Wormhole (W) Jumps 10%—But Is a Pullback Coming?

Wormhole (W) jumped almost 12% Thursday after the project has unveiled its official product roadmap. The one -year birthday of the project sparked speculative interviews.

However, technical data show that buyers and sellers are locked in a fierce battle, because Momentum indicators suggest a weakening trend. The DMI, Ichimoku Cloud and Ema structures all reflect the indecision of the market, without any confirmed clear direction.

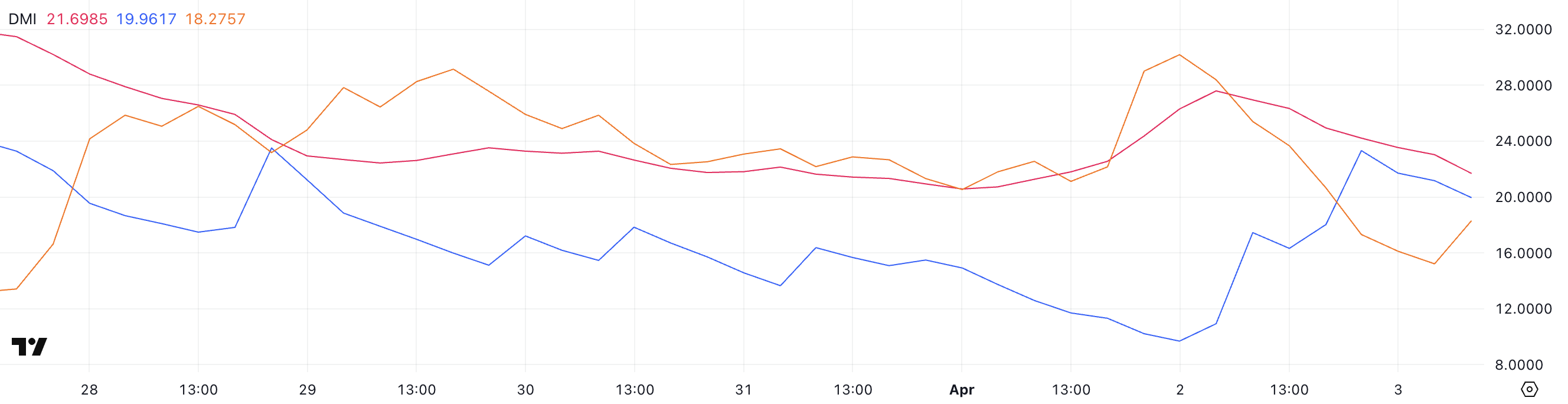

The DMI graph with green holes shows market indecision

Wormhole’s DMI graph shows that its ADX (average directional index) fell to 21.69 from 27.59 a day earlier, indicating that the recent trend could lose strength.

ADX is a key indicator used to measure resistance – not the direction – of a trend. Generally, the values less than 20 suggest a low or non -existent trend, while the values greater than 25 indicate a strong trend.

With ADX which now hovers near the threshold, it suggests that the bullish momentum seen in recent days could discolor.

Looking more deeply, the + DI (positive directional indicator) fell to 19.96 after peaking almost 24 earlier, although it jumped 9.68 the day before.

Meanwhile, the -Di (negative directional indicator) increased to 18.27 after falling at 15.21 earlier, after a sharp drop of 30.18 yesterday. This narrowing gap between + di and -Di – combined with a weakening ADX – subjects uncertainty and potential indecision in price action.

With an unlocking of $ 137.64 million on the horizon token, this change could refer to an optimistic impulse and the risk of renewed sales pressure if the supply wins over demand.

The Ichimoku cloud shows mixed signals

Wormhole’s Ichimoku clouds show a mixed perspective. Price action tries to unravel the resistance but still faces notable opposite winds.

Tenkan-sen (Blue Line) recently flattened and is closely aligned with the Kijun-Sen (red line), the signaling of indecision or a potential break in the momentum.

As a rule, when these lines are flat and close together, this indicates consolidation rather than a continuation or a clear trend reversal.

Meanwhile, the Kumo (cloud) remains thick and red, reflecting strong resistance to general costs and a long -term lower bias.

The price oscillates near the lower edge of the cloud, but has not yet made a decisive movement above him – suggest that this bullish impulse is at best provisional.

For a confirmed trend reversal, a clear break above the cloud with bullish multisgments would be necessary. Until then, the graph is pointing towards a market always trying to find a direction, in particular before a major token unlocking event which could have an impact on the feeling and the action of the prices.

Will Wormhole recover $ 0.10 in April?

Wormhole, which builds solutions around interoperable bridges, continues to see its EMA configuration reflect a lower structure. The short -term mobile averages are always positioned below those in the longer term, an indication that the downward pressure remains dominant.

However, one of the short -term EMAs began to bend up, referring to a possible change of momentum while buyers are starting to intervene. This early increase could point out the start of a trend reversal, although confirmation is still pending.

If the bullish momentum gains ground, the green hole can try to break the resistance nearby at $ 0.089. A successful break could open the door to a movement to higher resistance levels at $ 0.108 and even $ 0.136.

Conversely, not erased $ 0.089 could strengthen the lowering control, postponing the price to test the support at $ 0.079.

A rupture below this level could expose W upon $ 0.076, $ 0.073 and potentially less than $ 0.07 – marking unexplored territory for the token.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.