Will Ethereum Price Hold the Line at $2,400 or Sink Deeper?

The cryptography market has struck rough waters, triggering widespread sales and massive liquidations. According to Coinglass, the company has seen $ 458.61 million liquidated in the last 24 hours only. Ethereum was the hardest shot, representing $ 170.78 million in liquidations, including $ 157.03 million in long positions and $ 13.75 million from shorts. This highlights increasing uncertainty and volatility, leaving traders on the short -term price of the cliff and ETH. However, this ETH price analysis is derived to erase all the mist.

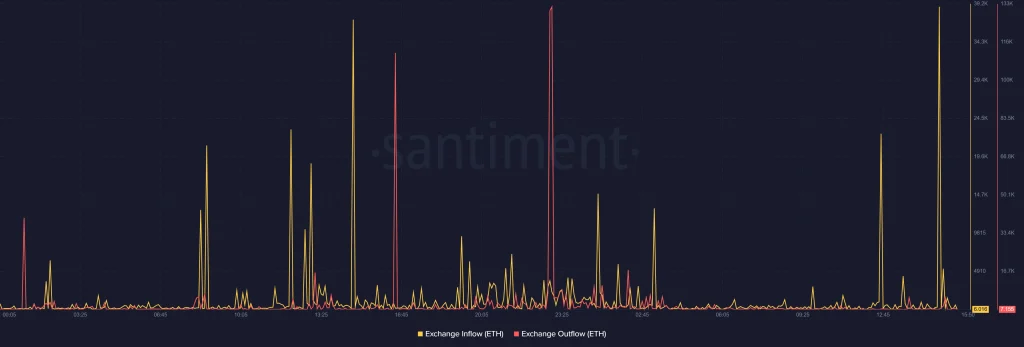

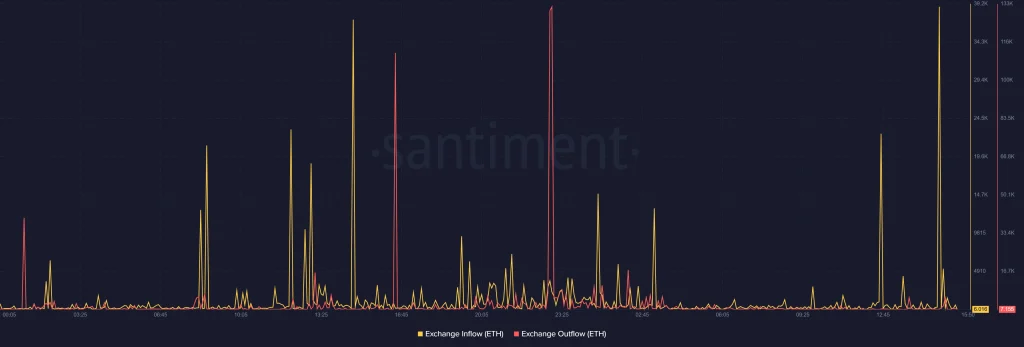

Exchange the peak entries:

The data on the santly chain paints a down -to -date image. The ETH flows into centralized exchanges at an unusually high rate, unfolding the flows. This thrust generally points out that holders are preparing to sell, which aligns the liquidation wave which has just struck Ethereum. The magnitude of these entries implies a sale of panic or an aggressive profit.

It is a question of noting that such behavior changes often come before the downward pressure unless the interest of strong purchase. Until the exchange entries are reduced, the price of Ethereum should remain under intense sales pressure. This metric suggests a short -term low -term feeling overlooking the market, demanding the prudence of ETH bulls.

Ethereum price analysis (ETH):

At the time of the press, Ethereum changed hands at $ 2444.01, down 4.15% in the last 24 hours. However, the net increase of 44.75% of the negotiation volume to $ 20.99 billion indicates a significant activity, probably driven by volatility triggered by the liquidation.

From a technical point of view, ETH RSI is 40.29, oscillating just above the territory of occurrence, which can suggest a short-term rebound. Supporting this, the 4 -hour graph shows that ETH rebounded in the Bollinger strip less than $ 2,371, forming an upper hammer -shaped candle, which signals the support of buyers at lower levels.

However, the ETH remains under the SMA of 20 periods, reflecting the bearish momentum. For a recovery, the bulls must recover the resistance of $ 2,495. If this level does not hold, ETH could again test the support area of $ 2,400.

Read our prices prediction Ethereum (ETH) 2025, 2026-2030 for long-term objectives!

Faq

The drop in the prices of Ethereum is mainly driven by an increase in liquidations and heavy entries to exchanges.

Caution is notified to traders, while ETH shows that the signs of short -term support for buyers, the techniques remain lowering and the exchange entries are high, alluding to more volatility to come.

The key support is $ 2,400, while the resistance is nearly $ 2,495.