Will Bulls Break Through or Face Rejection?

Ethereum recently experienced a strong purchase interest after crossing certain key resistance levels. Its domination of the market increases, especially now that Bitcoin has rebounded above $ 85,000. In addition to this, several indicators on chain show positive signs, suggesting a growing bullish dynamic as Ethereum moves near a line of downstream resistance. However, a drop in the interests of whales could change forecasts.

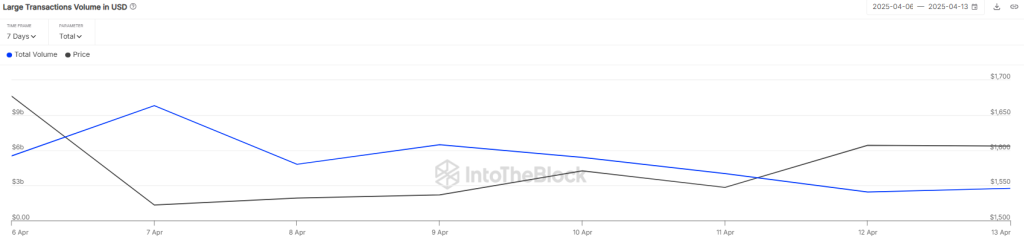

The large volume of transaction of Ethereum decreases

Ethereum recently experienced increasing purchasing interests, its price increasing by almost 6% in last week. According to Correglass data, around $ 82.8 million in trading posts in Ethereum have been liquidated, buyers losing around $ 43.5 million and sellers approximately $ 39.2 million.

Last week, ETH fell to its lowest point since March 2023. However, a break in the prices helped the price to recover slightly. However, this recovery was not sufficient to strengthen the confidence of investors. Glassnode data shows that the number of portfolios holding at least $ 1 million ETH has dropped considerably this year, reaching the lowest level since January 2023. This indicates a drop in interest in richer investors.

According to intotheblock data, the volume of large transactions Ethereum has dropped considerably. The activity of whales went from a peak of $ 9.81 billion to only $ 2.75 billion, showing a clear drop in the interests of major investors. A recent activity supports this trend – on April 14, a whale moved 20,000 ETH (worth around 32.4 million dollars) to Kraken exchange, probably in preparation for the sale.

Read also: Cardano Price Prediction 2025, 2026-2030: Will Ada Price have reached $ 2?

Adding to pressure, a chain analyst said that an Ethereum ICO 2015 investor had always sold. On April 13, this whale sold 632 ETH, worth around $ 1 million.

Meanwhile, the feeling of the market remains mixed and the open interests of Ethereum (the total value of current derivative contracts) dropped by 1.16%, now in around $ 17.91 billion. This drop in open interest could slow down Ethereum’s recovery and increase the chances of a short -term decline.

What is the next step for the ETH price?

Ether bounded from the key level of $ 1,500, because the sellers find it difficult to push the price below. Buyers are now focusing on maintaining the price above a descending resistance line to strengthen the current bullish momentum. Currently, ETH is negotiating about $ 1,640, up more than 2% in the last 24 hours.

The moving averages point upwards and the RSI is in positive territory – two signs that buyers currently have the advantage. If they can maintain the price above the descending resistance line, the ETH could make a strong movement towards the significant level of $ 2,000 in the coming hours.

On the other hand, if the sellers want to regain control, they will have to push the price below the EMA20 trend line. If this happens, Ether could drop to $ 1,384 – a key support level. A break below which could point out a short -term change in the momentum in favor of bears.