Will Bitcoin (BTC) Crash Again? Bearish Pattern Spotted

In the midst of the current tariff war, Bitcoin (BTC), the largest cryptocurrency in the world by market capitalization, is ready for a massive price accident due to its lower price action. In recent days, BTC seems to consolidate in a tight beach. However, on the more in -depth examination, he seems to have formed a head and shoulder motif in the four -hour period.

Current price momen

It seems that the market does not react to any positive news. Earlier, following the daring declaration of the Treasury Secretary Scott Bessent, the BTC and the major assets began to bounce, but the upward momentum was later and all the gains were lost. Currently, BTC is negotiated near the level of $ 82,500 and has recorded a price drop of more than 1.10% in the last 24 hours. During the same period, its negotiation volume fell by 50%, which indicates a lower participation of traders and investors due to the notable volatility of the market.

Bitcoin (BTC) Technical analysis and future levels

According to an expert technical analysis, with the recent drop in prices, BTC goes to the neckline of the Bearish head and shoulder motif.

Based on the action of recent prices and historical models, if this momentum continues and BTC violates the neckline at $ 81,500, there is a high possibility that it can decrease by 4% to reach the level of $ 78,200 in the near future.

Currently, the asset is negotiated below the exponential mobile average (EMA) on daily deadlines and four hours, indicating a strong downward trend and low momentum.

Traders generally await a price leap to short-circuit the asset, which explains the recent price increase and the subsequent drop in less than 24 hours.

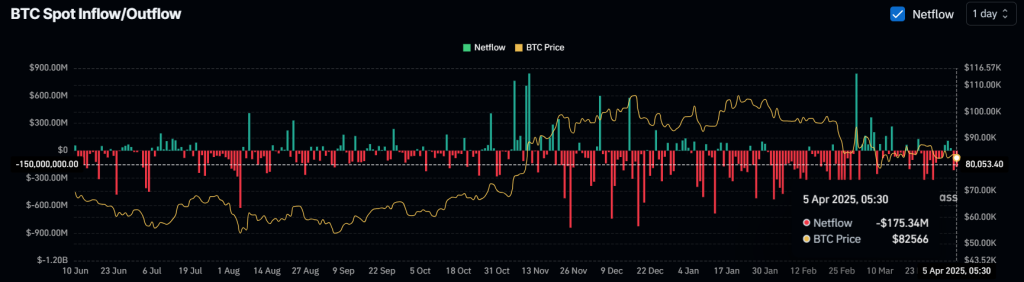

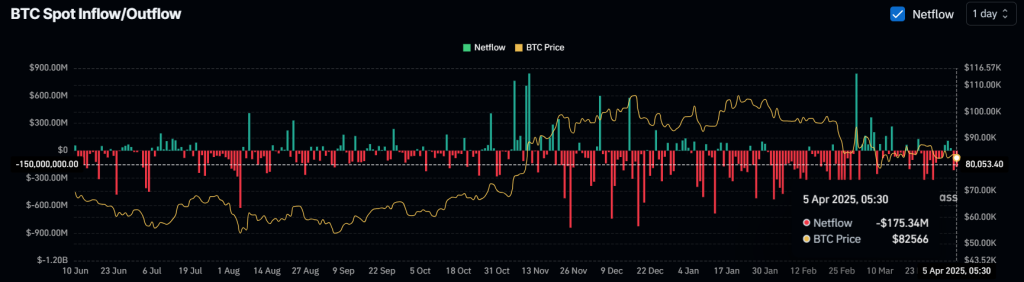

$ 175 million in BTC outputs

Despite the lowering prospects, investors and long -term holders seem to accumulate the assets, as reported by the Coinglass chain analysis company.

The Flow / OUT Spot Data Sweep reveal that the exchanges have experienced a flow of approximately $ 175 million in BTC in the last 24 hours. Such a exit during a lower market feeling suggests a potential accumulation.

Although this can create a purchase pressure and trigger an upward rally, it generally occurs during a bull race.