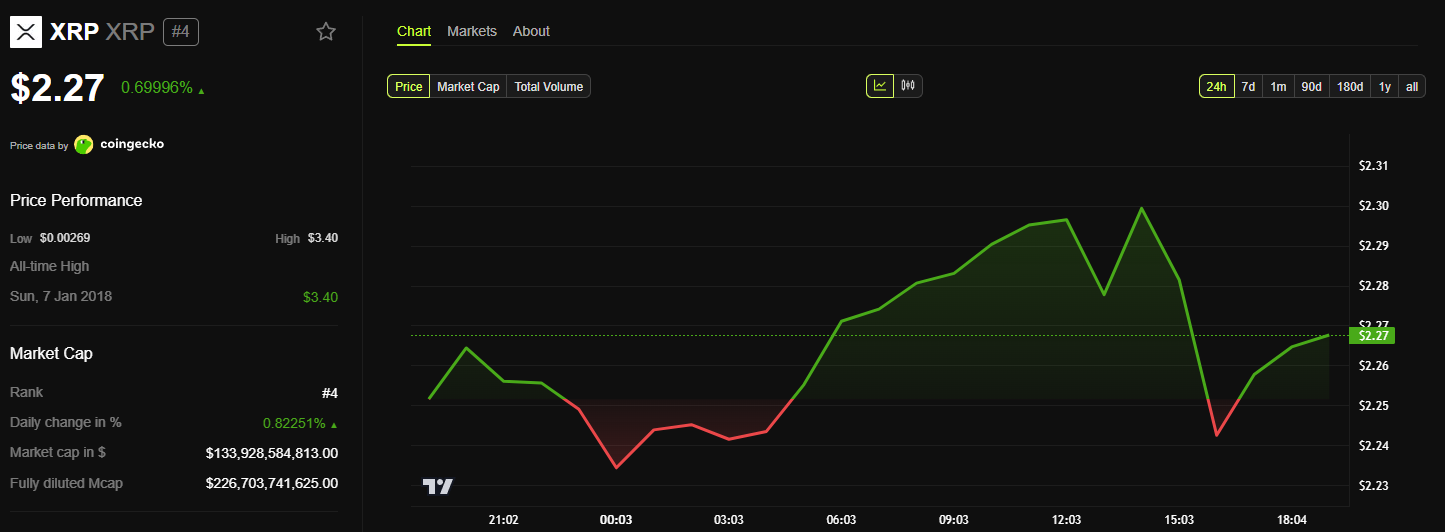

The XRP price only won about 3% after the news. This modest increase reflects reality that the banking license, if granted, does not directly improve the usefulness or legal status of XRP – at least not yet.

Ripple becoming an compliant American goalkeeper does not have an XRP impact

The banking request was filed with the office of the currency controller (OCC), the same federal regulator supervising the charters of the trust bank.

Ripple’s objective is to operate as a regulated banking entity, which allows it to have digital assets and manage Stablecoin reserves for its new product, RUSD. This development reflects similar movements by other cryptographic companies, such as Circle and Fidelity.

However, Ripple’s strategy has limited implications for the price or demand for short -term XRP.

Above all, the OCC license would not modify the current regulatory status of XRP in the United States. Earlier, Ripple abandoned his crossed tip against the dry in the XRP trial. This means that the decision of the Federal Court in 2023 is.

To summarize, the decision revealed that XRP retail sales are not titles, but institutional sales by Ripple have violated the laws on securities.

This injunction is still standing, and Ripple cannot sell XRP to institutions in the United States Without recording or appropriate dry exemption.

Consequently, even if Ripple wins banking status, he cannot use this charter to restart institutional XRP sales at the national level. It also does not make XRP a regulated or approved asset under the federal securities law.

Conditional bullish scenario

What the license could allow is an improvement in integration between the Ripple services – in particular the RUSD – and its broader infrastructure.

If Ripple uses its bank capacity to serve regulated customers, XRP could indirectly benefit as a liquidity bridge. But it would depend on new trade flows and the expansion of the corridor, not legal changes.

Now Ripple could possibly use its banking status to establish confidence with American institutions. This would potentially rekindle the interest in using XRP in asset systems to tokenized or cross -border payment rails.

However, it is a long -term story, not an immediate catalyst.

For the moment, the action of XRP prices reflects this. Traders tariff a story of corporate conformity, not an upgrade of chip utilities.

Until XRP becomes at the heart of the operations supported by Ripple, the market will probably consider this decision as neutral from the point of view of the value of token.

Ripple’s banking license, if approved, could reshape the regulatory profile of the company. But XRP remains where it was – partly authorized for retail, limited for institutions and awaiting a higher case -use case.

The post why the Ripple’s American banking license offer is not a clear optimistic signal for XRP appeared first on Beincrypto.