Will XRP Crash Below $2 in March? Latest Insights

XRP corrects almost 30% in the last 30 days, with its price less than $ 3 for almost a month. The Directorate Movement Index (DMI) shows a strong downward trend, the average directional index (ADX) exceeding 35, indicating an increased down dynamic.

However, a potential reversal could occur if the dry drops its trial against XRP, possibly triggering a rally to key resistance levels.

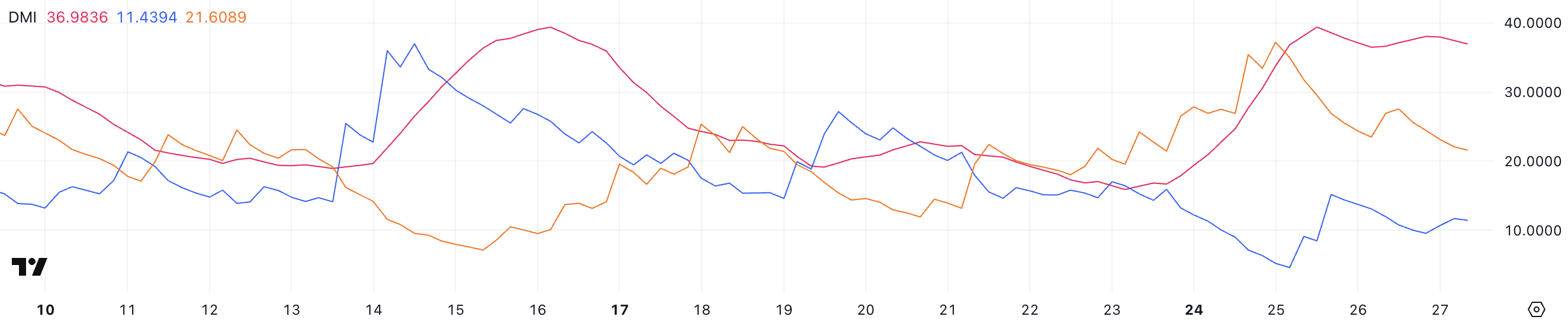

XRP DMI shows the absence of a clear direction

The XRP directional movement index (DMI) reveals that its average directional index (ADX) is currently at 36.98, a significant increase of 15.89 only four days ago.

ADX is an indicator of resistance to the trend that does not indicate the direction of the trend but measures its intensity. As a rule, an ADX value greater than 25 signals a strong trend, while a value of less than 20 suggests a low or non -resistant market.

The XRP ADX rising strongly above 35, it indicates that the current downward trend is growing.

This increase in ADX suggests that market players show a stronger conviction, making the existing trend more likely to continue.

Meanwhile, the + DI of XRP (positive directional indicator) is 11.4, down compared to a summit of 15.1 two days ago, indicating a weakening of the upward pressure. On the other hand, the -Di (negative directional indicator) fell to 21.6 of 37.2 on February 2, showing a decrease in the lower momentum.

Despite the reduction in down pressure, the -Di remains above the + DI, confirming that the downward trend is always intact. The widening gap between the ADX and the directional indicators suggests that the downward trend is strong and persistent.

Until the + di crosses the -Di, signaling a potential tendency inversion, XRP is likely to stay in a bearish phase.

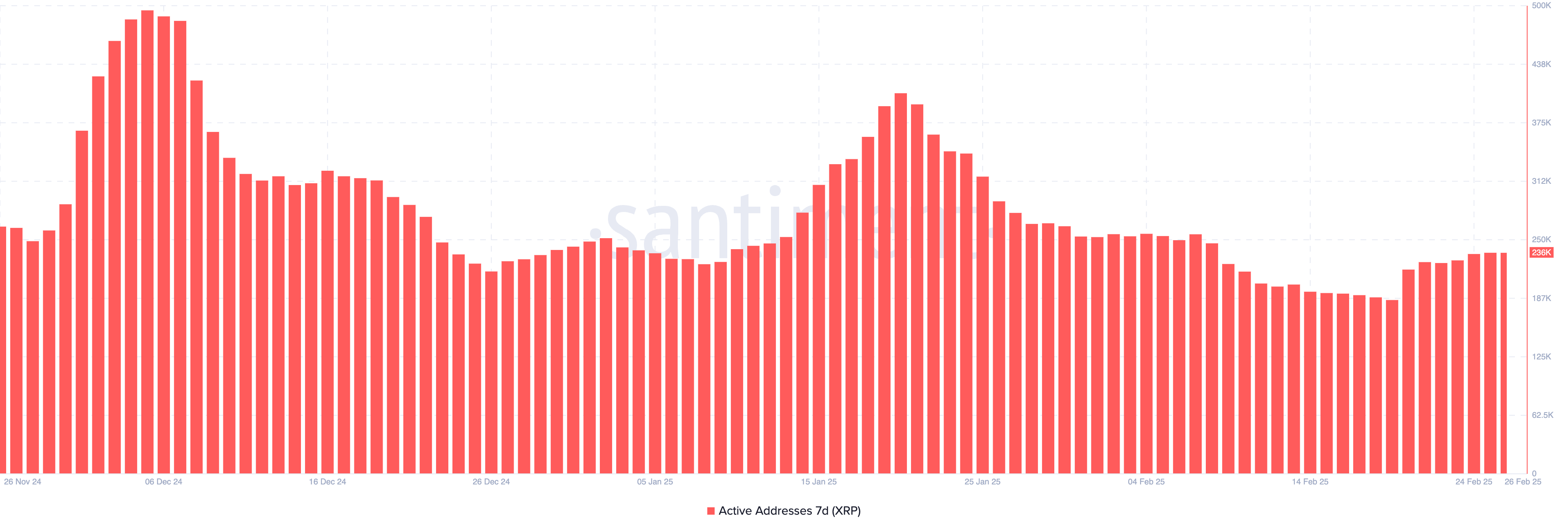

XRP active addresses recover after reaching its lowest level in 3 months

The number of 7 -day XRP active addresses increased from 407,000 on January 20 to around 186,000 on February 19, the lowest level since November 2024.

This metric is important because it measures user engagement and network activity, reflecting XRP demand. A decrease suggests a reduction in interest and a lowering feeling, while an increase indicates increasing participation and potential purchase pressure. The net drop reported interest in decreasing investors, contributing to the lowering XRP perspectives.

Recently, XRP active addresses began to recover, reaching 236,000 – up 26.8% last week. This increase suggests an increasing user activity and a renewal of interest in the network.

Historically, the increase in active addresses can precede pricing, because participation results in higher demand. If this trend continues, it could support a potential price rebound, but sustained growth is necessary to confirm a bullish change.

The upward trend of XRP depends largely on the dry and Ripple trial

XRP EMA lines are currently showing a lower configuration, with short -term lines below those in the long term. The price has been negotiated below $ 3 since February 1.

This alignment suggests a continuous decline, because the shorter EMAs reflect a recent lowering feeling. If the downward trend persists, XRP could test two solid levels of support at $ 2.15 and $ 2.06.

If these are lost, the XRP price could fall to $ 1.77, lowering below $ 2 for the first time since November 2024.

However, a trend reversal is possible, especially if the dry drops its trial against XRP in March. Recently, the SEC has abandoned cases against Gemini, UNISWAP, Robinhood and Coinbase, signaling a change in regulatory pressure.

If the trial is deleted, it could trigger an upward trend, with XRP test resistances at $ 2.36 and $ 2.52. If these levels are broken, XRP could continue to increase around $ 2.71, which can potentially reverse the downward perspective.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.