WLFI Co-Founder Sued Over Dough Hack Reimbursement

According to a new report, the co-founders of World Liberty Financial (WLFI) Chase Herro and Zak Folkman have not reimbursed their customers of their last startup, finance, after a hacking of $ 2.5 million.

Herro is currently being continued by a paste investor to recover his lost assets. World Liberty is perhaps a Trump family project, but none of the Trumps has nothing to do with this incident. Hopefully this detail will encourage easy settlement.

The co-founder of WLFI continued to hack the dough

The cryptography industry has seen many world -renowned hacking incidents, but minors can suddenly resurface unexpectedly.

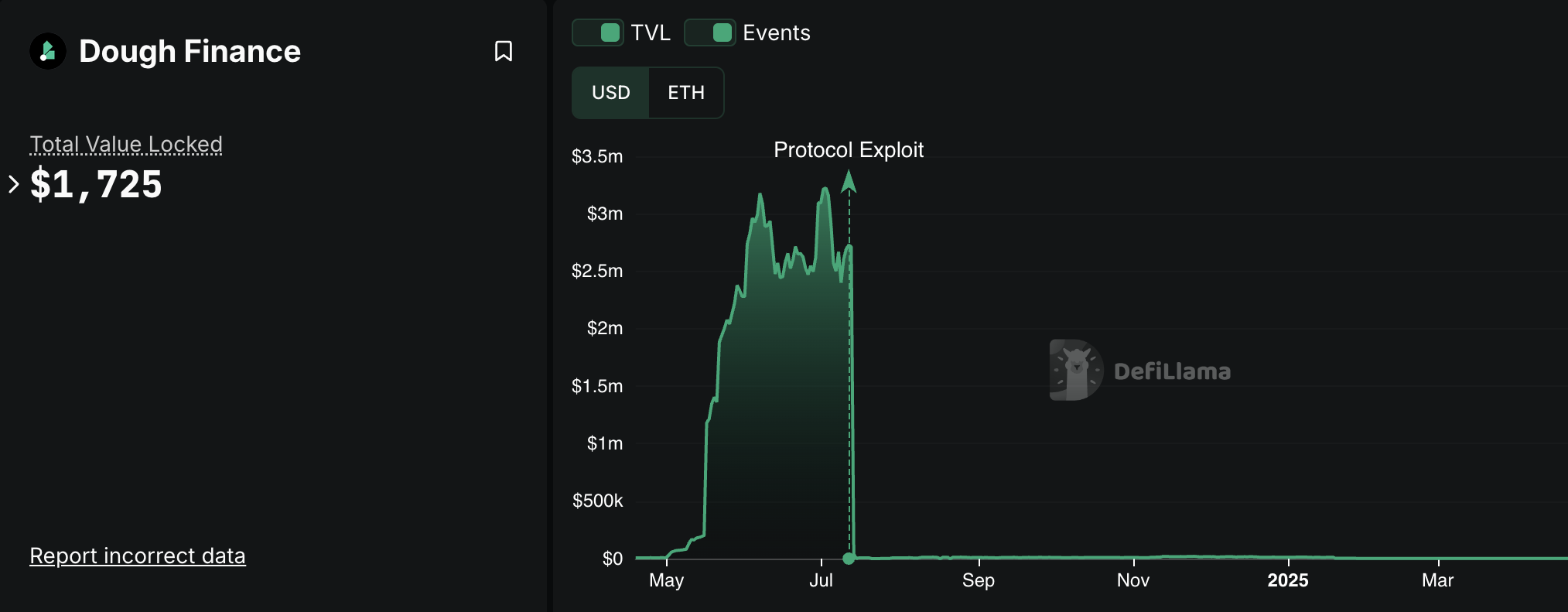

Today, Reuters Called attention to a violation of July 2024 against the finance of the dough which led to a loss of $ 2.5 million. The company closed shortly after. After hacking, the co-founders of Dough continued to create WLFI, but investors remain at a loss:

“You – The Paste Finance Community – have adopted governance vote to make holders of tokens whole! Assé with support of 99.5%. Thank you for making your voice heard. The team is now working on the distribution of funds – seated upon updates! ” The dough displayed a month after hacking. It was his last public declaration, since remaining since.

Shortly after hacking, the Dough team recognized its errors, which allowed the flight. They recovered $ 280,000, of which $ 180,000 was apparently delivered to former creditors.

However, since the co-founders of Dough then created WLFI with Zack Witkoff, there were no new developments.

Various Crypto projects by Donald Trump, World Liberty Financial is currently attracting the most buzz. Between the main partnerships and political controversies, the new company of Herro and Folkman makes the headlines and serious profits.

Regardless of personal opinions, the company was certainly a major success.

Why, then, have the co-founders of WLFI not reimburse their former donors to the dough? Last Friday, World Liberty invested $ 3 million in the EOS tokens, a figure that exceeds the losses of hacking.

USD1 WLFI has a market capitalization of more than $ 2 billion; A reimbursement of $ 2.5 million is practically a change of spare alongside this. What is the Holdup?

This question is at the center of a trial brought by a former paste investor against the founder of WLFI Chase Herro. Reuters Affirms that the applicant, Jonathan Lopez, targets only Herro, not folkman or WLFI as a whole.

Since the hacking of July 2024, users have mainly received reimbursements in paste tokens, which are practically worthless in 2025:

Currently, the test date of the prosecution is only scheduled for April 2026. Hopefully the co-founders of the WLFI will conclude a settlement with the creditors of Dough before this happens.

Whatever happens, the WLFI can be a Trump family project, but none of the Trumps has a link or responsibility for this incident. This can encourage Herro and Folkman to easily solve the problem.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.