XCN Traders Shift Focus as Active Addresses Plunge

Onyxcoin (XCN) has maintained its downward trajectory, falling 10% in last week while Bearish Senture seizes the market.

With more merchants turning away from Altcoin, its number of active addresses experienced a strong fall, signaling a loss of interest in assets and low participation in the network.

XCN struggles as the open sellers take control

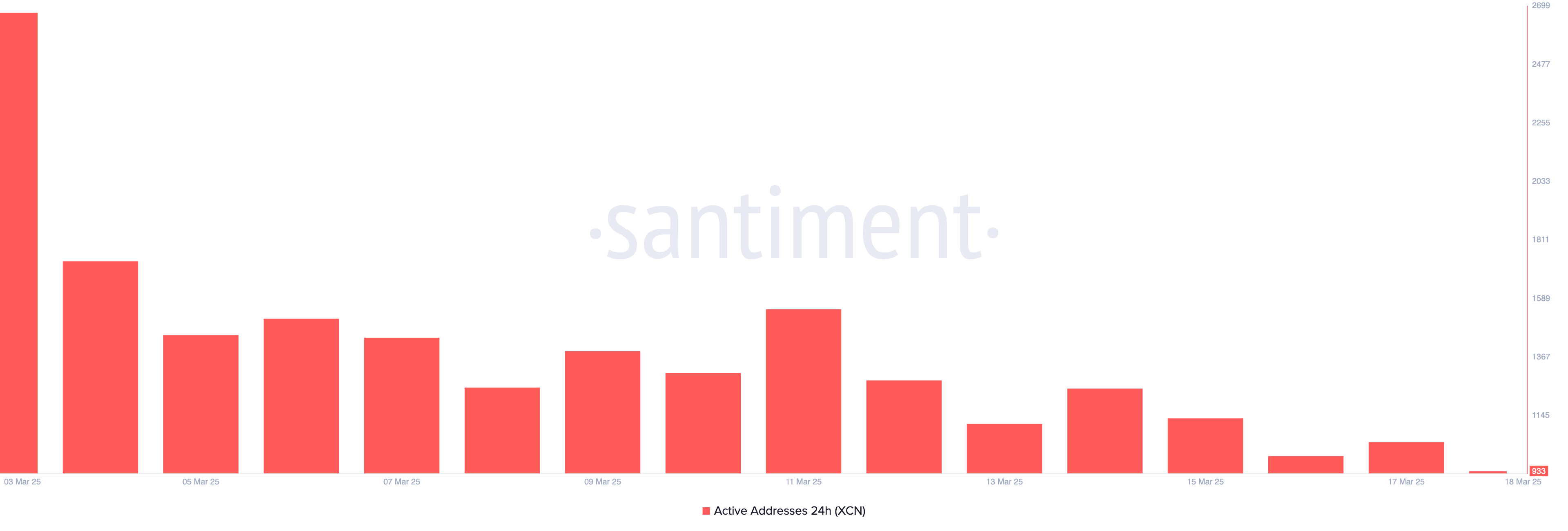

Since the beginning of March, health data has revealed an aggressive decrease in the number of daily active speeches of XCN.

According to the chain data provider, on March 3, 2,673 unique addresses made at least one transaction involving XCN. Since then, this figure has regularly decreased, reaching a hollow of 1,044 on March 18.

This decrease highlights the activity of the decreasing network on onyxcoin and reduced demand for its altcoin, strengthening the bearish feeling surrounding XCN.

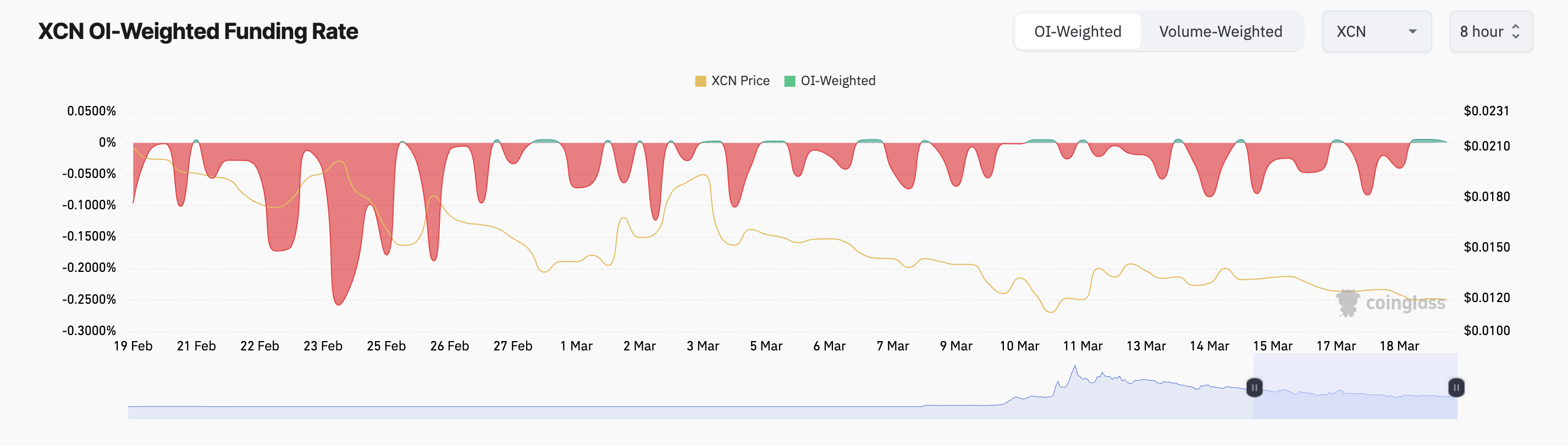

In addition, the month was marked by a significant increase in the demand for short positions, as reflected in the mainly negative financing rate of Altcoin.

The rate of financing of an asset is a periodic fee exchanged between its long and short traders in perpetual term contracts. When the funding rate is mainly negative, the open -out sellers dominate the term markets of the room.

The growing demand for XCN shorts highlights the lower market prospects. Sellers maintain control and limit any potential short -term recovery.

XCN faces a strong sales pressure

The token Silver Silver Flow (CMF) supports this downward perspective. At the time of the press, the momentum indicator is less than zero at -0.19.

The CMF indicator measures the fund in and outside an asset. When its value is negative, the sale of pressure exceeds the purchase activity. This indicates the probability of a new drop in prices because demand remains low. In this scenario, the XCN price could increase to $ 0.0075.

Conversely, the price of the token could go around $ 0.022 if buyers regain control of the market.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.