XRP Bears Continue to Drive Price Down, Risks Further Losses

XRP continues its decline, lowering 10% in last week while the downward momentum is strengthening.

The fourth largest cryptocurrency by market capitalization remains under pressure, with decreasing purchasing interests referring to the possibility of new losses.

XRP’s prospects worsen as the purchase pressure fades

Since he reached a summit of $ 3.40 on January 16, XRP remained mainly in a descending parallel channel. This is a lowered reason formed when the price of an asset moves between two lines of trends parallel to the decline, indicating a downward trend.

When the price of an asset is negotiated in this channel, it marks a period of decline during which sellers dominate and the purchase activity is low. This exerted a significant drop pressure on the price of XRP in the last month.

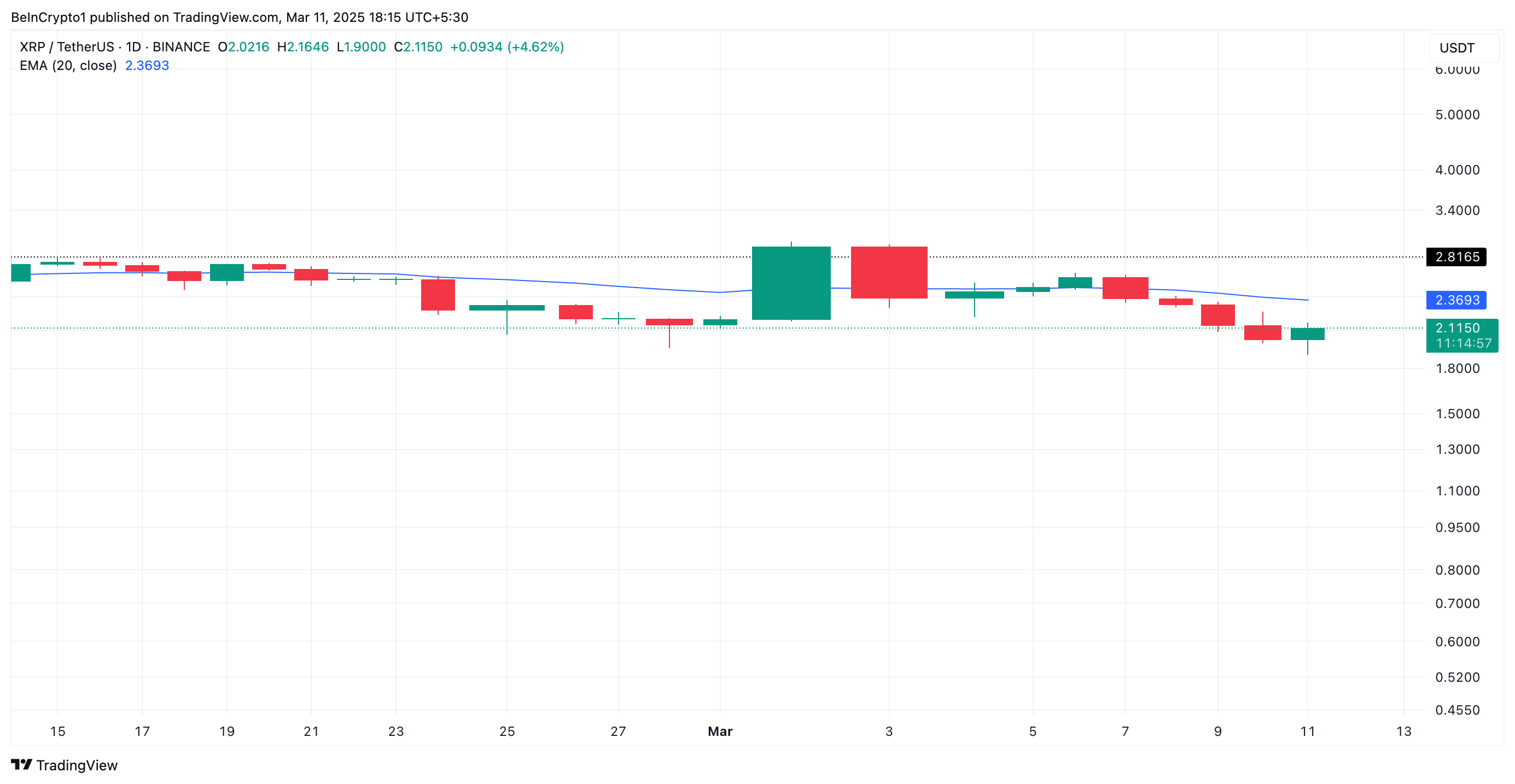

XRP is currently negotiated at $ 2.11, exchanging hands below its 20 -day exponential mobile average (EMA). This key mobile average measures the average price of assets in the last 20 days of negotiation, which gives more weight at recent prices to reflect short -term trends.

When the price of an asset falls below his 20 -day EMA, he suggests that the sales pressure is high and that the asset is in the lower phase. These signals continued to lower the momentum for XRP, unless the purchase of interest increases to postpone the price of the token above the EMA.

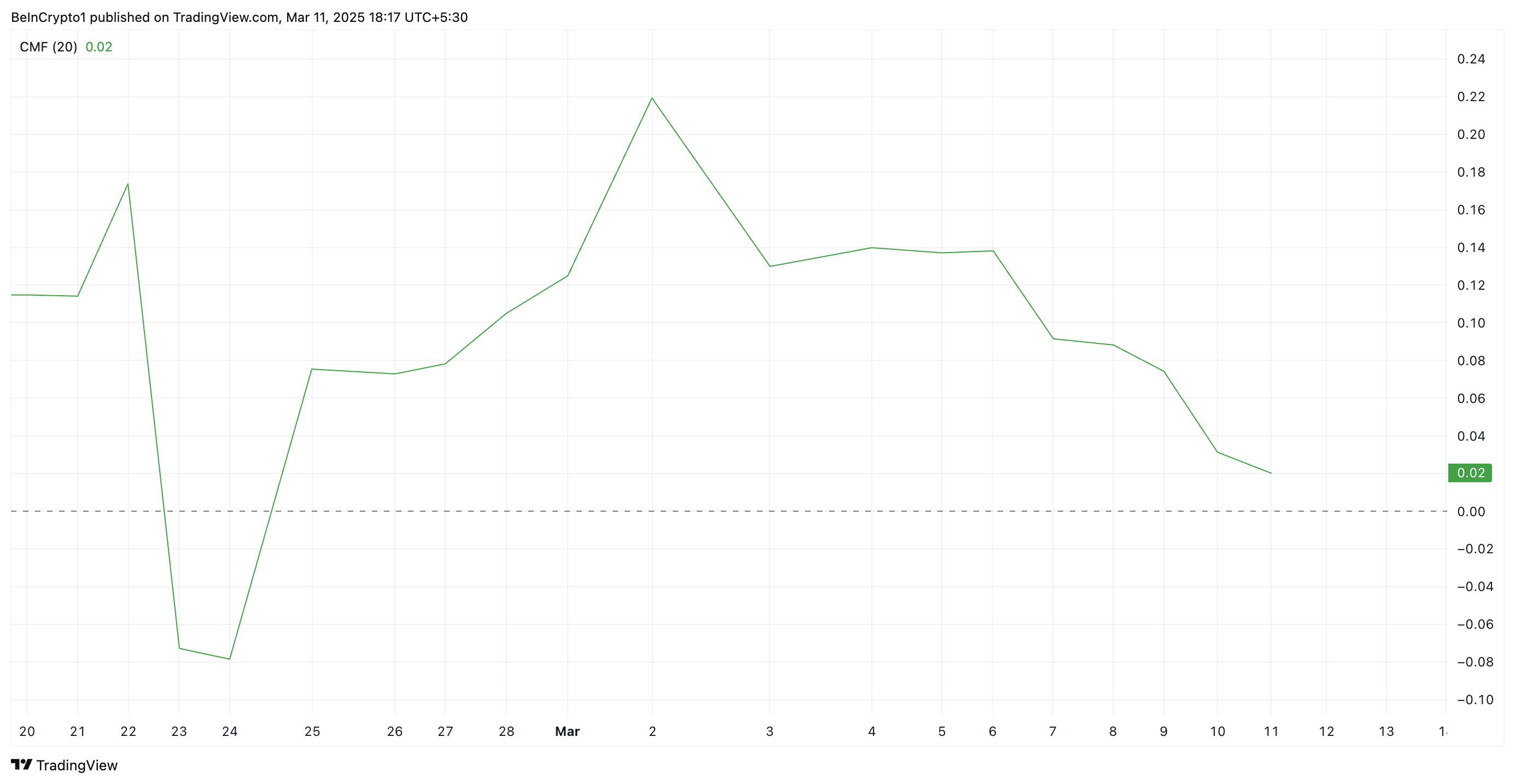

In addition, the flow of Silver Chaikin (CMF) of XRP is currently in a downward trend and is ready to violate its zero line. This indicator, which measures the flow of money in and outside an asset, is 0.02 to date.

When the CMF of an asset tries to fall below zero, it reflects the weakening of the purchase pressure and the increase in the domination of the sale. This suggests that the money flows from XRP rather than him, strengthening the downward perspective.

XRP faces a downward pressure: could it crash at $ 1.47?

XRP risks fall below $ 2 if the new request remains insignificant. In this scenario, he could drop to $ 1.47, a bottom which he reached for the last time in November.

On the other hand, if the sale of pressure and XRP sees an increase in the purchase activity, it could transform its price beyond the resistance to $ 2.81 up to the highest $ 3.40.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.