Will It Continue to Fall or Recover?

Ethereum (ETH) spent most of February in a close price range, fighting to take momentum. However, the slowdown this week on a market scale, launched by Donald Trump’s trade policies, pushed ETH to the bottom of several months.

With the lowering feeling and having trouble resuming strength, investors wonder if March will lead to other drops or a potential rebound.

ETH is struggling as the supply grows and sells pressure media

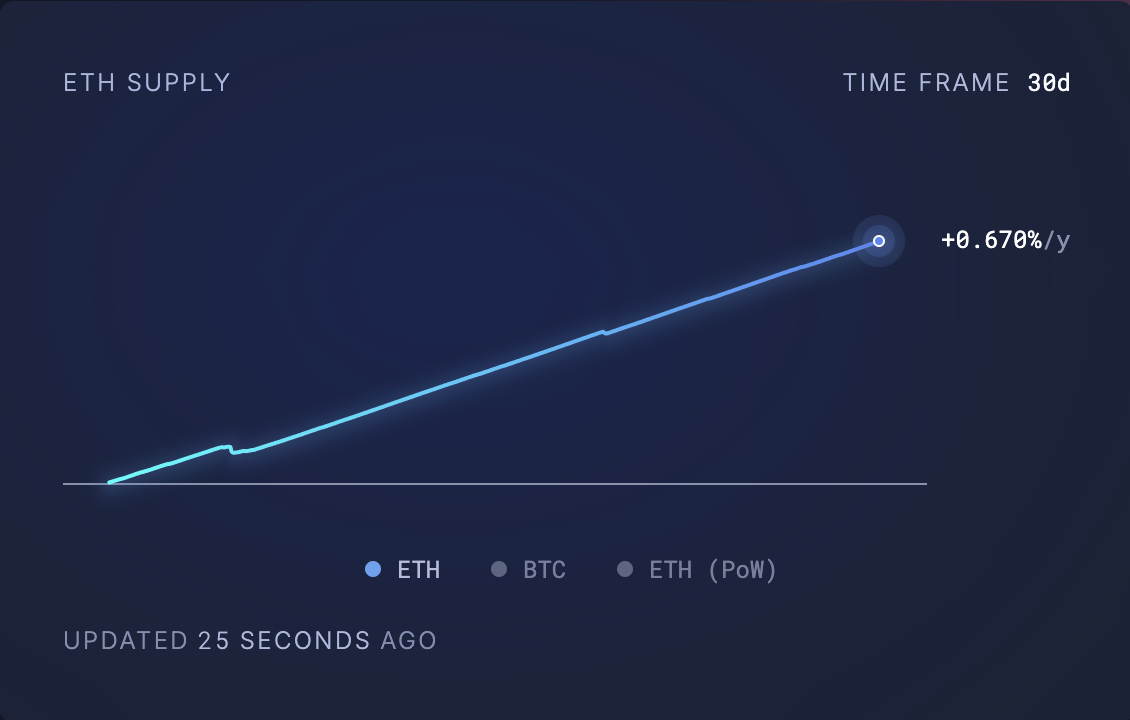

The constant increase in ETH’s circulating offer is a source of concern for market players in March. According to Ultra Sound Money, 66,350 ETH coins, valued over $ 138 million at current market prices, have been added to the circulating offer in Altcoin in the last 30 days.

When more ETH tokens go into circulation, the overall power supply available for purchase increases. If demand does not follow the pace, this increase in supply can exert downward pressure on the price of the medal as more and more tokens become available for sale.

With a lack of strong purchase interest in absorbing excess supply, this trend suggests that ETH could face a weakness sustained until March.

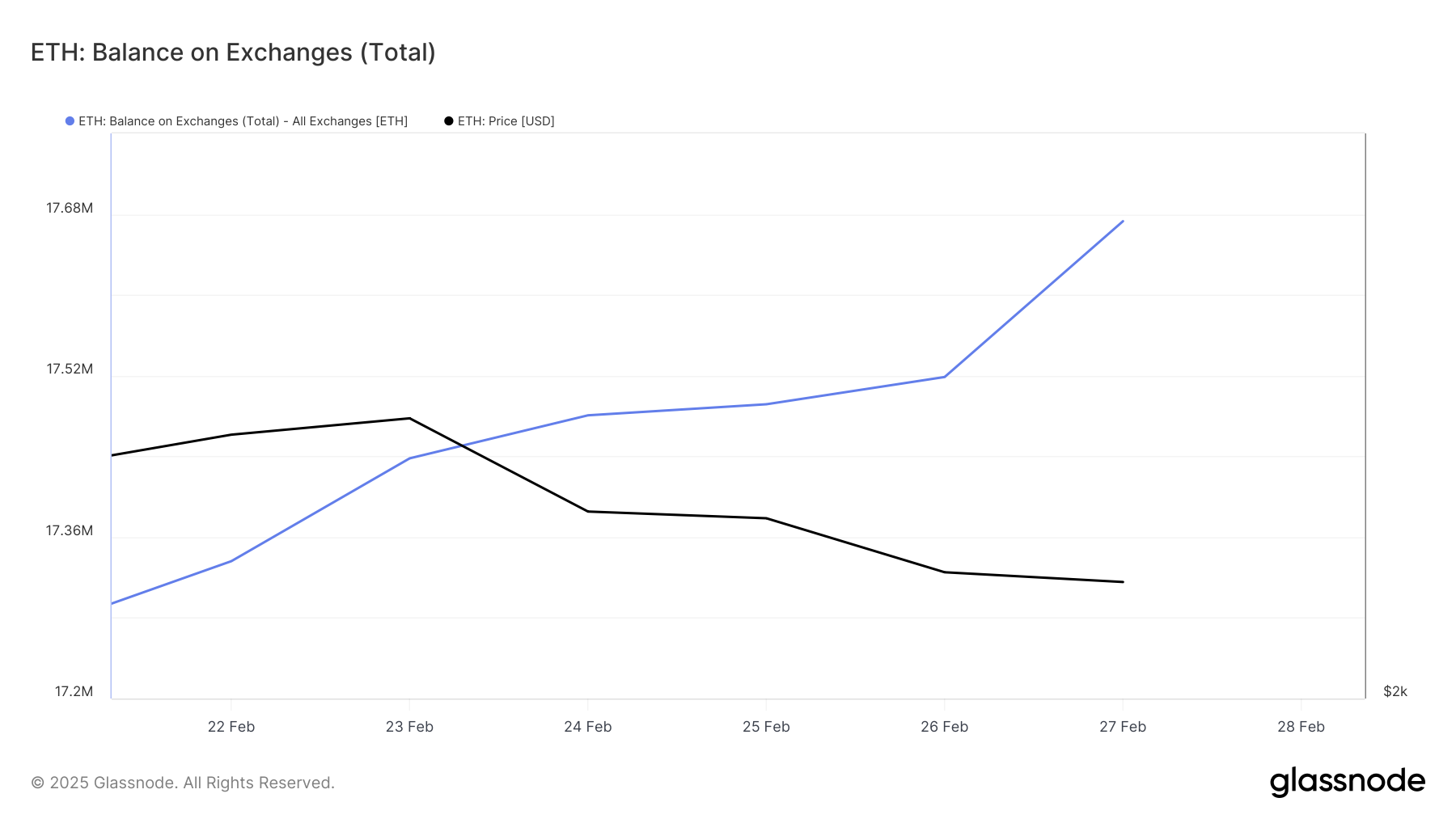

In addition, the increase in the balance of ETH exchanges is another reason to worry. After dropping at a lower of the year of 17.27 million ETH on February 21, he has since exploded. At the time of the press, 17.67 million ETH coins are held on exchange portfolio addresses, climbing 2% in the last seven days.

The exchange of ETH exchange follows the number of parts held on the exchange addresses. When this balance increases, a large quantity of eth is moved to exchanges, often pointing that holders are preparing to sell.

This increase in the liquidity of the sale added to the downward pressure on the price of the part, especially since the sales activity continues to prevail at the request for purchase. If he is supported in the coming days, he will aggravate the lowering feeling, because more and more traders will seek to unload the assets rather than accumulating, exacerbating the drop in prices.

A purchase opportunity?

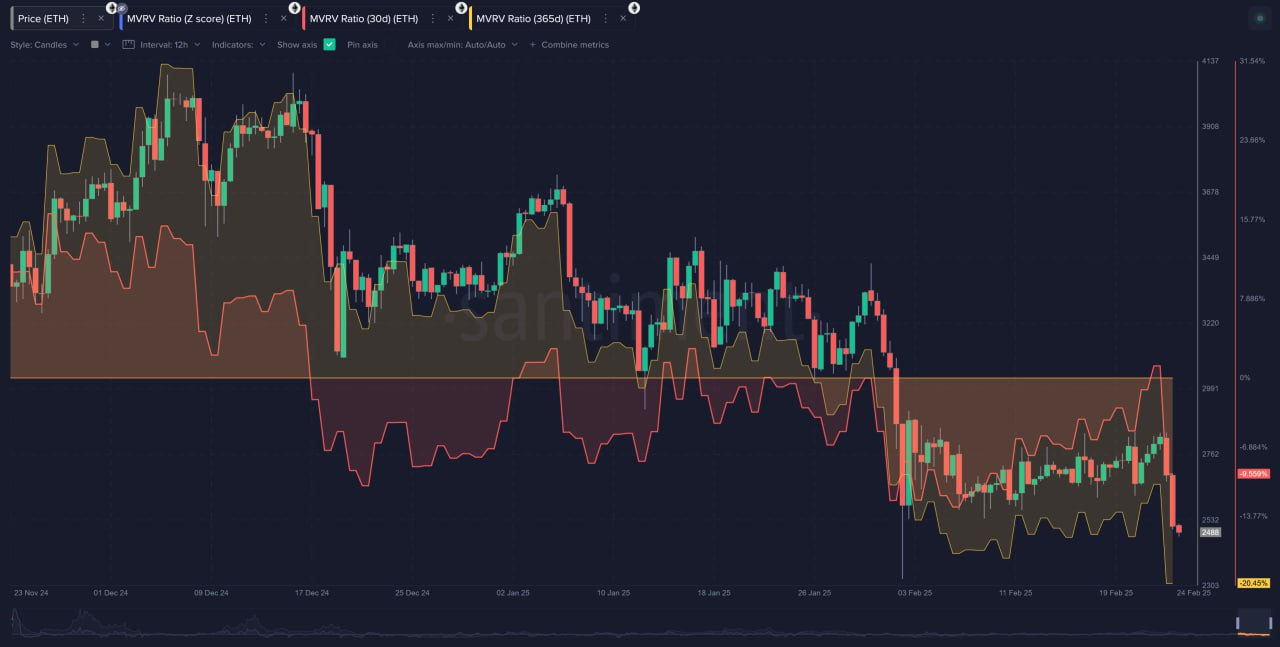

Despite ETH’s performances, some analysts think that this could present an opportunity to buy for those who seek to book gains in March. In an interview with Beincrypto, Santiment analyst Brian Quinlivan estimated that the current ETH price levels could offer an attractive entry point for long -term investors.

According to Quarlivan, short-term and long-term ETH holders are deeply in red, a condition rarely seen among the first 50 cryptocurrencies. Historically, such moments of capitulation have preceded major price rebounds, because the accumulation of large investors tends to follow heavy sales periods.

“The asset (ETH) can be one of the best performers in 2025 due to its disappointing performance in 2023 and 2024 compared to other higher alts and caps. Short -term and long -term holders for Ethereum are in the negatives, which is not the case for most TOP 50 tokens. So, to add to your position is to do it for a time of deactivation compared to the average moment of the history of the ETH, “noted Finlivan.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.