XRP Bears Lead, But Bulls Protect Key Price Zone

The Cosmos (Atom) wins a strong bullish momentum, jumping out of 14% in the last 24 hours while technical indicators flash the potential of the increase. The relative force index of the token (RSI) went from levels deeply to an almost exaggerated territory, highlighting an aggressive wave of purchase pressure.

On the Ichimoku cloud painting, the atom broke over the cloud with bull crossing, suggesting that a possible trend reversal is in progress. While the price approaches a key resistance area, the merchants are watching closely to see if Atom can maintain this escape and push towards the $ 6 mark in April.

Cosmos RSI is close to surachat levels

Cosmos experienced a sharp increase in the momentum, with its relative force index (RSI) climbing 68.11 after sitting at 29 only four days ago.

This rapid increase suggests a high purchase pressure over a short period, signaling a dramatic change in feeling. The RSI is a Momentum oscillator which measures the speed and the change in price movements, with values ranging from 0 to 100.

As a general rule, a reading less than 30 indicates that an asset is occurring and may be due to a rebound, while a reading greater than 70 suggests that it is excessive and could be started for a decline.

With RSI of Atom, which is now approaching the Surachat threshold at 70 years old, this indicates that the recent rise in prices can approach exhaustion – at least in the short term.

While an escape greater than 70 could point out a high increased continuation, such high RSI levels are also cautious, as traders can start making profits or reassessing entry points.

If the momentum holds, the atom could push in an exaggerated territory and extend its earnings. However, if buyers are starting to fade, the price could see short -term cooling while the market digests the recent increase.

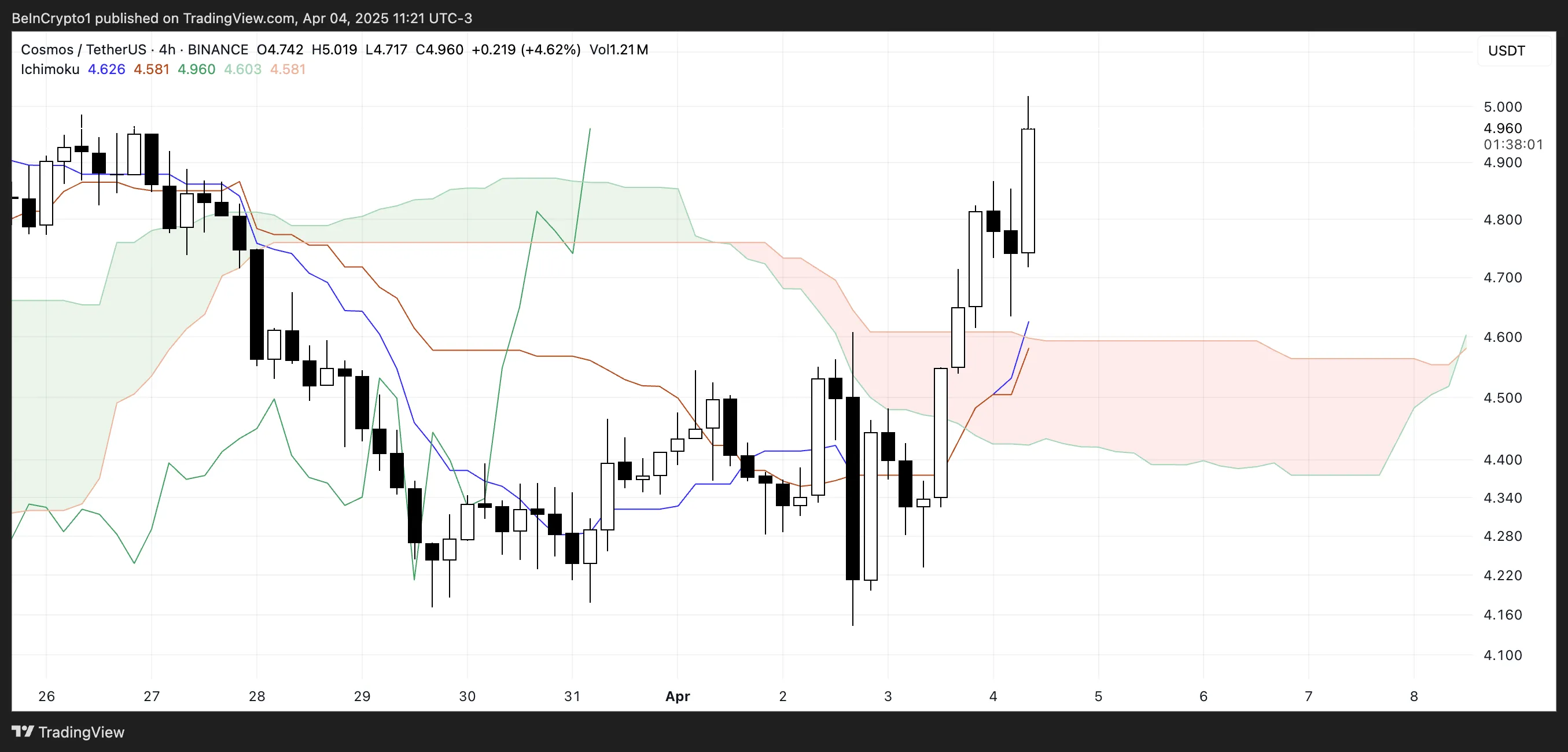

The Atom Ichimoku Cloud shows an upward configuration

Cosmos shows a bullish escape on the ichimoku cloud painting. The price took place decisively above the cloud, indicating an inversion of potential trend.

The blue conversion line (Tenkan-Sen) has turned high up and is now above the red basic line (Kijun-Sen), which is a conventional bullish crossover.

This alignment reflects a growing short -term dynamic and could further support the increase if it holds it.

In addition, the head range A (border of green clouds) began to bend up, while the head range B (red limit) begins to flatten.

This change means that the cloud is weakening, indicating that the lower pressure is weakening. With the price above the cloud and the delay duration (Chikou) of the action of recent prices, the overall configuration leans up.

Will Cosmos reach $ 6 in April?

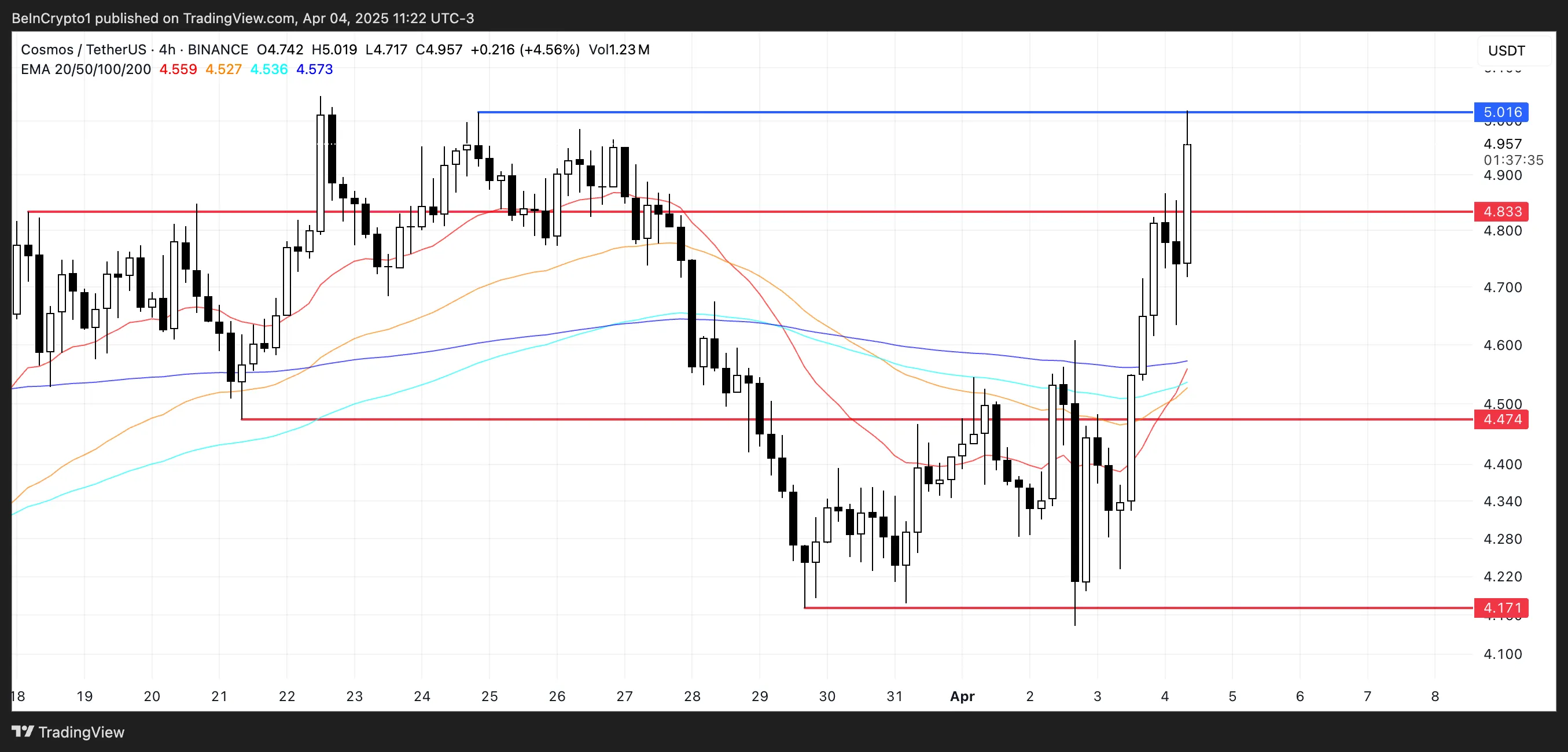

With the recent price increase, Cosmos Price is approaching a level of key resistance to $ 5, and an escape higher than it could open the way for additional gains around $ 5.5 and even $ 6.

The current alignment of the EMA lines shows a bullish momentum and a golden cross – where a short -term EMA crosses an EMA in the longer term – presents itself. If confirmed, this signal could attract more buyers and strengthen the potential of a continuous rise, especially if the volume supports break.

However, if the atom does not maintain its momentum and the price is rejected to resistance, the trend could be reversed towards key support levels.

The first area to be monitored is around $ 4.83, and a lower ventilation than that which could cause new losses. $ 4.47 and $ 4.17 are downward potential objectives.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.