Why Traders Might Get It Wrong

Bitcoin jumped 8% in the last 24 hours, recovering losses from last month. Now at $ 93,202, he tried to establish $ 93,625 as a support. This bright rebound has rekindled the bullish feeling, but caution is informed.

While Bitcoin is strength, traders and market trends are in disagreement, increasing the risk of volatility.

Transactions focused on the feeling of bitcoin are risky

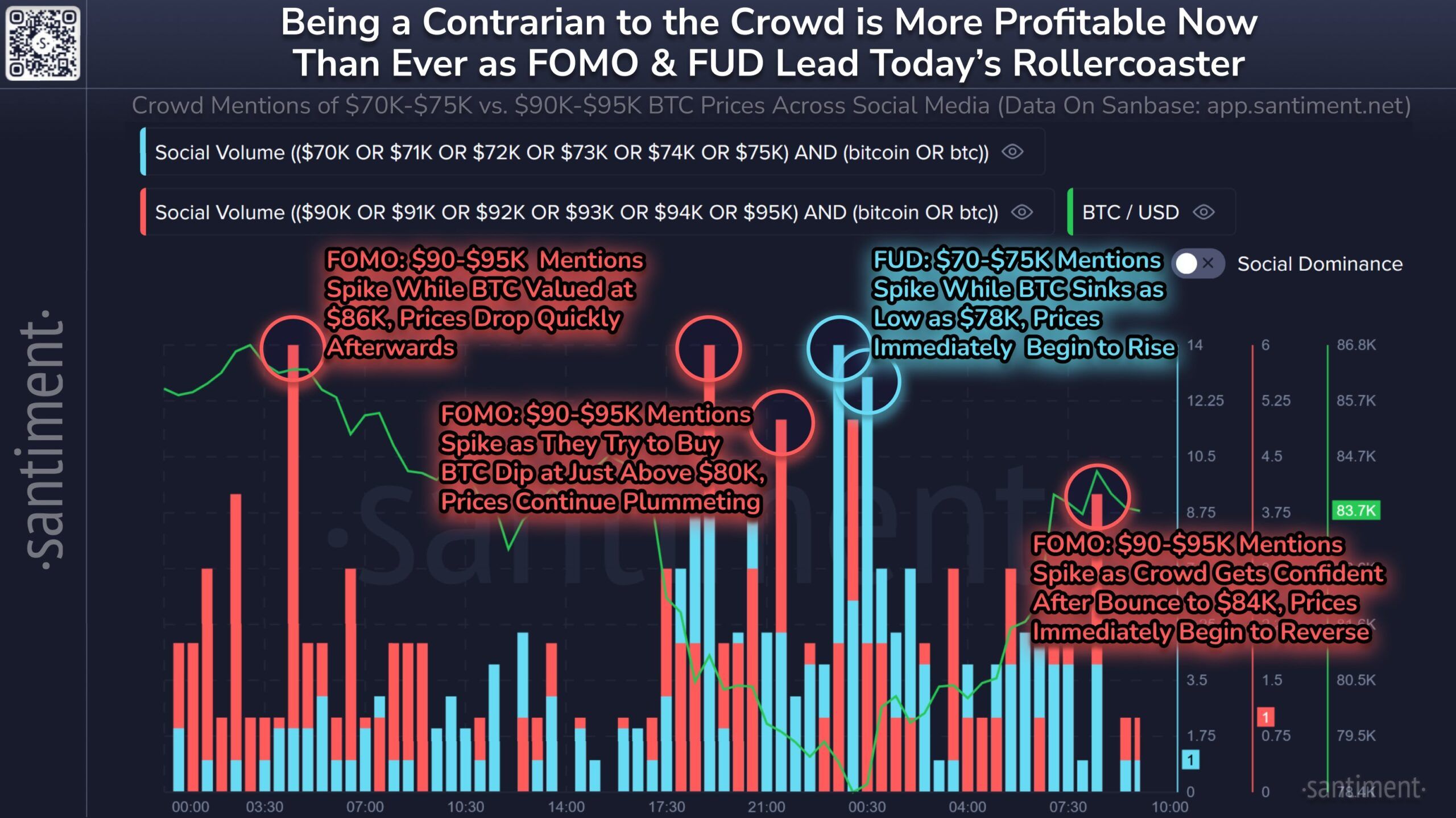

Santiment data highlights a recurring trend – trades are often poorly considered Bitcoin price movements. When traders expect a rally, the market tends to decrease. Conversely, when they anticipate a drop, Bitcoin often surprises with an upward trend. This model suggests that the unpredictability of the market remains high, which makes transactions focused on risky feeling.

Investors should watch out for volatility, because Bitcoin aims to break $ 100,000. Historically, contrary strategies have worked better than the monitoring of traders. With the uncertainty in force, market players may consider making the opposite of the opinions in force to navigate effectively under current conditions.

Bitcoin domination at 60.74% forms a fractal similar to 2020-2021, when it has led to decrease before decreasing. A similar trend is emerging, which suggests that historical models could repeat themselves. The price of Bitcoin has, on a few occasions, has shown signs of recovery during periods of decline in domination, although the strength and sustainability of these movements depend on broader market conditions.

As dominance decreases, altcoins gain ground, but Bitcoin often benefits in the long term. The current market structure reflects a transition phase, where the BTC could see more upwards. If this fractal holds, the recent increase in bitcoin prices can continue, strengthening positive impetus.

The price of the BTC must secure the support

The 8% Bitcoin increase increased its price to $ 93,202. If BTC holds $ 93,625 as support, another advantage of $ 97,696 becomes likely. Securing this level would improve the bullish momentum, strengthening Bitcoin recovery.

It is essential to overthrow the 50 -day EMA to maintain gains. This decision would erase the losses of February and have a base for a new appreciation. Maintaining this trajectory could position Bitcoin for a retention of higher resistance zones.

However, non-compliance with $ 95,761 could invalidate the bullish momentum, resulting in $ 92,005. The loss of this key level can trigger additional drops, weakening the ascending trajectory of Bitcoin.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.