Will Bearish Metrics Push BTC Price Below $80K?

The recent recovery in the cryptography market has faded on Friday while a clear sale has erased almost all weekly gains. Investors have become cautious in the midst of the concerns concerning the upcoming prices of President Trump scheduled for April 2 as well as stronger basic basic basic data. Bitcoin facing the increase in sales pressure of less than $ 85,000, it has been on the right track for its worst quarter since 2018, allowing analysts to speculate if it could finish March below the critical level of $ 80,000.

Bitcoin to face the worst Q1 since 2018

The price of Bitcoin has decreased sharply in the past hours. According to Coinglass data, nearly $ 90.56 million in BTC posts were liquidated, including $ 79.3 million from buyers and around $ 11.25 million from sellers.

This recent decrease in prices Place Bitcoin on the right track for its worst performance in the first quarter since 2018. Co -Correglass data indicate that Bitcoin dropped by around 11.86% in the first quarter of 2025, slightly worse than the loss of 10.83% in the first quarter of 2020, although far from the drastic decrease of 49.7% observed in the first quarter 2018.

Bitcoin’s open interest has decreased by around 4.5% in the last 24 hours, approaching a hollow of around 54 billion dollars. The drop in open interest indicates the drop in commercial activity between BTC traders, which can lead to a drop in volatility and more prudent short -term market.

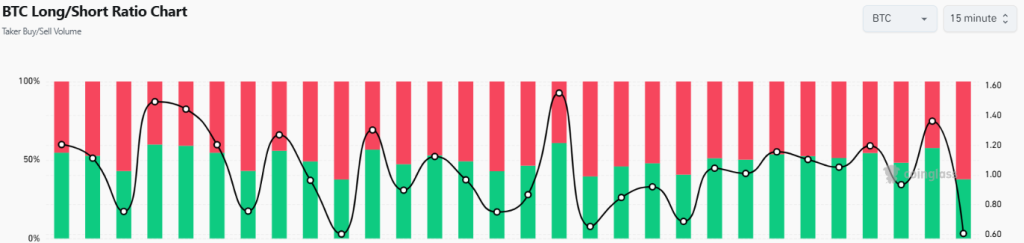

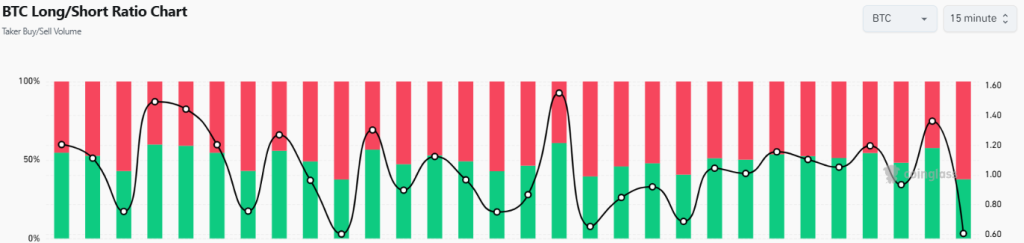

In addition, the long / short ratio experienced a significant drop, currently at 0.6051. This metric reveals that around 62.3% of traders are now betting on a new drop in prices for Bitcoin, while around 38% hope a potential rebound. Overall, these figures indicate a growing lower feeling among traders.

Read also: Bitcoin ETF Flow Stream breaks after a 10 -day wave

Adding to the bearish feeling, the Bitcoin FNB experienced notable outings, possibly pushing the BTC closer to the level of $ 80,000. The FBTC fund of Fidelity alone saw $ 93.16 million in outings on Friday, ending a sequence of 10 days of entries – the longest of this year. In particular, the FBTC had received $ 97.14 million in entries the day before, according to Sosovalue. The volume of negotiation in all American Bitcoin FNB increased slightly on Friday, totaling around 2.22 billion dollars.

What is the next step for BTC Price?

Bitcoin recently experienced an increase in sales pressure, which drops its price below the important levels of fibonacci support and reaching a minimum of around $ 81,644. Bitcoin is currently negotiating nearly $ 82,289, down approximately 1.7% in the last 24 hours.

Sellers actively hold the crucial resistance to $ 85,000, aimed at preventing the price from bouncing. Despite this, buyers remain determined and seem prepared for another push to recover this key level.

If buyers manage to regain the level of $ 85,000, the feeling of the market could change positively, potentially opening the way to a higher momentum with the largest major resistance nearly $ 90,000.

However, if buyers fail to overcome this critical barrier, Bitcoin could face increased sales pressure, may bring the price to the support area between $ 80,000 and $ 78,000.