Will CPI Data Trigger a Crypto Crash?

The wider market of cryptocurrencies is up in the past three days due to several optimistic factors, including a positive report on American jobs and a new restart of trade discussions between the United States and China. This created a recovery path from Thursday’s flash crash.

However, this optimism should have a short lifespan, because big shooting cryptos like Bitcoin (BTC), Ethereum (ETH) and Ripple’s XRP are at serious risk this week which could display similar movements like Thursday, June 5.

These results are planned as American-Chinese commercial discussions on Monday in London, which is considered a very volatile catalyst, with the potential to cause net movements.

Another most critical factor to monitor is Wednesday IPC data, which is crucial for the feeling of the market.

A Bloomberg survey suggests that inflation has probably increased in May due to prices. If the report shows a higher number than expected, it could trigger a lower decision, attenuating the feeling of the cryptography market by indicating a slowdown in consumption expenses.

Conversely, if the IPC is lower than that expected, this could lead to significant gains for cryptocurrencies and altcoins.

$ 112,000 at Bitcoin prices this week?

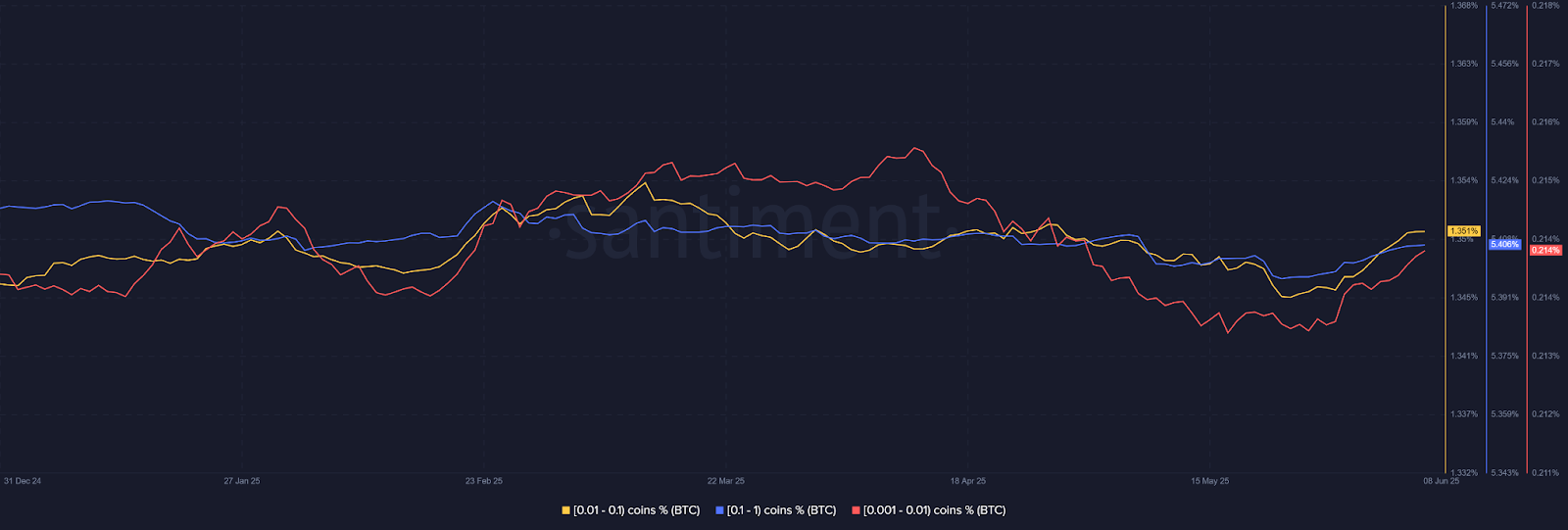

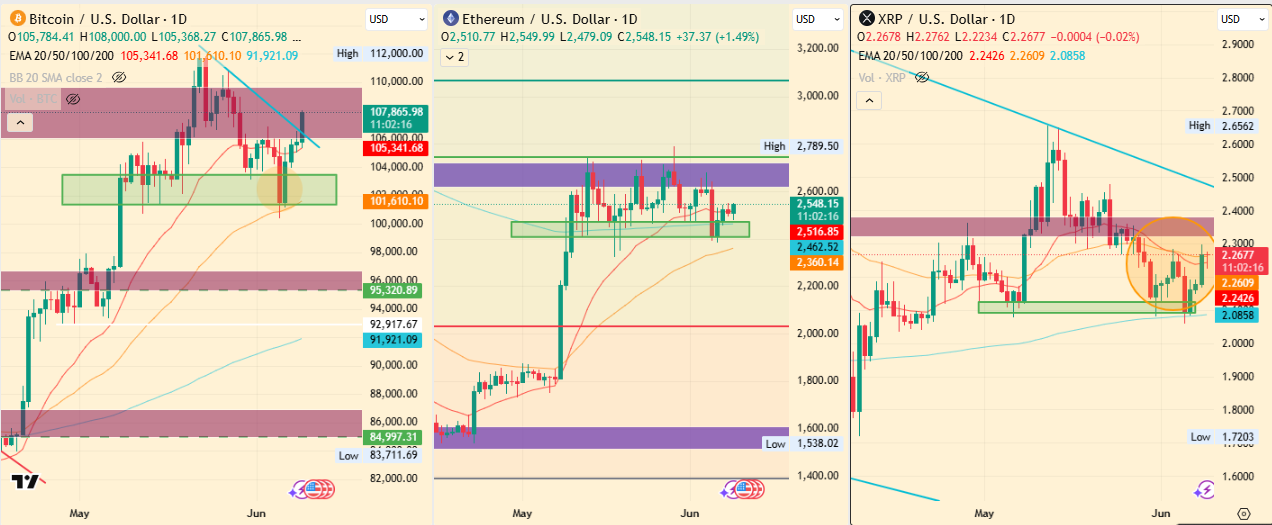

The price of Bitcoin Hands exchange at $ 10,7663, and he recovered after taking support from the dynamic EMA band of 50 days. He broke the short -term decreasing trend line and heads directly to the $ 112,000 bar.

If the momentum continues and the upcoming American CPI reports join the favor, then an ATH could be on its plate. Many experts hope that inflation prints gentle, because the current momentum seems strong and seems that Bitcoin is not yet finished.

However, the trufflation of the platform stresses that inflation can fall back, because in May, it started with 1.35% and at the end of the month, it was 2.06%. If CPI prints similar to what the data project, then the current momentum could be short -lived and may risk falling around $ 100,000 or even $ 95,000.

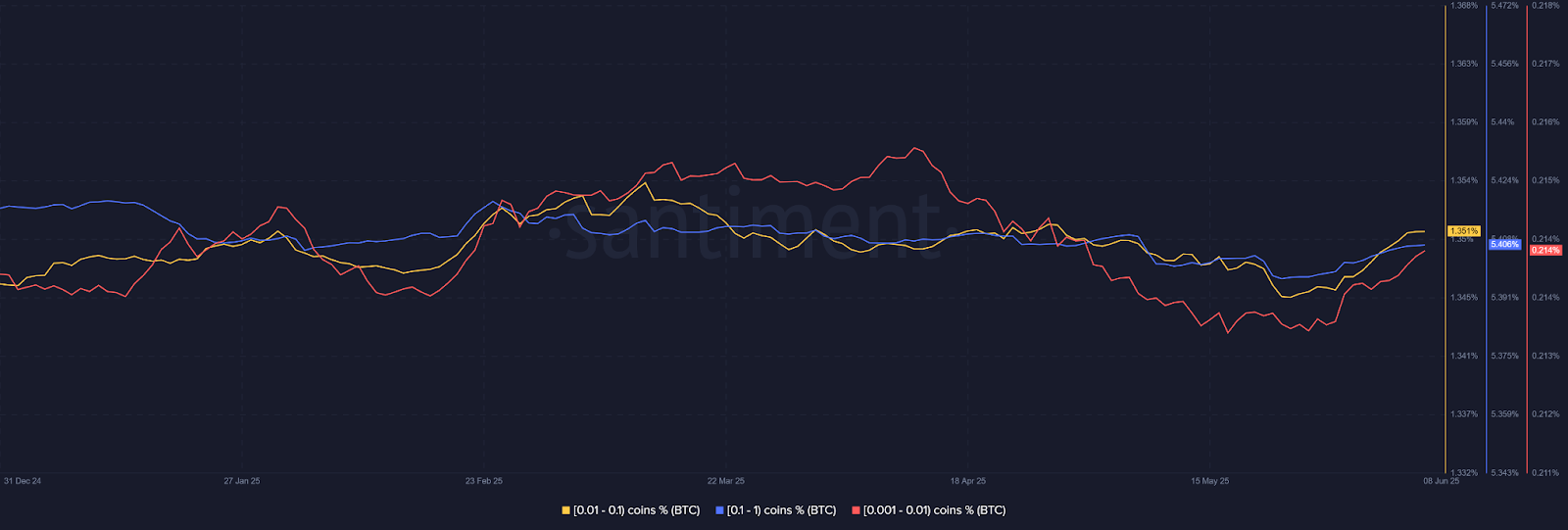

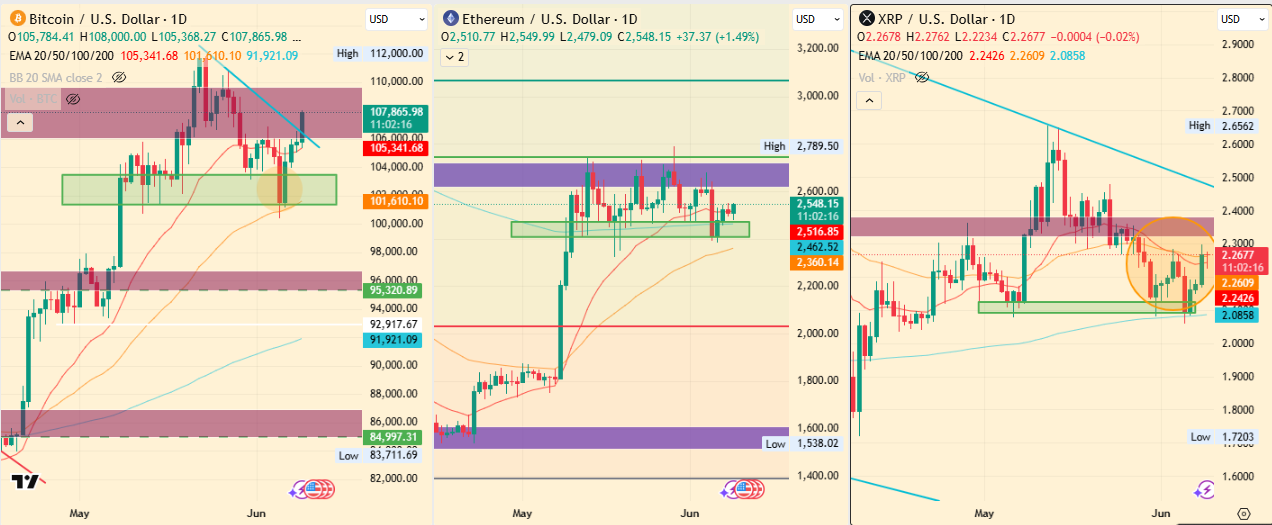

In addition, chain data revealed a worrying trend: small wallets, holding up to 1 BTC, have accumulated strongly. Historically, when holders of “small fish” buy with conviction, this often suggests that whales could prepare to sell in this liquidity. This retail FOMO is considered by many as a fatal warning sign that a sale could be on the way.

How should XRP and ETH operate this week?

Over the past three days, the increase in Bitcoin prices has also increased Altcoin prices. Even XRP and Ethereum increased 8% and 6% respectively.

However, gains are not enough to erase their limited distribution area; XRP and ETH prices face key obstacles. If the IPC increases, then a drop in the two prices of Altcoin seems likely, but if the IPC becomes soft, it could be a short -term catalyst to erase their nearest obstacles.

If the XRP price manages to increase, then $ 2.65 is the goal of this week, and for the Ethereum price, it is $ 3066. Right down, XRP could fall to $ 1.80 and ETH to $ 2,000, respectively.

Never miss a beat in the world of cryptography!

Stay in advance with the news, expert analysis and real -time updates on the latest Bitcoin, Altcoins, DEFI, NFTS, etc. trends

Faq

As of June 9, 2025, the global market capitalization of cryptography was around 3.46 billions of dollars, with slight fluctuations today. Bitcoin is negotiating $ 105,000 at $ 106,000, and several altcoins like ICP and XRP display a positive movement.

Trade negotiations can mitigate investor fears, resulting in stable cryptography prices or stimulate bitcoin if tensions increase.

According to the BTC price forecasting of Coinpedia, the Bitcoin price could peak at $ 168,000 this year if the haus feeling suffered.

According to our prediction of ETH 2025 prices, the price of the ETH could reach a maximum of $ 5,925.

Yes, XRP remains a promising investment of 2025 due to fundamental solids, the use of stables and potential FNB lists.