Will A 17 trillion PEPE Outflow Trigger a Price Breakout?

The price of Pepe (PEPE) shows renewed signs of force, increasing by almost 57% in the last month.

While the wider market has cooled in the last 24 hours, Pepe remains one of the few tokens who are negotiated near a level of key technical break. Despite the recent rally, the token even is still negotiated more than 51% below its top of all time, suggesting an upward potential if the market dynamics are valid.

Lourdes exchange outings suggest that the confidence of the holders is high

Since July 16, nearly 17.9 billions of Pepe tokens have left exchanges, reflecting a coherent scheme of a week of outings. This type of movement generally indicates that the bearers move their chips to private wallets; Often a bullish sign because it reduces short -term sales pressure.

For TA tokens and market updates: Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

What is interesting is that the releases of tokens continued despite the fact that the PEPE price increased more than 12% during the same period. This could mean that the sale is not the priority for the moment.

Exit on exchanges are a useful measure because they measure the net movement of tokens from trading platforms. When more tokens leave than to enter, this generally implies that fewer traders are preparing to sell.

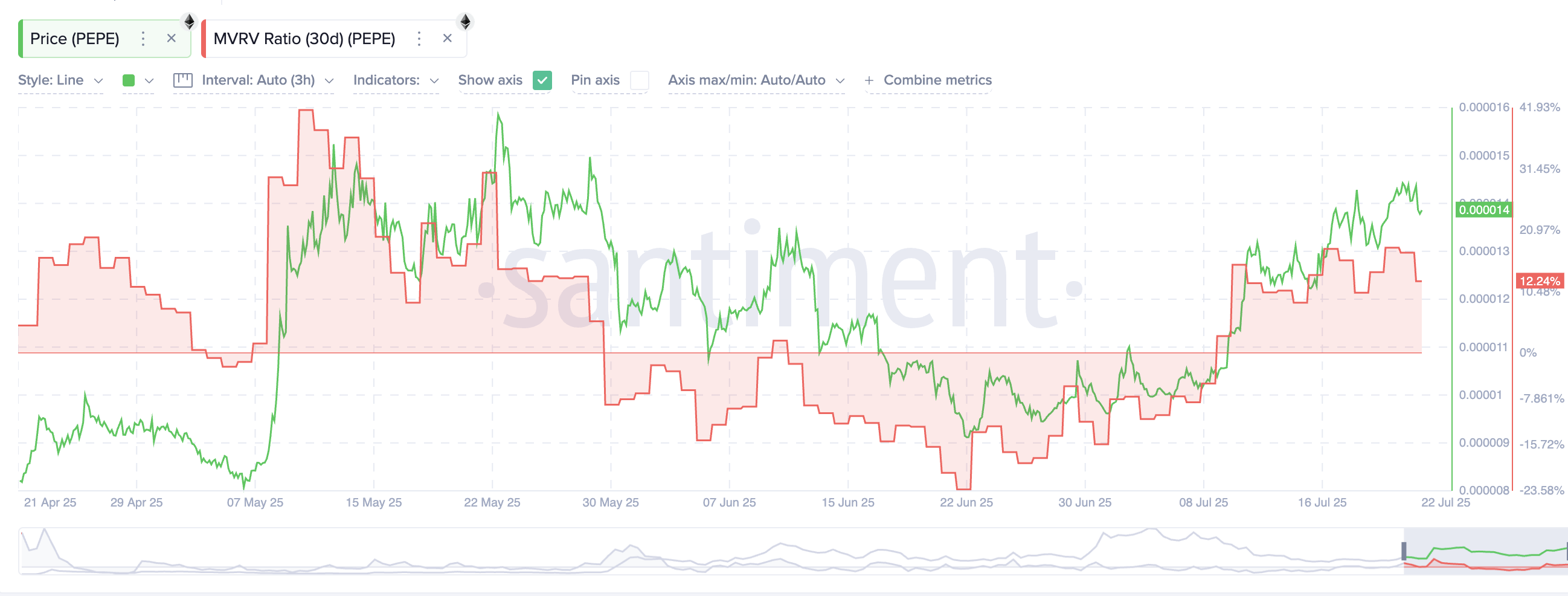

MVRV data alludes to a low -sales risk despite recent gains

The ratio of market value from 30 days to 30 days of pepe (MVRV) entered the positive territory, but it remains modest at + 12.24%. Historically, short -term holders are starting to sell when this metric crosses 20 to 30%, which means that the current level always leaves room for new gains.

This observation is synchronized with aggressive exchange outings, despite the action of positive prices. The two metrics in combination suggest that better gains could be expected from Pepe.

The MVRV ratio compares the price to which the tokens were displaced last time at their current value. A weak but positive MVRV suggests that holders are seated on light benefits, but not enough to trigger mass sales. Combined with sustained outings, this adds weight to the idea that the recent force of pepe prices can have legs.

Pepe Price is near the corner break, but …

Pepe is currently negotiated along the upper limit of a corner pattern. It is a configuration often associated with upward eruptions. The final confirmation, however, depends on the closure of Pepe above 0.00001497 of 0.00001497. This price level is aligned with the extension of 0.382 Fibonacci.

Although escape can be a sign of trading for many, a clear overtaking beyond 0.00001497, a key resistance level, could operate as an additional validation layer. If this level of fibonacci resistance based on the trend is violated, the PEPE price could have the legs to move around $ 0.000017 or more.

But if Pepe fails to maintain the momentum and fall below 0.00001200, this would probably signal the start of a wider retracement and invalidate the current bullish configuration.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.