XLM Price Prediction For March 28

XLM, the native token of Stellar, draws massive attention from merchants and investors when approaching a significant drop in prices. During his recent ascending movement at the end of February and early March 2025, the asset formed a downward mountainous corner model.

XLM technical analysis and price action

Meanwhile, as the feeling of the market changes and the price continues to drop, XRP has reached a lower crucial border of its increasing corner model and now seems to consolidate. This current XLM price moment seems to lead the feeling in a downward direction.

XLM price prediction

According to an expert technical analysis, XLM is at a key level of $ 0.285, which now seems to be a brand or breaking situation for the assets. Based on the action of recent prices and historical models, if XLM does not hold this key level and closes a candle of four hours below $ 0.28, there is a high possibility that it can decrease by 15% to reach the level of $ 0.236 in the coming days.

On the other hand, if the feeling changes and the price of XLM soars, closing a daily candle above the brand of $ 0.31, it could open the way to an increased rally. The daily graph of XLM indicates that the asset is in an upward trend, because it continues to be negotiated over the exponential mobile average (EMA) on the daily time.

The moment of current XLM prices

At the time of the press, XLM is negotiated nearly $ 0.286, having recorded a price wave of 1% in the last 24 hours. However, during the same period, its volume of negotiation fell by 10%, which indicates a lower participation of traders and investors, perhaps because of the unclear feeling of the market.

Traders View Bearish

With this lower price action and the feeling of the market, traders are betting strongly in short positions.

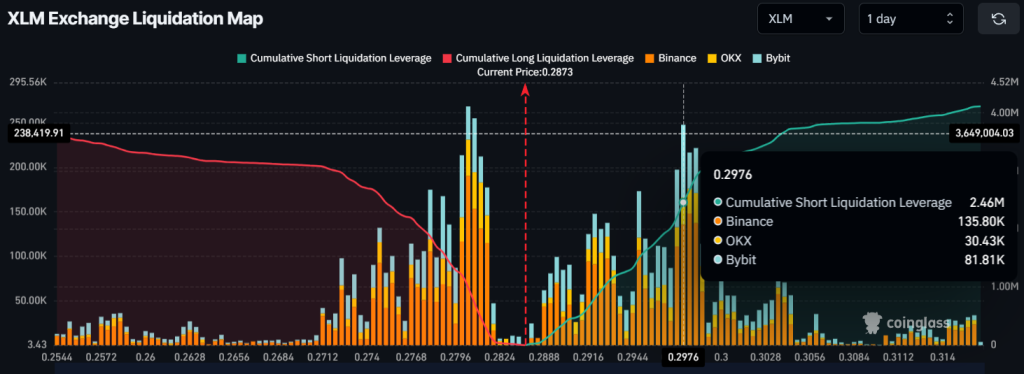

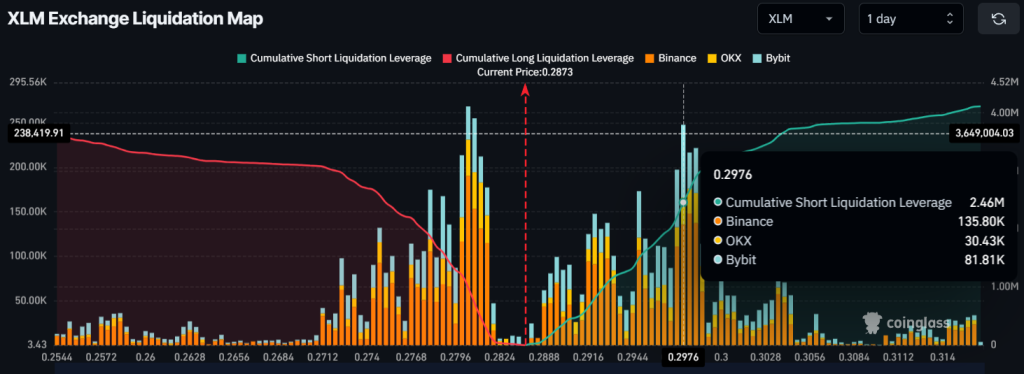

The data from the Coinglass chain analysis company reveal that the traders are currently over-deposed at $ 0.28 on the lower side, where they built a value of $ 995,000 in long positions. Meanwhile, $ 0.297 is another over-move level, traders who have built $ 2.50 million in short positions.

This clearly indicates that the feeling towards XLM remains lower among the traders, which could push the assets below in the coming days.