XRP Bears Lead, But Bulls Protect Key Price Zone

XRP has experienced a significant slowdown in the recent price action, its value decreasing by almost 15% in the last seven days while bears maintain market control. The technical indicators of the medal display mixed signals, the rebounding RSI from the territory of occurrence while the models of clouds from Ichimoku continue to paint a downward predominance image.

Despite yesterday’s level of critical support of $ 2.06, which led to a temporary rebound, the momentum remains negative, with short -term EMA positioned below the long -term averages. The passage of extreme surveillance conditions suggests that XRP could enter a consolidation phase before its next significant price movement.

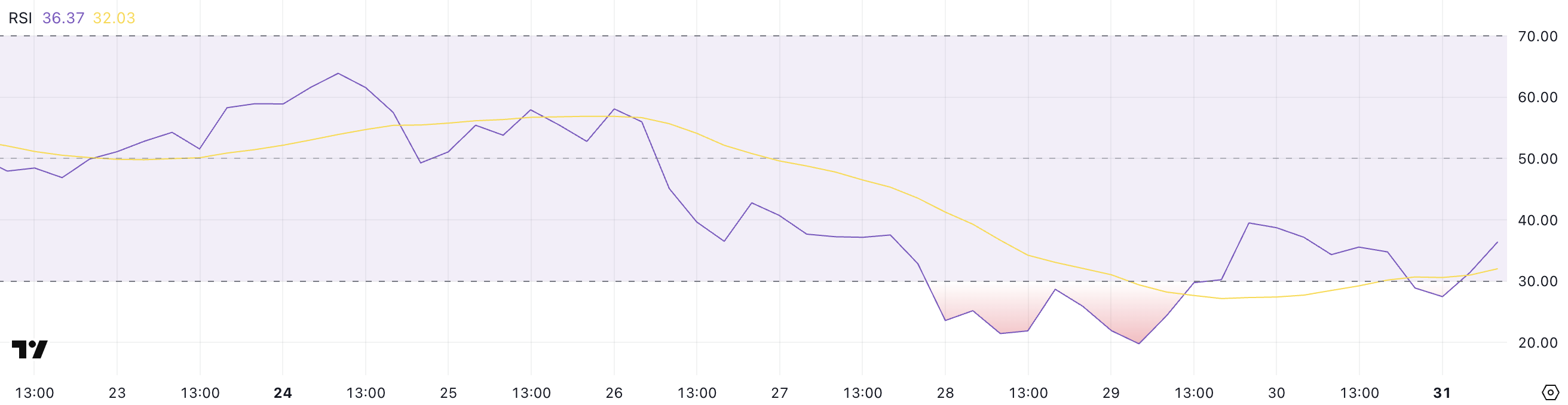

XRP RSI is increasing from the levels of occurrence

The relative force index of XRP (RSI) is currently at 36.37, showing a notable rebound in a hollow of 27.49 just hours ago. This upward change indicates a change of momentum, because the purchase of interest began to resume after a period of high sales pressure.

Although still in the lower range, this recovery suggests that traders can step back.

RSI is a widely used momentum indicator which measures the speed and variation of price movements on a scale of 0 to 100. Reading less than 30 generally indicate that an asset is occurring and can be undervalued, while the readings greater than 70 suggest that it is excessive and could be due to a correction.

XRP rebound from 27.49 to 36.37 signals that he may have left the conditions of occurrence. This could mean that the recent sales phase is softening. If the purchasing momentum continues to build, XRP could enter the first stages of a potential recovery.

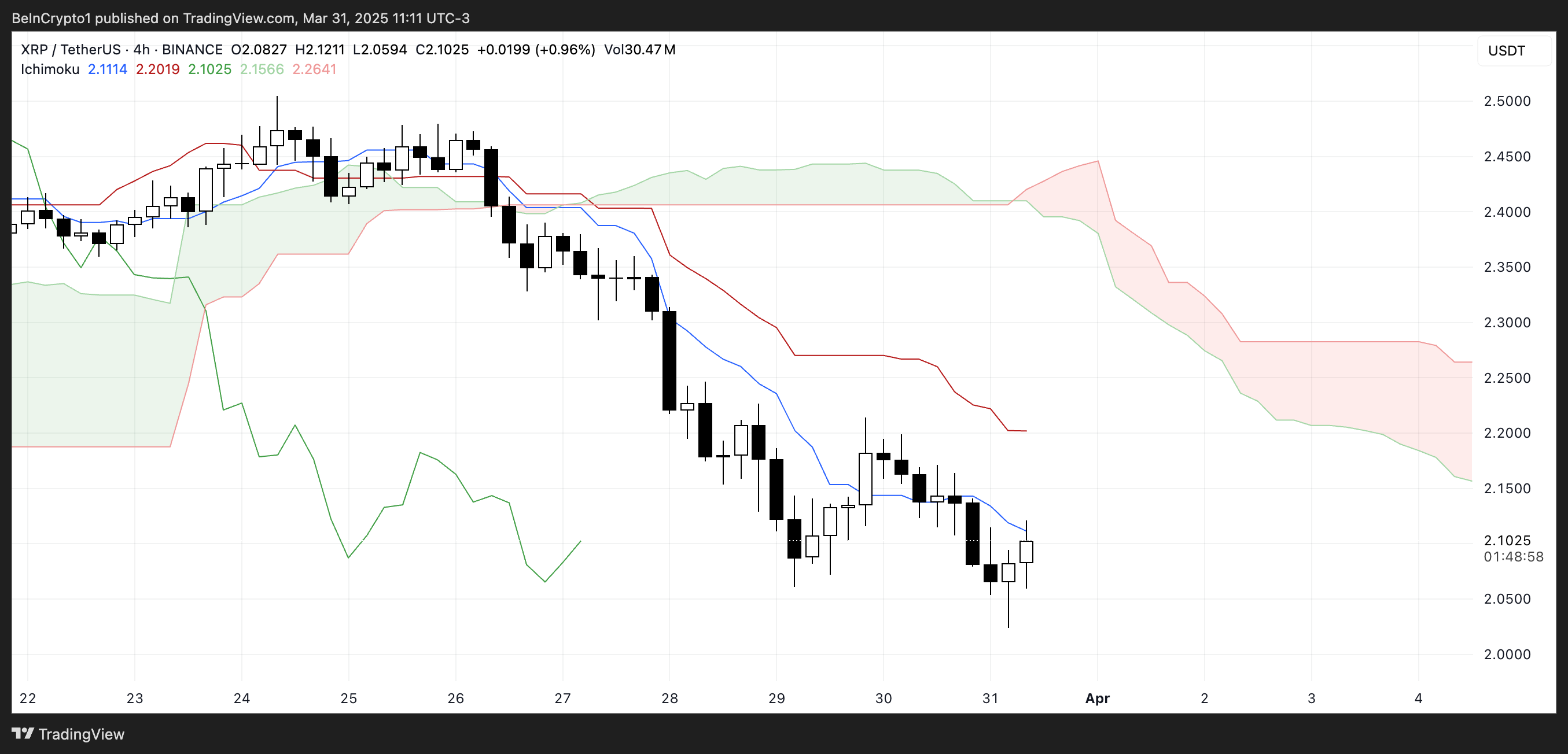

The XRP Ichimoku cloud shows a downward scenario

XRP’s Cloud Ichimoku graphic shows that the price of the prices remains below the red basic line (Kijun-Sen) and the blue conversion line (Tenkan-Sen). This indicates that the momentum in force is always lower.

Candles are also formed well under the cloud, which reflects a wider downward trend.

When the price is under all the main components of Ichimoku like this, it generally signals a continuous drop pressure unless a strong reversal breaks these resistance levels.

In addition, the upcoming cloud is red and extends horizontally with a slope down, strengthening the short -term lower perspective. The thickness of the cloud suggests a moderate resistance if the price tries to move upwards.

However, a certain consolidation is obvious in recent candles, showing that sellers can lose a certain control.

For any potential tendency reversal, XRP should break over Tenkan-Sen and Kijun-Sen, and finally challenge the cloud itself-a decision that would require a clear increase in the momentum.

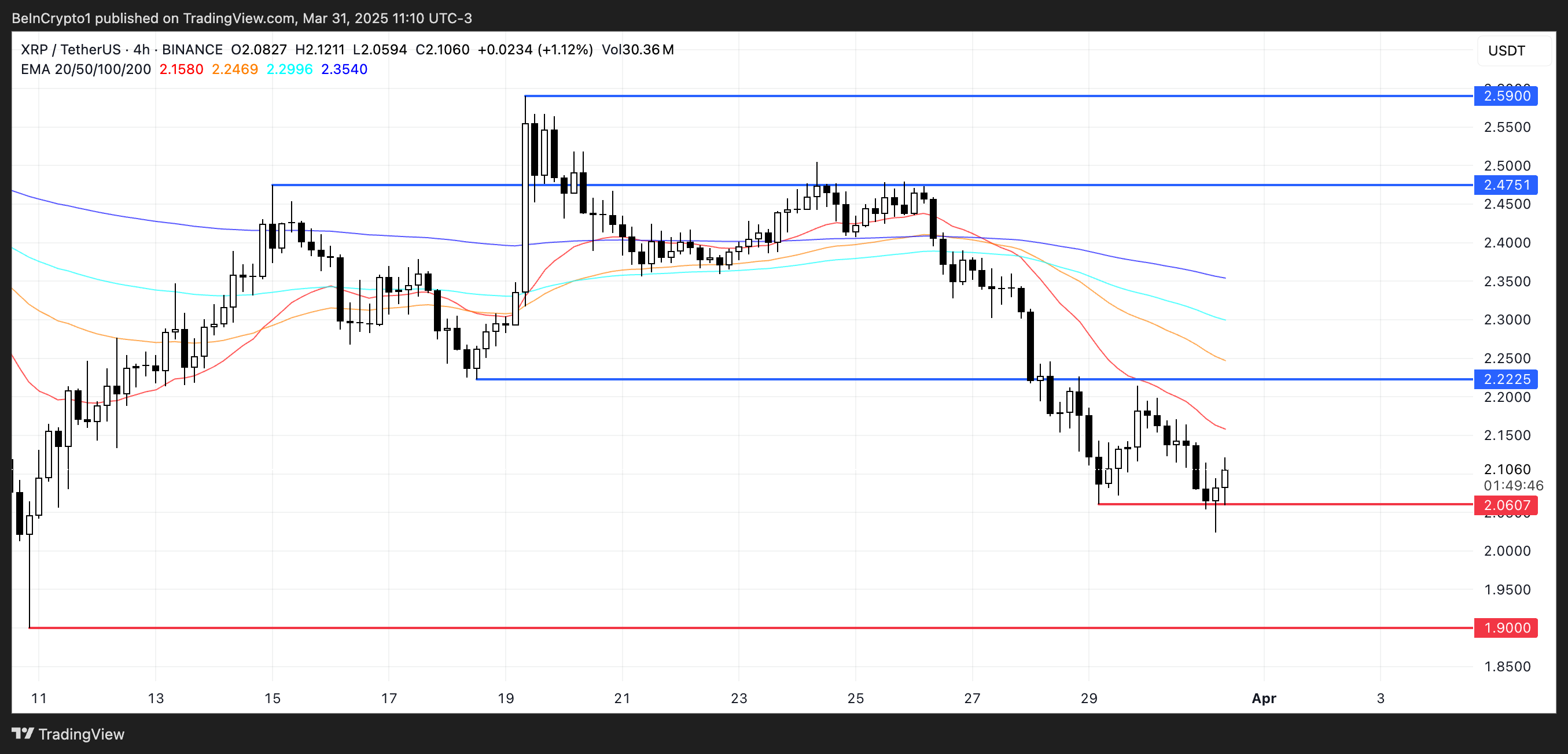

XRP could increase after testing significant support yesterday

The EMA of XRP lines are clearly aligned in a downward training, with the short -term averages sitting well below the longest long -term and a notable gap between them – a strong momentum down.

Yesterday, the XRP price tested the level of support at $ 2.06 and rebounded, showing that buyers are still active in this area. However, this support remains critical. If it is tested again and does not hold, XRP could fall further. Its next major support being around $ 1.90.

If the trend is starting to move and XRP breaks above the EMA in the short term, the first key resistance to watch is $ 2.22. A successful decision above this level could trigger a stronger recovery, potentially pushing the price to $ 2.47.

If the bullish momentum continues, the next target increased would be $ 2.59. For the moment, however, the EMA structure is still leaning down. XRP would need sustained purchase pressure to turn the trend and target these higher resistance levels.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.