Will Bitcoin Prevent Price Crash To $92,000? History Says No

The Bitcoin price has fluctuated in the past two months, forming a lowering model that has raised concerns among investors. After a sharp increase, Bitcoin recently encountered resistance, and the current model suggests that other losses could be in advance.

The feeling of the market remains cautious while Bitcoin is struggling to unravel the key levels. In addition, a potential drop to $ 92,000 is widely discussed.

Bitcoin is too hidden

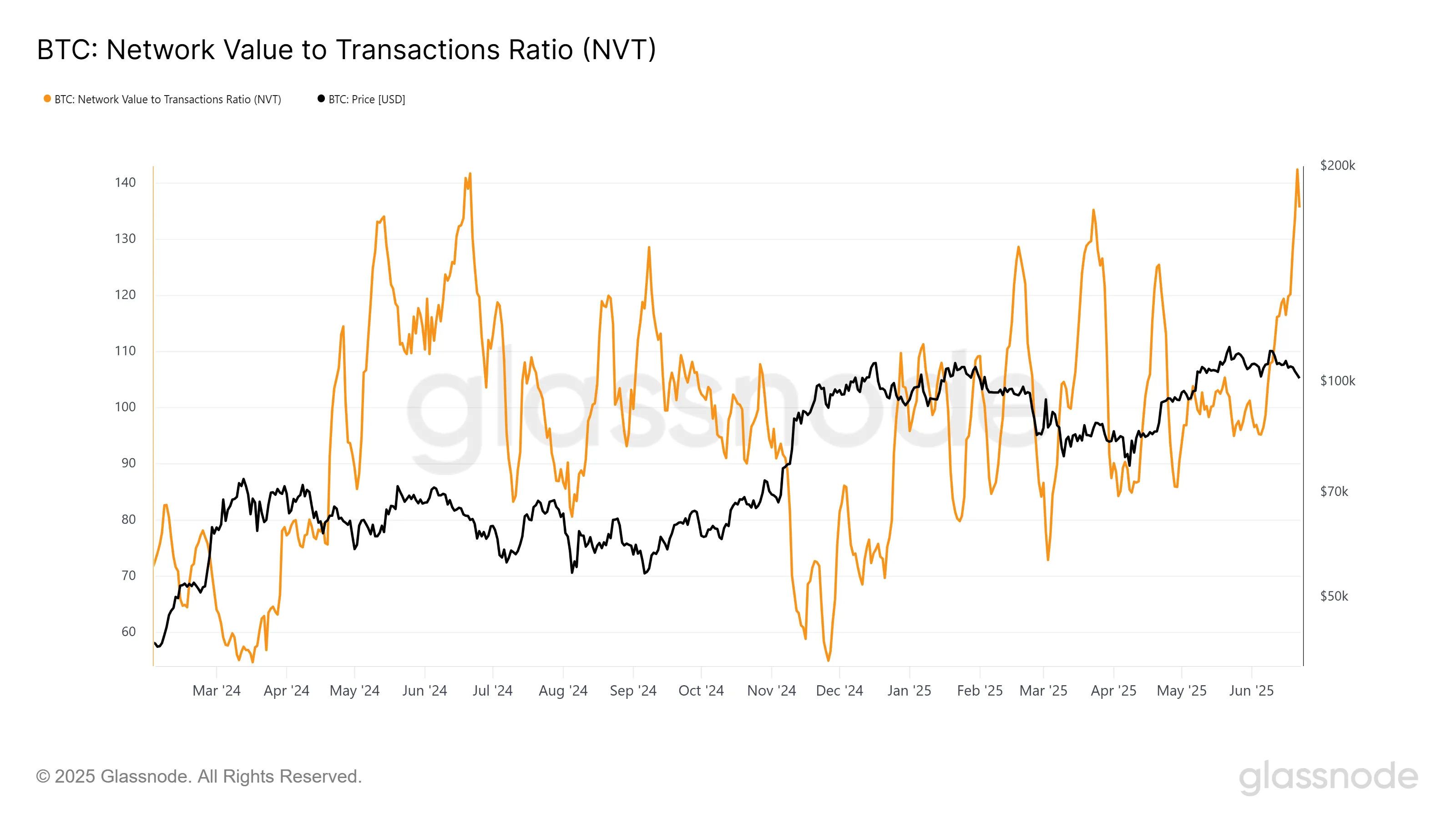

The network value ratio / transactions (NVT) for Bitcoin is currently at its highest level in one year, indicating that the network assessment far exceeds the transaction activity. Historically, such a peak in the NVT report has often acted as a precursor to a market correction.

This suggests that Bitcoin can be overvalued, leading to a potential price of the price. Although a slight drop in the NVT report was observed last weekend, it was widely attributed to external factors and has not changed the wider trend.

Bitcoin remains vulnerable as an exaggerated active, and historical models show that after such accumulation, a correction is often inevitable.

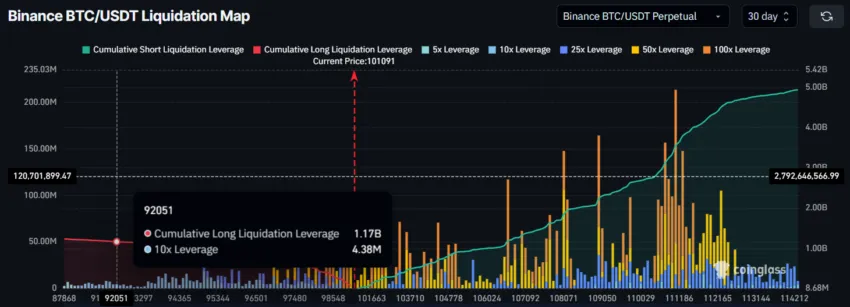

In addition, the Bitcoin liquidation card indicates that more than $ 1.17 billion long liquidations could occur if the Bitcoin price drops to $ 92,000. This potential liquidation peak suggests a significant risk for those who occupy long positions.

Despite the positive financing rate, which encouraged optimism in certain quarters, the liquidation card shows that Bitcoin could face significant drop pressure if it reaches the $ 92,000 mark. This suggests that the downward trend is not yet finished and that Bitcoin can find it difficult to maintain its price above the main levels of support.

The price of the BTC is vulnerable to losses

Bitcoin is currently forming a high double pattern, also known as the W -reverse Wame. This model is generally considered to be a lower signal and suggests that if it is validated, Bitcoin could face a correction. The formation of this model in the past two months highlights increasing sales pressure, which could lead to a new drop in prices.

The model is currently more than $ 100,000, but a drop below this crucial level would confirm the downstream configuration. If the Bitcoin price breaks down below $ 98,000, it will probably target an accident at $ 92,000, which represents a drop of 9%. This would trigger more in -depth sales, strengthening the lower -term Bitcoin perspectives.

However, if the wider market conditions are improving and Bitcoin manages to maintain above the level of support of $ 100,000, it could bounce back. A recovery that sees Bitcoin turning the resistance of $ 102,734 in the support would overthrow the momentum towards the bullish side. This could potentially generate the price of Bitcoin up to $ 105,000, invalidating the current lower thesis.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.