World Liberty Financial Token2049 Announcements

The world of the Trump Liberty Financial family (WLFI) continues to make the headlines, extending its scope in the crypto arena. Recent developments follow key announcements during the Token2049 in Dubai.

Eric Trump made interesting revelations during the event, including integrations involving a stablecoin USD1.

World Liberty Financial in 2049: what users need KnoW

Speaking during the Token2049 event, Eric Trump announced the integration of the Stablecoin USD1 from World Liberty Financial with Tron.

Trump’s Defi Venture launched the Stablecoin USD1 recently by ordering it to promote the domination of the dollar. Short -term US Treasury bills and cash equivalents support Stablecoin.

Notwithstanding this integration, USD1 will be deployed in the form of a TRC-20 token on the Blockchain Tron. This would allow USD1 to take advantage of the high -speed and low cost blockchain for transactions, intelligent contracts and DEFI applications.

Consequently, integration extends the interoperability of the USD1 stablecoin beyond the intelligent BNB (BSC) and Ethereum.

Despite the severity of this integration, this decision is not surprising given the recent links between World Liberty Financial and the founder of Tron Justin Sun.

As Beincrypto reported, Justin Sun has invested up to $ 30 million in the DEFI company, actually becoming the largest investor of the project. Following this investment, the project appointed him adviser, stressing his leading role in the innovation of the blockchain.

Recent reports indicate that Justin Sun could attend President Trump’s exclusive dinner for the best holders of Trump next month. Speculation occurs while the HTX cold storage portfolio is ranked first in the Trump ranking, adding publications on social networks to the mystery.

USD1 Stablecoin to conclude an agreement of $ 2 billion

Another interesting revelation during the Token2049 is that the World Liberty Financial USD1 is the stablecoin choice for the investment of $ 2 billion from MGX in Binance.

In March, MGX, a sovereign heritage fund of Abu Dhabi, undertook to invest $ 2 billion in the exchange of binance using stablecoins.

“MGX, a sovereign heritage fund of Abu Dhabi, invests $ 2 billion in Binance for a minority participation. The transaction will be 100% in crypto (Stablecoins), marking it the largest investment transaction made in crypto to date. wrote Changpeng Zhao (CZ), founder of Binance and former CEO.

With USD1 ascending to become the choice of shock in this historic investment, he underlines the increasing adoption and legitimacy of the token. The funds will see MGX ensure participation in Binance, becoming one of the first institutional investments in the greatest exchange in the world.

In particular, this revelation only occurs a few days after the leaders of World Liberty Financial met Changpeng Zhao in Abu Dhabi. They would have discussed the standardization of cryptographic industry and the strengthening of global adoption efforts.

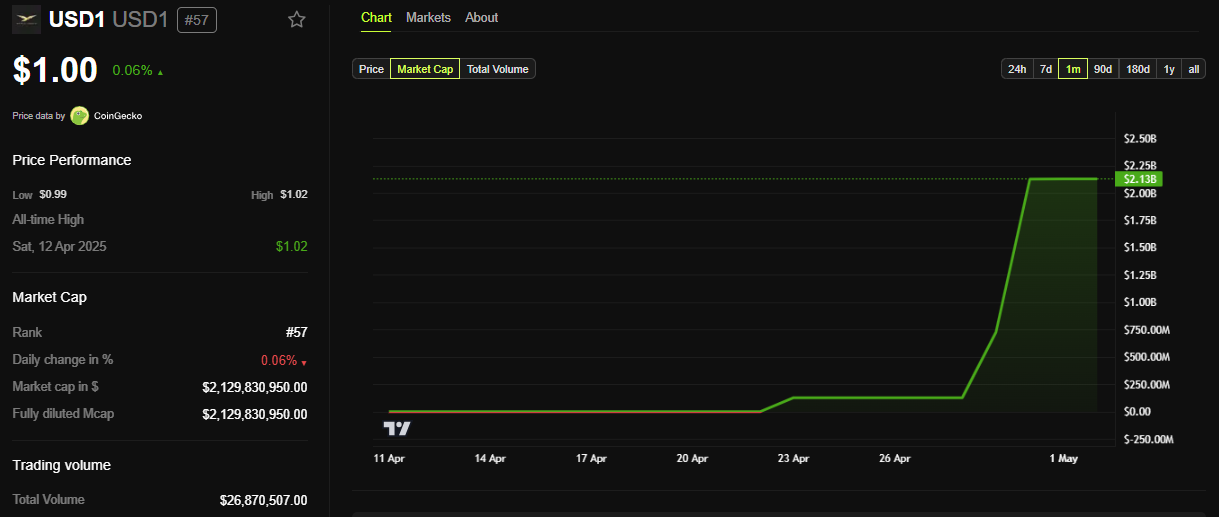

Meanwhile, in the midst of these revelations around the DEFI company, the data show that the stablecoin USD1 exceeded $ 2 billion in market capitalization measures.

This positions it as one of the stable stables for the fastest growth since its launch in March.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.