Will Holders Trigger Strong Selloff?

Ethereum (ETH) has shown signs of cooling volatility after failing to break the level of resistance of $ 4,000 during the weekend. Despite a strong momentum earlier this month, the price was firmly rejected near this psychological level, which raises concerns concerning a potential sale. This is due to the weakening of the purchase pressure and low volatility, according to data on the chain. Some traders consider rejection as a signal for making profits, in particular after the regular rise of ETH in recent weeks.

Ethereum’s volatility drops below 50%

In the past 24 hours, Ethereum (ETH) has seen a peak of price swings. According to CorciLass, approximately $ 124.5 million in ETH posts were liquidated, also affected buyers and sellers.

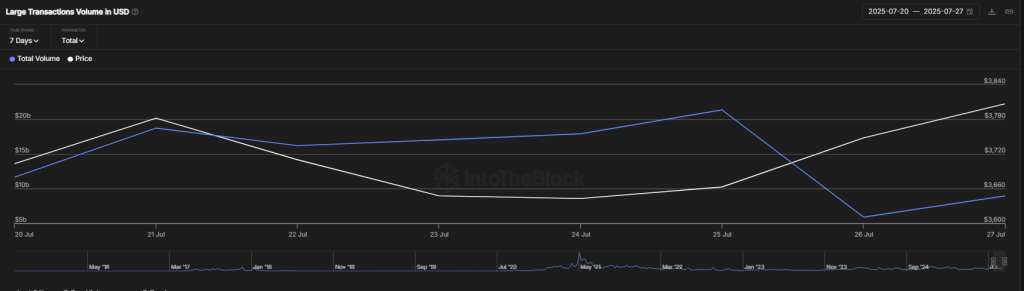

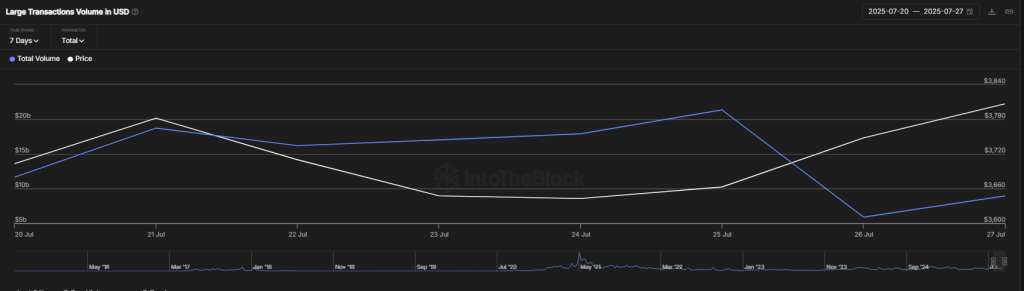

The drop in prices came after a period of low volatility. Intotheblock data show that Ethereum’s volatility increased from a maximum of 53.9% to 47.6%. At the same time, the activity of large investors or “whales” has decreased. The total value of significant transactions fell sharply by $ 21.3 billion to $ 5.9 billion in just one week.

This slowdown in key measures has reduced the purchase interest. Fewer long -term holders add to their positions, and many are already sitting on profits, which makes them more likely to sell.

Despite this, the ETHEREUM ETF ETF have had strong entrances. Just on July 25, they recorded $ 452 million in positive Netflows – the 16th consecutive day of gains in July.

The institutional interest remains high, supported by companies focused on Ethereum and their market performance. This suggests that if retail investors can cool, institutional demand could help generate long -term ETH ETH.

Thus, although the short -term purchase has slowed down and volatility has dropped, the situation as a whole always points to an optimistic perspective for Ethereum in the coming days.

What is the next step for the ETH price?

Ethereum (ETH) meets a strong resistance of sellers around the level of $ 4,000. However, it is a good sign that buyers do not give up much land. During the editorial staff, the price of the ETH is negotiated at $ 3,807, down more than 0.37% in the last 24 hours.

When a price remains close to a difficult level of resistance without falling a lot, it often means that a break could happen. If ETH exceeds $ 4,000, it can push higher and test the following main level at $ 4,100. If he exceeds this, he could launch a new gathering around $ 4,900.

Leaving, the first level of support is at the EMA20 trend line. If ETH falls below, the next probable stop is about $ 3,500. Buyers will probably intervene at this level, because if it breaks, the momentum could change in favor of the sellers.

The RSI (relative force index) drops quickly and is now around 51, which gives the sellers an advantage. However, the recent drop in prices arouses many purchasing interests. If Ethereum can bounce above the level of fibonacci of 23.6%, there is a good chance that the price can come from large people.